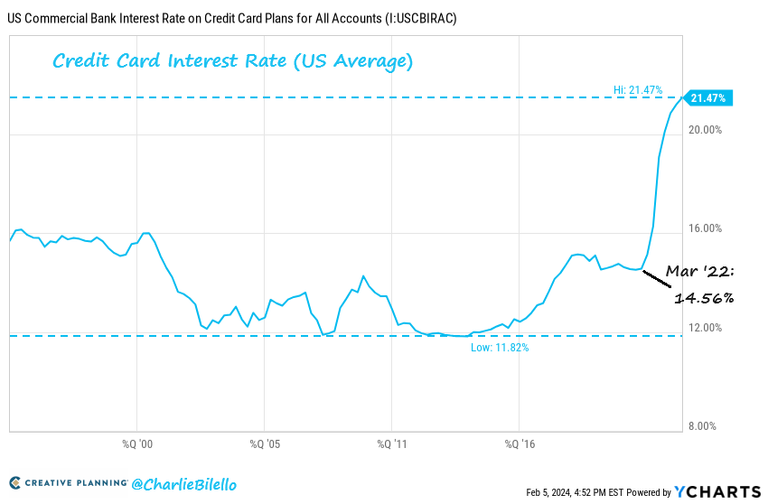

The average interest rate on US credit card balances is now 21.5%

This is the highest rate charged since 1994, (the Federal Reserve interest rate in 1994 was 5.5%, same as it is now). Here's the chart:

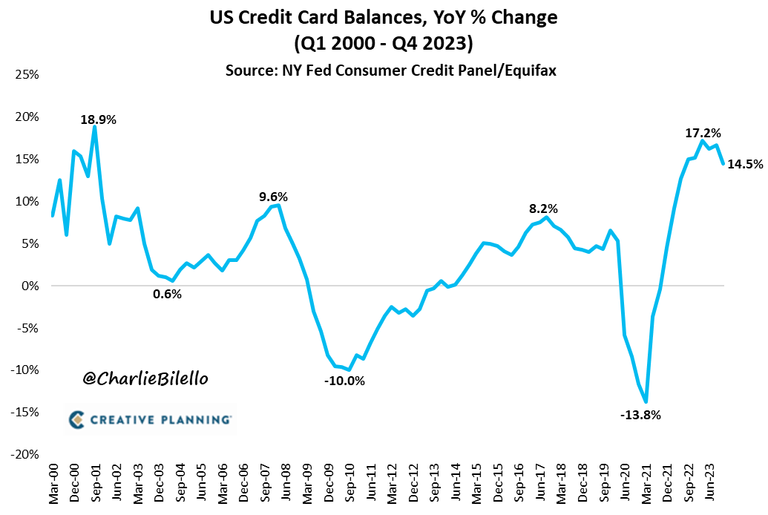

Despite this eye-watering interest rate, US credit card balances still increased by 14.5% in the last year. See

This seems irrational - high interest rates should deter people from borrowing on their credit card.

So what explains this?

I think some people simply haven't realised that credit card companies have jacked up interest rates so much. Others are reluctant to curb their spending and are simply putting stuff on their card with an "I'll worry about this later" attitude. Others genuinely think they'll get a payrise that will dig them out of debt.

But with credit card interest rates this high, it's very easy for balances to balloon due to the interest alone. I predict defaults are around the corner.