Yen Goes To Zero Against Bitcoin

Yen Goes To Zero Against Bitcoin

Good morning Lion’s I trust you are safe and well and following along for the latest trends as the market continues to react to the latest news and developments with the financial markets and their flow on effects to the broader Crypto currency market.

Recent news on interest rates is once again providing fear not just in the Cryptoshpere but the broader financial markets which appear to be providing no respite to mortgage holders as inflation continues to become a problem for many families and people across the globe. The question everyone is asking is when will this end?

Recent market movements have been heavily influenced by broader economic factors particularly fluctuations in interest rates and inflation concerns. The interplay between these macroeconomic indicators and the crypto landscape has been evident in recent events. Events where the value of Bitcoin dipped amidst wavering hopes for rate cuts while the Japanese yen faced unprecedented challenges against Bitcoin..

Today we are going to dive into these issues and see how they are providing pressure on Bitcoin and the broader cryptopshere and see if we can break down the core impacts on the market and hope for a brighter more bullish future.

GDP Report Not Looking Good For Interest Rates

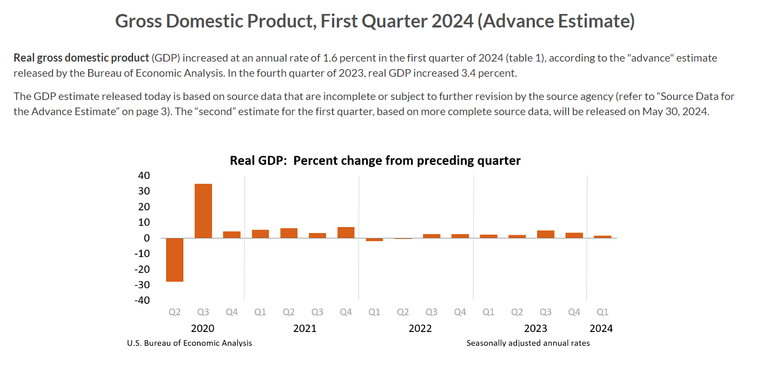

The latest U.S. economic data particularly the first quarter GDP report has sent shockwaves through financial markets including crypto currencies.. The outlook has disappointing figures showcasing slower growth and higher inflation than anticipated which have caused dimmed hopes for imminent interest rate cuts. As a result risk assets across the board took a hit. With major U.S. stock indexes experiencing significant declines. Bitcoin, the flagship crypto currency briefly dipped below USD 63,000 reflecting the broader market sentiment of uncertainty. Ethereum and other altcoins followed suit witnessing notable drops in value as investors reacted to the data.

The Federal Reserve's preferred inflation gauge which is the core Personal Consumption Expenditures (PCE) grew by 3.7% in the first quarter which is exceeding expectations and causing further potential challenges for the Fed's rate-cutting strategy.

While higher interest rates aim to combat inflation they also pose risks to risk assets like stocks and crypto currencies making alternative investments less attractive. As expectations for rate cuts dwindled coupled with geopolitical tensions or war. The crypto market is facing increased volatility and downward pressure.

Japanese Yen Goes To 0 Against Bitcoin

On the other side of the globe the Japanese yen encountered a unique predicament against Bitcoin. Amidst efforts to address hyperinflation and economic instability the Japanese currency stumbled to a 34-year low against Bitcoin.

Factors such as discrepancies in interest rates between Japan and the U.S. contributed to the yen's downfall. This unprecedented event shows the growing significance of crypto currencies as alternative stores of value and the vulnerabilities of traditional fiat currencies in the face of economic uncertainties.

Bitcoin's resilience and perceived strength as "sound money" have been reaffirmed by its outpacing of the yen in direct monetary value. The symbolic moment when one Japanese yen equalled zero BTC highlights the shifting perceptions and narratives surrounding currencies and assets in today's digital age. Bitcoin's finite supply and decentralized nature contrasted with central banks' interventions and fiat currencies' inflationary tendencies have positioned it as a hedge against economic turmoil and currency depreciation.

Mainstream and Decentralised Finance Interconnectedness

Despite the challenges posed by recent economic developments the crypto currency market remains resilient and adaptive. While short term fluctuations may occur in response to macroeconomic indicators. We can see the underlying fundamentals driving the adoption and innovation within the crypto space remain robust. The recent liquidations and market turbulence serve as reminders of the volatility inherent in crypto investments but also present opportunities for traders and investors to navigate and capitalize on market movements.

As central banks continue to navigate the delicate balance between inflation management and economic growth, crypto currencies are likely to continue playing a pivotal role in shaping the future of finance. The convergence of traditional finance and decentralized technologies presents a paradigm shift in how value is created, transferred and stored globally. As such the understanding of interconnectedness between macroeconomic factors and crypto markets becomes increasingly essential for market participants and observers alike.

The recent events continue to show the delicate but connected relationship between interest rates, inflation and crypto market dynamics. Bitcoin's price movements in response to rate cut expectations and the yen's struggles against Bitcoin highlight the evolving landscape of global finance.

As the crypto market matures and integrates further into mainstream financial systems its resilience and potential as a transformative force in the global economy become increasingly apparent.

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha

!PIZZA

$PIZZA slices delivered:

@tin.aung.soe(1/10) tipped @melbourneswest

I might say it's because of the halving that is causing it to o down

perhaps but we just don't know for sure

https://inleo.io/threads/melbourneswest/re-leo-curation-2ohndprvq

The rewards earned on this comment will go directly to the people ( melbourneswest ) sharing the post on LeoThreads,LikeTu,dBuzz.