Proof the US stock market is overvalued

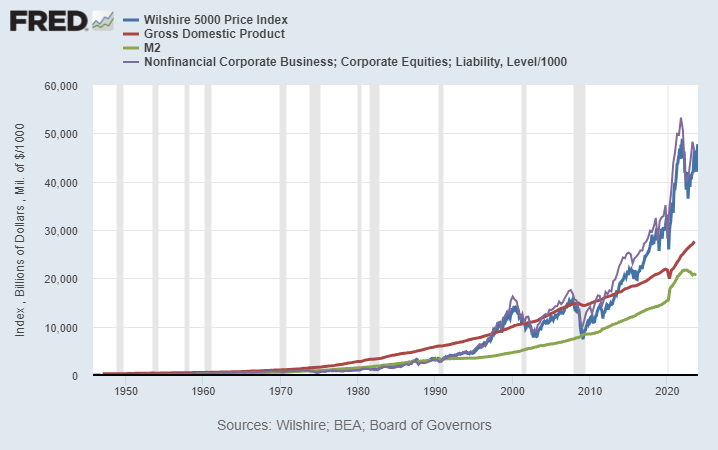

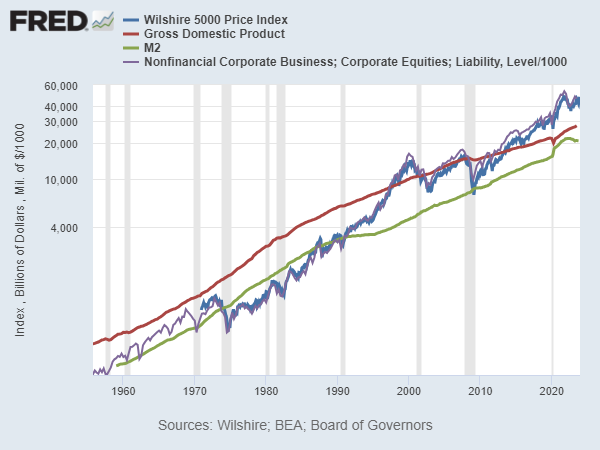

Here is a chart comparing the market capitalisation of US stocks to Gross Domestic Product (the first chart is linear, the second is a log chart):

As you can see, stock market capitalisation roughly tracks GDP on average, give or take bull and bear markets - except since 2020.

In order for stock market capitalisation to be so much higher than GDP, outside non-US money must have flowed into the stocks. M2, the money supply, is lower than the stock market cap, indicating it's not Fed money printing that is the culprit, it's outside money printing that has done this: the Bank of Japan, the European Central Bank, the Bank of England and the Bank of China.

Of these, the European Central Bank and the Bank of England have been reversing QE, as are minor central banks like the Bank of Canada and the Bank of Australia.

At some point, foreign investors will take profits, especially if they are leveraged (the reversal of QE makes life tough for all borrowers). When that happens, the stock market will fall to get back in line with GDP.