Mortgage-free American homes surge

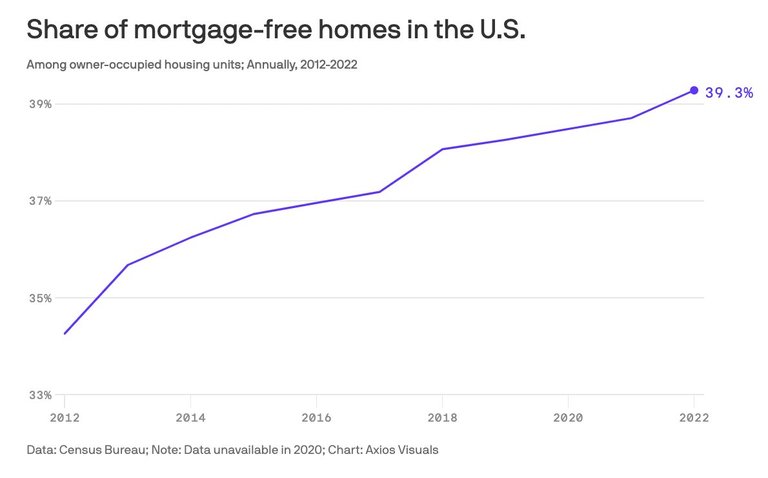

They now stand at 39.3% of households. Here is the chart:

After the Great Financial Crash of 2008/9, people who lived in recourse states (where they are personally liable for their mortgage debt even if their house sold for less than the amount they borrowed), knuckled down and worked to pay off their mortgage. The low interest rates helped; they'd refinance to minimise interest payments, and use the money saved to overpay the capital.

In states like Virginia, the number of households who own their properties outright is at an all-time high.

And good on them; after all, the period of ultra-low interest rates was meant to help people to cope with and clear their debts, and it would be a crying shame if no-one took advantage of that.

The high level level of outright home ownership explains the resiliency of the US economy despite interest rate rises. After all, for the 39% who own outright, interest rate rises represent an increased income from savings.