A Deep Dive into the SEC's Bitcoin ETF Delay: Impacts and Insights

The SEC has decided to delay its decision on Bitcoin ETF filings, this was not well received by crypto folks who’ve been waiting for an approval or denial for over 2 months since the applications were filed. In this post, we'll delve into the reasons behind the SEC's prolonged decision-making process, its implications and what comes next.

Just a little over 2 months ago, the entire crypto space was rallying with excitement about one of the biggest asset management firms filing for a BTC ETF with the SEC, it spoke volumes because such huge firm filing for a BTC ETF meant institutions finally showed interest in a digital asset that has been labelled scam and sidelined by major players in TradFi.

Shortly after, Fidelity, another major player in TradFi, followed suit and filed for BTC ETF while other institutions that had been rejected in the past refiled again, it was indeed an interesting month that crypto and TradFi met in the middle for a handshake literally, but unfortunately they had a common opposition/determinant, the SEC, as they were in charge of approving or disapproving whether or not the handshake will happen.

So why is the SEC stalling? Public Comments

Imagine you have a classroom of kids, and the teacher is thinking of introducing a new game for recess. Before deciding, the teacher asks all the kids what they think about the game. She wants to know if they like the idea, if they have any worries, or if they've seen problems with the game elsewhere. The teacher does this because she cares about the kids and wants to make sure everyone will have fun and be safe.

In the same way, the SEC sometimes asks people what they think about a new financial product, like an ETF, before they make a decision. They do this to make sure it's a good fit for everyone and won't cause any problems.

So the SEC is asking for comments from the public based on the following questions. According to sources, the SEC wants to know the following;

If the exchange is designed to prevent fraudulent and manipulative practices

If commenters' views on whether there is a reasonable likelihood that a person attempting to manipulate the Shares would also have to trade on the CME to manipulate the Shares?

If commenters believe the Exchange has shown that the bitcoin market is resistant to price manipulation?

If commenters agree with the Exchange's assertion that such an agreement with Coinbase would be "helpful in detecting, investigating, and deterring fraud and manipulation in the Commodity-Based Trust Shares'?

These questions are publicly available on the SECs website.

If someone is being paid to secure financial investments of the public, you’d expect them to do just that by doing their own research but this is not the case of the SEC, you can’t tell me these questions are what is holding the decision on the filings, this interest in public opinion just looks like dilly dallying to me but let’s let them have it.

In the meantime, kindly head over to the SECs website to give your opinion if you have some time to spare, they say they’ll assess the responses but you and I know that those responses will have little to do with whatever decision they come up with eventually, but again, let them have it.

The ETF decision has been extended by 8 more weeks, 3 for public opinion and 5 for internal review or a maximum of 240 days, meaning we might not be hearing about this anymore till 2024 which raises my spider senses because guess what! The next Bitcoin halving just happens to be in 2024. If this doesn’t tick your spider senses, I’m not sure what else will.

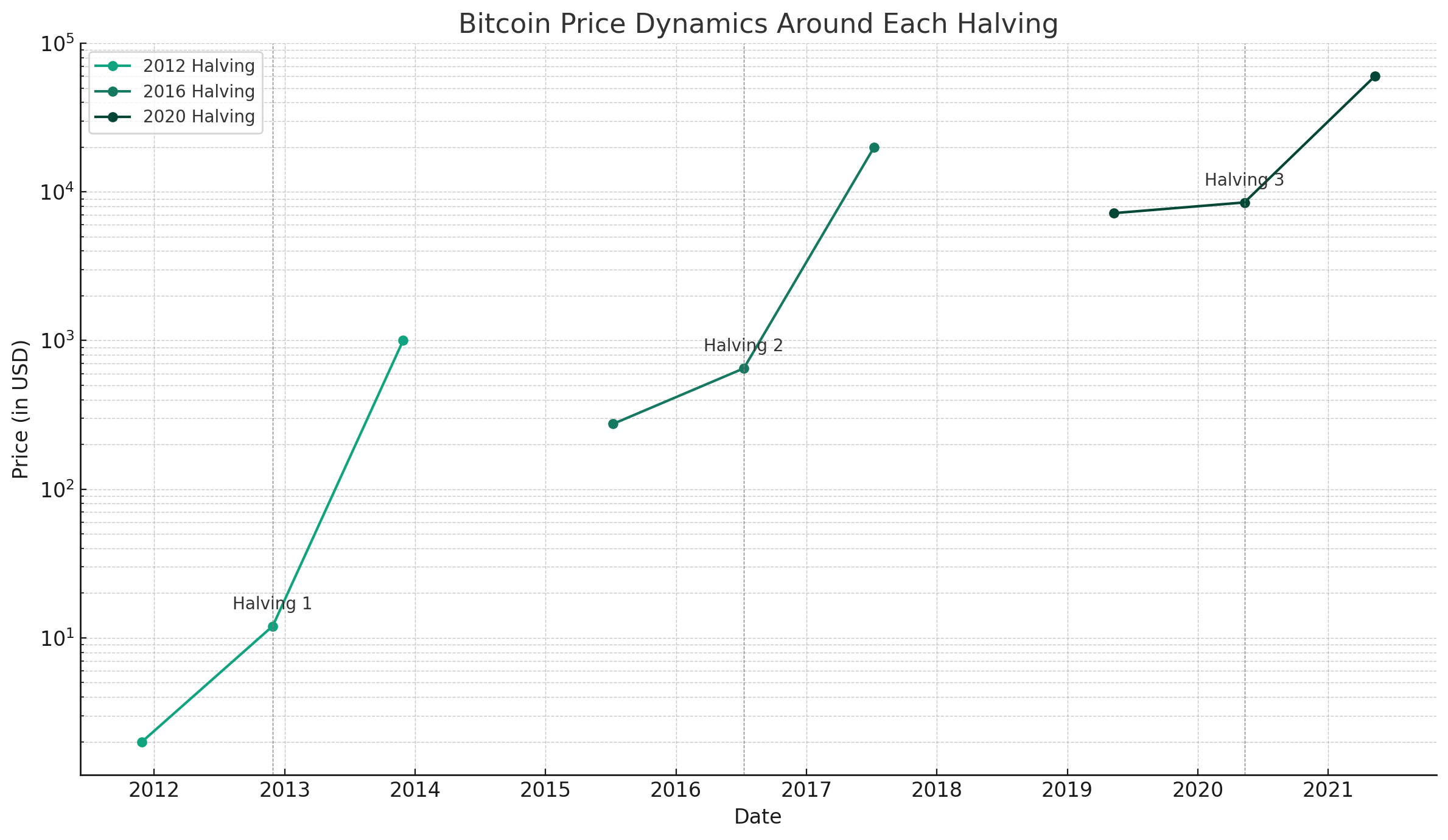

We all know what happens to the price of Bitcoin after the halving takes place, according to the data illustrated below;

Each line represents the price trend surrounding a halving event: from about a year before the halving to a year after.

The vertical dashed gray lines indicate the exact dates of the halvings.

The chart uses a logarithmic scale on the y-axis, which makes it easier to visualize large price changes.

You can observe:

For the 2012 halving, the price rose from $2 a year before the halving to $1,000 a year after.

For the 2016 halving, the price increased from $275 a year before to $20,000 a year after.

For the 2020 halving, the price moved from $7,200 a year before to $60,000 a year after.

Now back to the ETF filing, after this much delay, it would absolutely make no sense for the SEC to disapprove the applications, even if they did, it will only lead to more regulatory clarity, and the institutions will fulfill their regulatory obligations and refile and we will still get the same effect.

However, if they are approved, If BlackRock buys $10B BTC, that’s 2% of the total Bitcoin market cap. That’s how liquid the Bitcoin market is. However, $10B is current 344.800 BTC, ie 17% of all bitcoins available on exchanges, that’s how illiquid the supply of bitcoins is. This will lead to a massive supply shock, and BlackRock is not the only one waiting in line for a green light on the ETF filing, one can only speculate the potential market shifts ahead and from where I stand it is super exciting I don’t know about you.

Posted Using LeoFinance Alpha

So what I get from reading this is that they are delaying approval to the halving to give someone or someones more time to accumulate Bitcoin beofre the next bullrun, which could happen in 2024 and coincide with the halving and the first ETF? And then someone or someones will make huge profits DCA selling into the huge green candles of BItcoin bullrun, and many retail traders will become exit liquidity for the next BItcoin crash.

Or to give themselves more time to cause fud and scare people to sell their bitcoin for cheap so they can accumulate more before the time

Yep, that too! 😂