Will the wait for Zero Coupon Bonds in DeFi be over now?

DeFi or decentralized finance is the hottest use case of Ethereum at present. DeFi caught public attention as there was no centralized authority or third party involved in the transactions. Everything happens through smart contracts and these smart contracts operate on publicly viewable blockchain. DeFi is transparent. You have no need to rely upon anyone. It is automated finance based on programmed protocols. DeFi is opening a new horizon for individuals and organizations by empowering them. Nowadays, maximum DeFi dapps operate in Ethereum only. It has already become a movement.

Most popular use case of DeFi is lending and borrowing. Do you find lending money to strangers risky? It is the most popular way of learning passive income in DeFi. In DeFi, you can lend any stranger as all loans are secured with collaterals. Obviously here the collateral is not your earthy asset like gold or real estate. Here the collateral is crypto. MakerDao is the most popular DeFI dapp and 40-45% of Ethereum DeFi activity happens here. MakerDao issues DAI, a stablecoin, when you lock in ETH. DAI is pegged to dollar i.e. its value is programmed to be 1 USD always. If you want, you can learn about DAI in one of my previous article. DAI provides liquidity into the MakerDao system. There are many other DeFi dapps like Aave, InstaDapp, Compound etc. Various dapps are providing different types of lending and borrowing assets. Everywhere borrowing is backed by collaterals and borrowing-lending business involves variable interest rate. DeFi is doing really well. Many future use cases will be coming in the DeFi sector.

The missing organ of DeFi: Zero-Coupon Bonds

Presently, DeFi lacks one important tool. This is zero-coupon bond! A zero-coupon bond pays a fixed yield on maturity. The crypto market is volatile and lending-borrowing is taking place on a variable rate of interest. But there are many people who like the fixed rate of interest. Non-availability of a fixed rate of interest is a barrier towards mass adoption of DeFi. Recently crypto research company paradigm published a whitepaper depicting creation and issuance of zero-coupon bonds as ERC20 tokens on the Ethereum blockchain.

“yTokens are like zero-coupon bonds: on-chain obligations that settle on a specific future date based on the price of some target asset, and are secured by collateral in another asset. By buying or selling yTokens, users can synthetically lend or borrow the target asset for a fixed term. yTokens are fungible and trade at a floating price, which means their “interest rates” are determined by the market. The prices of yTokens of varying maturities can be used to infer interest rates, and even to construct a yield curve. Depending on the target asset, yTokens can settle through “cash-settlement” using an on-chain price oracle, through “physical settlement” in the target ERC20 token, or by synthetically issuing or borrowing the target ERC20 token on another platform.” – Abstract of the whitepaper

The protocol is called the Yield Protocol. It enables fixed-rate lending. The yTokens are just like DAI but they offer fixed yield. In MakerDao system, the system governance decides interest rate based on price oracle feed and it keeps on varying. The Yield Protocol doesn’t rely upon system governance. It decides price according to market prices rather than depending on governance or any formula. This is revolutionary on-chain lending protocol. The problem of DAI is that it is pegged to 1 USD but the collateral is not USD. DAI is supposed to trade at parity with USD and that’s why the interest rate is continuously changed by the governance model. But yToken price is expected to float and the interest rate will be determined by the trade discount. yToken will have expiration date also. If you hold yToken for a fixed term, you should earn predictable rate of interest and if you withdraw early, you may incur loss.

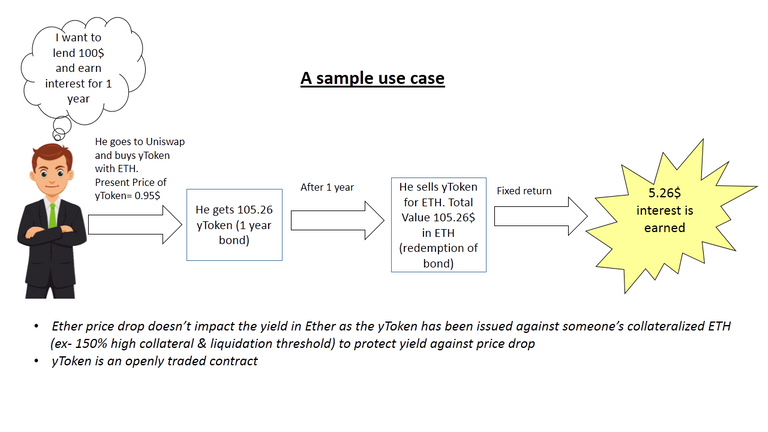

A sample use case of the protocol made by me

DeFi is evolving. The traditional financial concepts are getting a new lease of life in DeFi. It has risks but its transparency factor is pulling the mass. Trustless nature of DeFi is the deviant feature to lead its way towards globalism. A new financial system better than the current version can be made. Let’s see how the new instruments help it to grow faster. Fingers crossed!

Note: The images (if not cited) are generated by the author using free vectors

Dear @paragism,

Quite interesting topic that I did not research enough yet. How do DeFis make sure that the borrower will pay back the money?

For example a bank makes sure you will pay back as it can take your property, use state power to force you to pay back, etc...

Sincerely,

@vlemon

Borrowing is collateral based. Collateral is crypto here and it is locked in smart contract. So, the loan is secured. Ex- you can get 75% loan term value by submitting 1 ETH in Aave. Collateral gets liquidated when ETH price falls below liquidation threshhold( for Aave it is 80%). When liquidation happens, liquidators impose liquidation penalty of 5% in Aave. You can check Aave dapp through metamask or Trustwallet. It is very user friendly and easy to understand.

Thank you for this comment @paragism,

I was also wondering, what is the difference then to a leverage trade where you have USD or ETH in collateral to use more ETH?

It is for a longer period of time? I'll check it out, thank you :)

Only risk is liquidation risk. No cryptocurrency is stable. So if ETH price falls heavily, the collateral gets liquidated and incurs some loss (not total loss).

Congratulations @paragism! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

#posh

https://twitter.com/paragism/status/1260183587103653888?s=19

Interesting analysis...defi has broad scopes

Learning passive income , I think you meant earning.

I see the Defi concept is expalined well but I don't understand the ytoken ... I think right now, DEFI is not safe, it has potential but of late there have been to many vunerabilities in the system of various DEFI applications that have been exploited by hackers!!

I am very small investor and such a person, who can't own a Ledger wallet now, can't affort to keep funds in smart contacts like metamask and lend just to earn passive income.

But I see there are players going to build on DeFI like this ytoken...

Stable coins give returns too, they are not volatile and are used in DEFI applications.

All the best in the ytoken business, let it be an element to strenghten this DEFI movement!! , must needed I think.

You are right. Many times DeFi systems have been attacked successfully. It is still evolving.