USDC Added to Shopify and OnlyFans builds Ethereum Wealth

USDC Added to Shopify and OnlyFans builds Ethereum Wealth

It's been a shocking year for USDC as the number 2 stable coin loses significant ground against it's competition Tether almost cutting it's market cap in half compared to this time last year. While USDC was sitting high at a total market cap of USD56 Billion 12 months ago, it has currently fallen to USD26 Billion.

Some are stating that the stable coin wars are over and Tether has emerged the winner however, that is not entirely accurate as USDC is still recovering from being caught up in the silicon valley banking collapses. The company is still working towards addressing it's assets that were caught up in the debacle and has slowly been regrowing.

But the fear has set in currently with punters moving in on Tether bringing the token's total market cap to a staggering new all time high of USD83 Billion.

It's not all that simple to focus on one thing, market cap to decide if the war is over, after all USDC is utilised right across a broad range of Blockchains and paired with a broad range of crypto currencies so it's constantly at the forefront of volatility, while Tether appears to be more of a storage account.

Coinbase Invests in USDC

USDC isn't exactly out of the race just yet with a lot of motion occurring in the background more recently with Coinbase becoming a stake holder in Circle with the figures being closely guarded and not disclosed to the public. It's not the only big news to grace USDC in as many days with Circle also partnering with Shopify to add Solana pay to enable USDC payments.

This provides a real use case for USDC once fully enabled Decentralised Finance (De-Fi) users earning interest on their investments can easily trade their tokens for USDC then head over to Shopify to make purchases online with USDC.

It's a good move by USDC with Shopify home to 4.1 Million active websites that make up 5.6 Million online stores and the overwhelming majority of them, 70% registered in the United states. With 2.1 Million active users regularly purchasing of Shopify generating the company a whopping USD200 Billion in sales, it will strengthen the US's position in accessing some of that trillion dollar crypto economy.

Interesting position with blocking fiat entry and exit points but opening up online stores to enable purchases, this will most likely see people take a lot more risks to be able to purchase items.

OnlyFans Bets on Ethereum

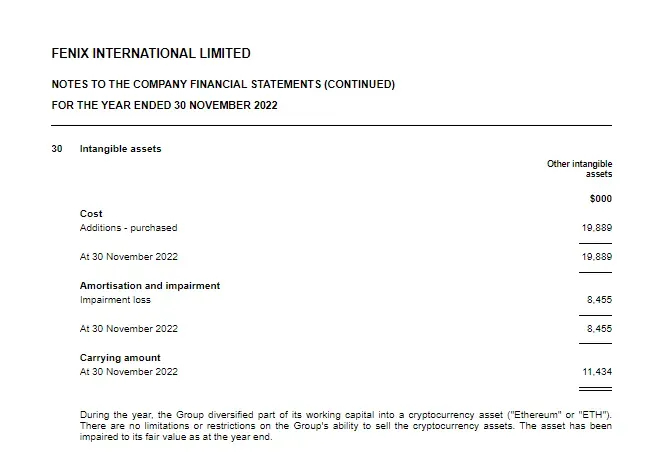

As it turns out, no0dz aren't the only thing OnlyFan's parent company Fenix International Limited is interested in with the company reporting it has diversified it's holdings into Ethereum with their financial report published this year. Despite the company once holding 19 Million Pounds worth of the Token it's holdings have dipped to 11 Million.

But these heavy losses have been subsidised by the increasing amount of people willing to take off their clothes for a few quid and those willing to pay a few quid to have a peak.

The company has continued to grow from strength to strength and it's income continues to grow.

OnlyFan's incorporates Ethereum NFTs

It makes a bit more sense now on what the company Last year announced it would be supporting Ethereum NFTs for publishers who used verified Ethereum NFTs in their profile.

Clearly the company is taking a long hold approach for Ethereum and hopes it can cash in on future price growth of the token and unlike the many it can mitigate the risk by other income generated by subscribers and content creators.

It's been an interesting week already in the Decentralised world with growth for Crypto currency adoption with purchases being able to be conducted with USDC on Shopify and news of OnlyFan's investment in Ethereum will surely cause further hype in the current market.

While we are all suffering in the current bear or the deepening winter freeze, there are still a lot of people out there holding onto for when this winter ends. Despite there being not much on offer for clearer days, the pure sign that many companies are HODLing and others are trying to break into the sector to provide retail options.

It is a sure tail sign that one day, soonish there might be another bull run on the cards. Where will you be?

image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

!PIZZA

$PIZZA slices delivered:

@tin.aung.soe(2/10) tipped @melbourneswest

Your comprehensive analysis of the stablecoin landscape and its intersection with decentralized finance (De-Fi) is incredibly insightful. The fluctuation in USDC's market cap over the past year indeed showcases the dynamic nature of the crypto space. It's fascinating to see Tether's market cap soar while USDC navigates its recovery process post the banking mishap. The focus on market cap alone doesn't capture the nuanced roles these stablecoins play – USDC's wide utilization across blockchains and pairings, and Tether's reputation as a reliable store of value.

The strategic moves by USDC are noteworthy, especially its partnership with Shopify and the investment by Coinbase. Enabling USDC payments on Shopify presents a tangible use case, potentially propelling the stablecoin's adoption within the massive Shopify network. This leap into e-commerce could indeed bolster the US's foothold in the evolving crypto economy.

The mention of OnlyFans diversifying into Ethereum caught my attention. It's intriguing to see how companies are exploring alternative investments and hedging their holdings. The incorporation of Ethereum NFTs by OnlyFans aligns with the broader trend of integrating NFTs into various platforms, harnessing the token's potential for future growth.

Your post offers a panoramic view of the current landscape, blending news, trends, and possibilities in the crypto world. It's refreshing to see your cautionary note about this not being financial advice, encouraging readers to conduct thorough research or seek professional guidance. The prospect of a potential bull run amid ongoing developments surely keeps us all intrigued and optimistic. Thank you for sharing your keen insights and thought-provoking analysis! 🚀📈

Thank you for such an insightful and in-depth comment

You are welcome 🤗

Congratulations @melbourneswest! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 69000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

https://leofinance.io/threads/melbourneswest/re-melbourneswest-281szgybx

The rewards earned on this comment will go directly to the people ( melbourneswest ) sharing the post on LeoThreads,LikeTu,dBuzz.

Haha of course the nudes are going to try to make NFT’s. I can only imagine how that’s going to go lol. Mia Khalifa’s left buttcheek NFT.

Hahaha that would be funny, I wonder if many people are making them and making cash off them?

I think USDC will be more stable if Coinbase invests in it now

Do you feel that way too?

It will increase it's stability and people will trust it more also