Zhao Dynasty Comes to an End

Zhao Dynasty Comes to an End

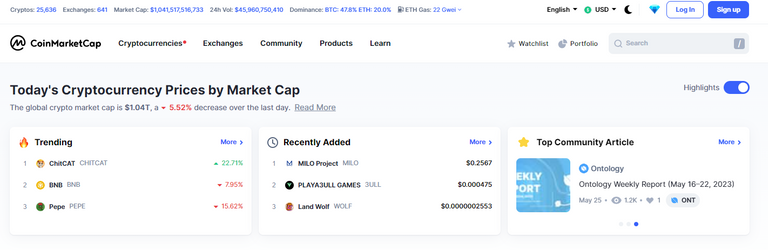

Crypto Currency has taken a dramatic hit in the wake of the Australian wing of Binance suspending deposit and withdraws of AUD which caused a market mismatch in the Bitcoin AUD pool providing some serious slippage. he resulting 20% discount caused Bitcoin to dip in the overall market and reminiscent of the previous death spirals, this week we're seeing some further dips across the entire crypto market.

No doubt this too shall pass as it always comes to do what it will climb back up to is anyone's guess but things might be a little different as it is starting to look like the US is ready to roll out crypto regulation. Unlike the typical increased taxes and CTP gain's the moves from the US SEC appear to be targeting centralised exchanges which, for a long period of time have gotten away with dodgy operating.

Centralised exchanges have appeared to have been enabled to undertake all kinds of trades, investment opportunities and high stakes behavior where they were always in a win win situation and a completed removal of any accountability when offering people scam tokens.

US SEC Bites down hard on Binance

Binance was once again at the center of further controversy as the US SEC Charges Binance and Coinbase and they too are taking a stand at the constant launching of dodgy Crypto assets. While new tokens are some of the games best gambled moves, they also continue to cause many losses of money while providing quick wins for centralised exchanges who profit trading them.

As it turns out, centralised exchanges can be alleged to benefit from new token launches as they appear to be big winners despite many failing within a few days of their initial launch. This has resulted in the SEC cramping down on the centralised exchanges to prevent this market making situation from occurring.

US Follow's Australia

It isn't all good news for retail investors with some popular tokens being labelled as securities mainly being Cardano and Solana which are popular digital assets. The decision does come with some questions considering ADA is a fork of Ethereum which one would think Ethereum is a security also. But I guess Ethereum has a lot more mainstream funding in it so no one want's to see Ethereum cancelled.

Either way in a 136 page complaint in the New York Court lodged by the US Securities Commission the SEC looks to be closing Binance down and cancelling their financial services license. They claim that Binance has for years been ignoring US laws and enabling American's to open accounts and trade large volumes of digital assets stating Changpeng Zhao, had “engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law”

Market Reaction

Coinbase hasn't escaped the onslaught and to has been declared an illegal exchange with many investors around the world rushing to exit positions launching another death spiral with millions of tokens already being liquidated from locked contracts.

With US dollar deposits and withdraws On Binance now suspended many will be rushing to get cash out and unstake from networks before having funds locked into projects that they potentially won't be able to access again.

Although the SEC isn't having an easy time finding Changpeng with no one actually knowing where he operates from other than a rumor that he might be in Dubai.

Getting a handle on it

With over 25,000 active digital assets you can see why things are moving as it is fast becoming an out of control sector that is more a minefield of scams and failed dreams. So while the sector is once again in a bank run no doubt things will once again improve. For this incident though I think it is a little different as we know many mainstream banks are now operational in the sector providing access to the market.

Much like the Internet bubble of the 90s with most projects collapsing away to nothing I think we're watching the US in a position to now be ready to shut down Zhao and other operators and replace them with........ Banks.

It's anyones guess

What are you anticipating the final show down to look like? Do you think this is it for Binance or will they continue to trade well into the future or will the mainstream banks take over?

image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using LeoFinance Alpha

A lot of alts are now close to their Dec '22 lows. It is what it is. I would load up, but I don't plan on jumping back in the market until August.

Yeah it's a long way to go still.

Many projects will fail and this is part to be in the game. You need to expect regulations and clarity from this ongoing battle with the SEC.

!LOL

lolztoken.com

To get his teeth crowned.

Credit: reddit

@melbourneswest, I sent you an $LOLZ on behalf of @myintmo.shweyi

(1/2)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP