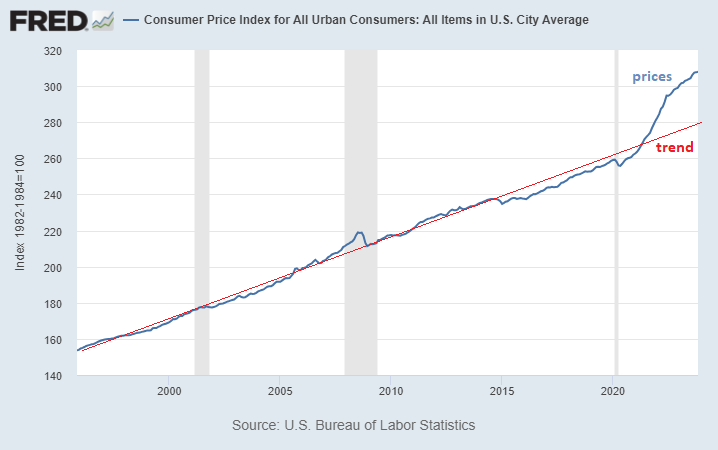

Here is how far above trend consumer prices have got

The following graph is from the Federal Reserve. The trend line is based on prices rising by 2% per annum (the Fed's target for CPI)

To get back to the trend line, we need a period of deflation, where the price rises of the last two years are completely reversed.

But the Fed and other central banks around the world are utterfly terrified of deflation thanks to the horrible experience of the 1930's.

Yet the world experiencd a lot of deflation in the 19th century without problems. Indeed falling prices in the 19th century made a lot of people better off, as previously unaffordable goods became affordable.

The difference between the 19th century and 20th/21st centuries was debt. There was very low household and govt debt in the 19th century. That's not the case now.

It's very hard to service debt when prices and income are flat or falling. Now that the world is on a debt treadmill, inflation is required to keep servicing it manageable.