The Challenge of Choosing Between Crypto and Property In An Uncertain Economy

Guys, check out my dilemma. When it comes to investing, my girlfriend and I are at a deadlock. While I'm a staunch advocate for cryptocurrency, she's a powerhouse in the real estate industry. And while I respect the tangible benefits of owning property, the current economic climate in our region has me questioning this as a primary investment strategy.

Why Cryptocurrency Appeals to Me:

The decentralized nature of crypto, combined with its global reach, shields it from the economic downturns of any specific region. It's a fluid asset, easy to liquidate, and has shown promising returns in recent years.

The Real Estate Rundown:

Real estate, on the other hand, is tangible and often seen as a safe, long-term investment. The value of land and property tends to increase over time, providing both rental income and capital appreciation. My girlfriend's success in this field is a testament to its potential.

The Inflation Issue:

However, here's where my concerns lie. Our local economy is grappling with soaring inflation rates. To put it into perspective, let's consider a hypothetical situation:

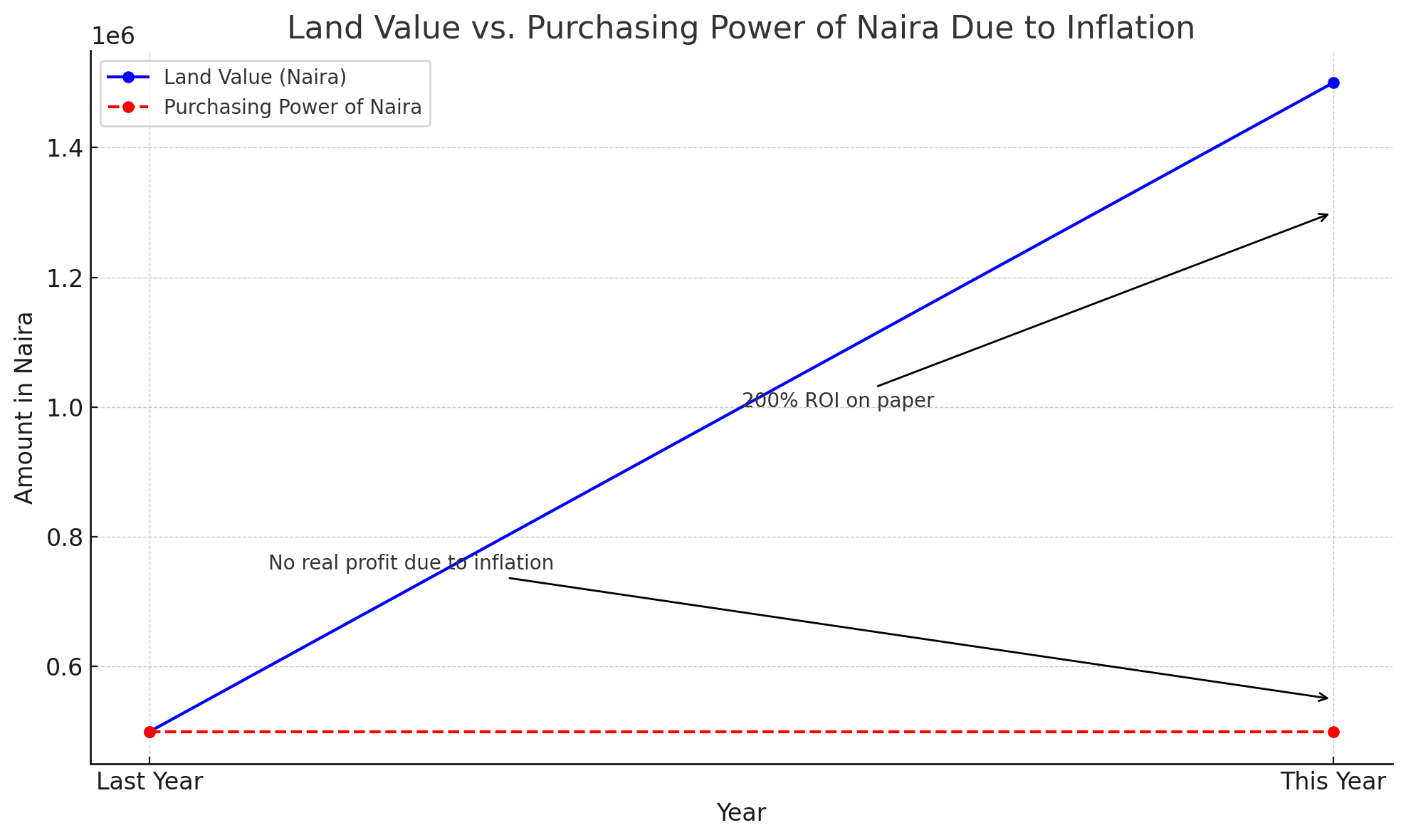

Last year, a plot of land worth 500,000 Naira seemed like a good investment. Fast forward to today, and its value has skyrocketed to 1.5 million Naira. At face value, that's a whopping 200% return on investment. But here's the catch: due to rampant inflation, the purchasing power of 1.5 million Naira today is equivalent to what 500,000 Naira could buy last year.

The cost of fuel, transportation, food, and other commodities has significantly increased, with no signs of improvement. This, combined with the continuous decline of the Naira against the dollar, exacerbates the situation.

So, while on paper, the land's value has tripled, in reality, the effective profit is nullified by inflation. If we project this trend into the future, the returns from real estate might not only diminish but could lead to a net loss when considering the eroded value of the Naira.

Here's a graph illustrating the analogy:

The blue line represents the value of the land over the two years. As you can see, the value has tripled on paper.

The red dashed line represents the purchasing power of the Naira, which remains constant despite the increase in land value. This highlights the effect of inflation, where the increased value of the land doesn't translate to an actual profit when considering the eroded purchasing power of the Naira.

This problem is mostly unique to our local economy, this fuels my hesitation in real estate investment in contrast to cryptocurrency. While Crypto has its downside in volatility, Bitcoin, for instance, has consistently increased in value almost every year, or at least every 2 to 3 years, irrespective of local economic conditions.

Apart from the known giants like Bitcoin, there are other exciting options in the crypto world. If one is looking to play safe away from volatility, there are options that provide yield with stable coins, for example, HBD, Hives stable coin offers 20% APR in its savings vault, so if one is looking to save money, it is a very viable option that puts one’s capital to work, while it doesn’t offer a potential increase in value like real estate, it offers secure and stable income.

Moreover, cryptocurrencies are more than just a financial asset; they represent a technological revolution. As blockchain technology continues to evolve, we can anticipate more real-world applications, making cryptocurrencies even more integral to our daily lives. Think about decentralized finance (DeFi) platforms, smart contracts and NFTs (non-fungible tokens).

These innovations could further stabilize the crypto market and drive demand. Additionally, as more institutions and governments show interest in integrating blockchain into their systems, we might see a more regulated and potentially more stable, crypto environment.

Interesting facts like these in crypto are what justifies my enthusiasm towards choosing crypto when it comes to deciding between crypto and other investment categories like land properties especially based on my geographical location.

Finding Common Ground:

They say the trick in investing is diversification. While I'm leaning towards crypto for its global value, hedging our investments with some real estate assets could balance out potential risks. After all, having multiple baskets to keep our eggs might be the smart move in these uncertain times.

So, what's your take In the battle between crypto and real estate? where do you stand?

Posted Using LeoFinance Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

I'll do both.

Whichever way, I believe both are appreciable assets. Despite the inflation, I've seen landed properties appreciate due to other factors like increase in economic value of the location.

Crypto is volatile but also has great potential!

That’s my resolution too, my hope is that at the time of sale of the land the inflation would not have eaten too deep into the profit from the land appreciation