DeFi Protocol Sturdy Finance Exploited and Lost $800K

There is more uncertainty in the crypto market. Due to regulatory scrutiny and challenging crypto market condition, it is getting more difficult to survive and move forward. The central authority goes hard on crypto like taking legal action to sue the popular crypto exchanges Binance and Coinbase.

In spite of unfavorable situations, hackers and exploiters keep attacking to exploit and steal cryptocurrency. The hackers attacked the DeFi protocol Sturdy Finance and successfully exploited and drained $800K worth of Ethereum from the protocol.

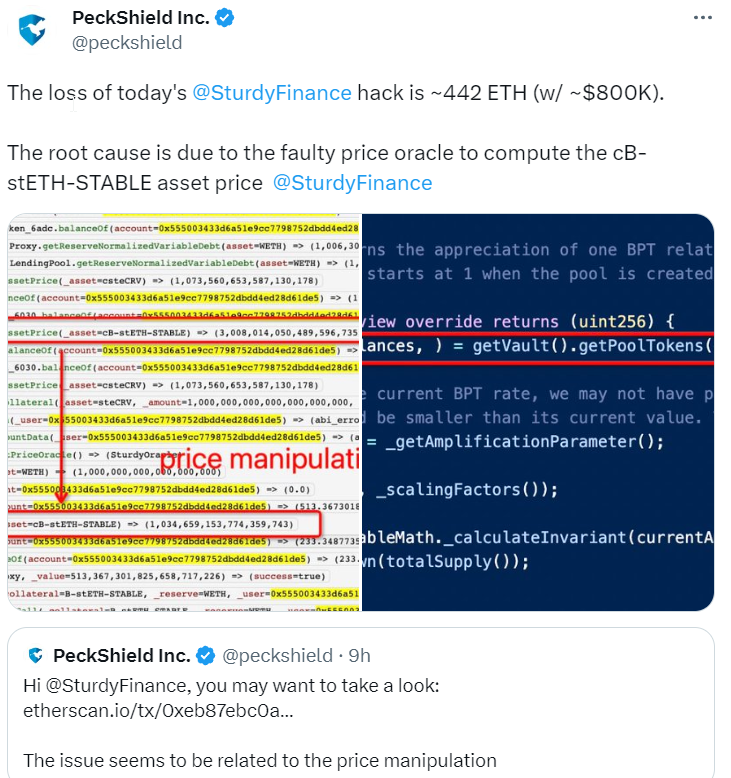

According to blockchain security firm PeckShield, the attackers manipulated the price to exploit and ended up getting 442 Ethereum which is worth almost $800,000. The faulty price oracle is defined as the root cause of this exploit which allowed the attackers to drain $800K from the Sturdy Finance protocol.

Sturdy Finance tweeted that they are aware of the current situation. They already paused all markets to mitigate the risk. It is confirmed that no additional funds are at risk. They will share more information later and users do not need to take any action.

Will DeFi protocol Sturdy Finance get its stolen funds back? There is no update from Sturdy Finance after the above tweet. It is confirmed by PeckShield that the attackers made their move and transferred the stolen $800,000 worth of ETH to the crypto mixer Tornado Cash. It seems there is hardly any chance to get the stolen funds back.

Sturdy Finance has to investigate this incident more and fix the vulnerability so that the hackers cannot take advantage of this again in the future. Users' funds are safe at this moment. But without tightening the security and fixing the vulnerability of the protocol, investors may not trust Sturdy Finance again.

The ongoing hacks and regulatory crackdown put more pressure on the crypto industry. Looks like the regulatory agencies are determined to drive crypto businesses away from the United States or at least make it way hard to survive.

Crypto winter shows its true color and makes its deadly blow. If you manage to avoid scams and not fall into hackers' traps, you are doing great. Staying calm and making your move as per your plan and strategy is a way to go.

Image Sources: 1, 2, and 3.

Reference: 1.

About Me

Hi, I am Rezoanul Vibes. I'm a content creator and passionate learner. I write about finance, cryptocurrency, and lifestyle.

Follow me on Twitter

Watch my videos: 3Speak, DTube, and YouTube.

Posted Using LeoFinance Alpha

It sucks to see this and I don't think they will get that money back after it goes through a mixer. I haven't heard about many oracle price manipulations but I guess there are a ton of things that can cause problems in Defi.

The risk of losing money in DeFi due to hacks and exploits will discourage people to get involved in the DeFi protocol. They have to fix the vulnerability and strengthen the security.

DeFi still requires a lot of maturation and advancement... the aspect of hacks and exploits is definitely holding it back.

Agree with you. Hope it would get better over time.