Solana Closes Ground On Binance as 740 Million in Liquidations Hit

Solana Closes Ground On Binance as 740 Million in Liquidations Hit

Oh wow what a wild ride Lion’s! a slight market dip saw some flash crashes wiping around USD 740 Million worth of funds and as the fear sales hit hard, the sharks moved in to relift the sector resulting in some large scale wins for them. This showcases how emotional the crypto currency. market can be.

Two weeks ago I mentioned how Solana is the new Binance killer and it seems other news sites are readin InLeo work because this is now the common theme with NEWSBTC now also sharing these thoughts as Solana now moves towards 5% dominance and it continues to rise even amongst the flash crashes.

So let’s take a look at some of the breaking news and break down what has happened over the past few hours and how the sector views solana and where it will be in the near future.

The crypto currency market recently experienced a tumultuous ride characterized by a sharp downturn that left investors reeling with fear dominating the market. As Bitcoin plummeted panic ensued triggering a cascade of flash sales and liquidations totaling a staggering USD 740 million. However, amidst the chaos the market's ability to bounce back from adversity as shown through although this could have been large whales causing a dip and larger players picking up the cheap bitcoin to retain the current prices.

Bitcoin is the bellwether of the crypto world, a household name and witnessed a sudden dip, briefly slipping below the USD 69,000 mark amid profit taking activities. The dip was exacerbated by hotter than expected US Producer Price Index (PPI) inflation data which spurred a rise in the US dollar and bond yields further dampening sentiment. Despite the setback faced Bitcoin managed to find its footing with dip buying bulls swooping in to buy the price back up to USD 70,500.

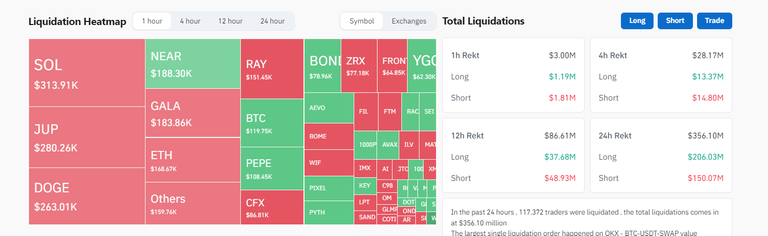

The sudden downturn in Bitcoin's price sent shockwaves throughout the market causing fear and triggering panic selling and liquidations. Leveraged traders who had bet heavily on continued upward momentum found themselves on the wrong side of the trade as their positions were forcefully liquidated. The liquidation heatmap on coinglass shows how bad things got with Bitcoin and Ethereum bearing the brunt of the carnage. Bitcoin alone witnessed a massive USD 27.75 million liquidation event highlighting the extent of overleveraging in the market.

Cause of the market correction? - Profit Taking

The reasons behind the sharp correction are widely debated. Traders eager to capitalize on the recent bull run took profits, triggering a natural market correction. The use of excessive leverage in the futures market exacerbated the price movements leading to a domino effect of liquidations which is a common event. However, despite the widespread panic the carnage in the futures market remained relatively limited with only over USD 100 million in leveraged long positions being wiped out.

Despite the dip, most market participants remained optimistic about the crypto currency's long term prospects. Users noted a pattern of short lived dips over the past week hinting at a strong underlying bullish sentiment. Moreover, the approval of spot Bitcoin ETFs in mid January had injected significant froth into the market suggesting that the dip might be a temporary blip in an otherwise bullish trajectory due to the increased liquidity.

Solana See's Biggest Gainz

While Bitcoin weathered the storm another crypto currency was making waves of its own. Solana often touted as the "Ethereum killer," surged to a 25-month high reaching USD 173.27 as bullish momentum continued to build. The crypto currency industry carried by Bitcoin's new all time high witnessed a substantial uptrend with Solana leading the charge. Over the past month SOL saw a remarkable 51% increase in value fueled by growing investor confidence and positive market sentiment.

Solana's rally was fueled by a combination of factors. The announcement of an Israeli Shekel backed stablecoin, BILS launching on Solana's platform bolstered investor confidence in the crypto currency's potential. Additionally technical analyses suggested a breakout and bullish momentum for SOL further driving up demand.

As Solana closed the gap on Binance Chain the race to 5% market dominance intensified, with SOL emerging as a strong contender.

As the crypto market creates a new era one thing remains clear volatility is par for the course although it might not be as bad as it once was. While a slight dip in the market may cause fear and panic, it also presents opportunities for savvy investors to capitalize on temporary downturns.

But we’re not out the woods yet as the halving event comes closer we may see a massive price correction and reduction so be safe and ensure you’re not playing with money that will send you bankrupt.

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha

!PIZZA

$PIZZA slices delivered:

@tin.aung.soe(2/10) tipped @melbourneswest

That’s crazy!

Solana is performing some magic