Legally robbing the bank! Should we?

Hello and welcome to this SPinvest post

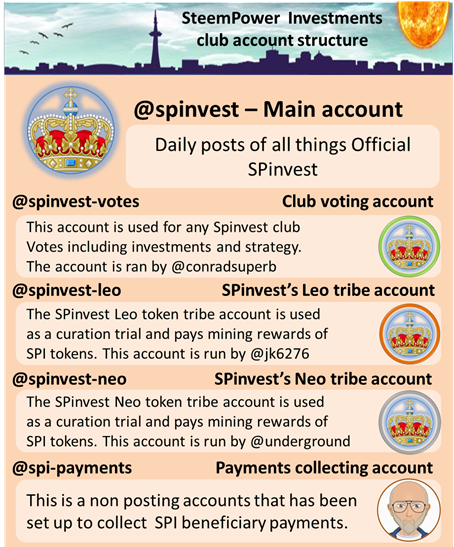

SPinvest is a tokenized investment fund/club for all users of social blockchains. Everyone is welcome! The concept of SPinvest is to get rich slowly by using time tested methods of earning, saving and compounding long term. This lets SPinvest offer an ROI of 20% per year on SPI tokens. We encourage long term investing on and off the blockchain. We hope someday everyone will HODL some SPI tokens that can be bought directly from @spinvest are through the steem-engine are dex.steemleo exchanges.

.

Hello folks, What if i told you that you could borrow money at a 1-6% APR and earn 8-12% on that borrowed money? You'd say im crazy and that nobody would give away free money like that. Well, it's possible and im gonna show you how in a few easy steps.

First off, this is not a scam, it is simply a loop hole that takes advantage of lenders lending money cheaply and using that money to earn interest at a higher rate. It is legal, low risk if done with caution but does require you to already hold some cryptos, you cant start with nothing.

How do we rob the bank?

No, not like this. That's the stupid way. We do it like a smart person, legally. You can rob the bank using cryptos you already hold as collateral against cheap loans and then use that loan money to earn interest at a higher rate than the bank is charging you borrow it. Sounds weird, right?

People over the age of 40 will remember when they were younger that a saving account with a high street bank used to pay 4-8% APR. The banks could do this as they were making 12-17% on money deposits. Nowadays, you're lucky to get 0.5% on your savings but do you think the bank makes any less money than before? NO, the banks consistently produce huge profits of between 12-17% on their holdings. Banks are too big to fail, they have the monopoly on how the game is played. We are idiots for letting them get away with this but crypto is changing the game and offers a way out. A game-changer indeed.

With the rise of defi investments, lots of new projects have been popping up, many have failed, a few have scammed, dozens are currently running at super small volumes but a couple are heads and shoulders above the rest. They claim to be crypto banks and offer debit cards and exchange currencies. Of course, they are not really real banks, they act more like your local credit union that offers a good interest rate on your savings while providing loans using your savings as collateral at a good interest rate. Defi companies are still very young and maybe in the future, we will see a few of these companies adding products like life/home/car/travel insurance are even opening an actual branch in the real-world. For now, they offer good interest rates for savers and cheap interest rates for lenders. These companies are highly profitable due to super low overheads.

SPnivest currently holds

1 BTC on celsius network earning around 4%

9500 tether USDT on Nexo earning 8%

I need to run the numbers through an excel sheet and compare all the different companies to produce the best income for us. Each company is different and has there own terms and interest rates but just to show as an example based on the wallet holdings, we could

Use the 1 BTC on Celsuis against a 25% collateral at 1% for 1 year

If BTC is $10k, we would take a $2500 tether loan and pay a monthly interest of $2.08.

We put the $2500 loan money into Nexo and earn $16.67 per month in interest.

After paying the interest for the loan every month, we have $14.59 profit

We do this for 12 months and profit $175.04 (700+ HIVE)

When the 12 months term is finished, we withdraw $2500 tether from nexo and repay the loan to Celsuis

Our 1 BTC, plus 4% is unlocked and free to use again.

Use our $9500 tether balance at Nexo against a 90% collateral at 5.9%

We borrow $8500 from Nexo and basically just hold it there and earn $56.67 every month

Our monthly interest payment on the loan would be $41.79 leaving a $14.87 profit.

We do this for 12 months and profit, $178.52 (700+ HIVE)

When the 12 months are finished, we pay back Nexo $8500

Our 9500 plus 8% Tether is unlocked and free to use.

I hope that the above examples make sense and you understand what we could do. Based on these examples, we could earn an extra $350 in a year. To actually get the 5.9% on Nexo, you need to stake some Nexo tokens but for the sake of an example, we'll keep it simple.

A few important things to know when thinking about this is stable coins are safer and the lower your collateral loan percentage is, the lower the risk is of defaulting on the loan.

If BTC is $10k you take a 50% collateral loan against 1 BTC and get a $5000 loan against it and the price of BTC falls under $5000, your collateral is automatically sold to cover the company from any losses. This will not happen with stable coins but highlights the risk of taking high collateral loans against cryptos.

Anyways, would do you think? Im not saying this is something we should do, after all it locks our BTC and/or tether up. We can always repay loans early with no repercussions.

.

SPinvest's content is contributed by @silverstackeruk, @underground, @no-advice, @metzli, @taskmaster4450 and

Today's post comes to you from @

I have been hearing about this lately and am waiting for the "what ca go wrong" post.

Who is taking out these loans?

What if they default?

How reputable are these exchanges?

How long can this cycle last?

I would like a naysayer's opinion, no people help me solidify my opinions.

Posted Using LeoFinance

you could google search "nexo liquidated me"

ahaha. Sounds simple enough.

I will also try nexo scam, nexo sucks, nexo bad...

Sounds like they have the same problems some of our Engine tokens have. One can keep accumulating more and more tokens without making an actual fiat profit.

I'll read up more on it if we decide to try this as an investment and put it to vote.

It is an interesting idea.

There is nothing wrong with arbitrage as a way to make money. If the BTC wont be sold for the year and is a HODL, then no problem.

Locking it up is not the worst thing in the world if we are long term thinking.

Earning by leveraging different rates is a good way to make things grow with minimal effort.

Posted Using LeoFinance

I think celsius has a 90 day minimum term but Nexo can be paid back at any time. Im having problems getting verified with crypto.com and blockfi. My camera will not open in browser to take a selfie to confirm my ID, lol.

We'll see how we gonna spread our tether funds and then maybe look into this for our BTC holding.

Let's do it!