Crypto Short Squeeze Again and Likely More to Come!

Picture in post courtesy of investorplace.com. Another example of crypto short squeeze may have been over shadowed by ETH hitting all time highs and or Doge coin also hitting all time highs. The crypto Ethereum Classic (ETC) just hit an all time high too but compare to ETH and DOGE it has rose much more than both this week.

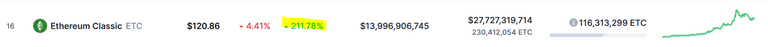

In just the past week ETC has rose over 200%, reaching all time highs as much as $144.

Chart above is from coindesk and basically shows how much ETC has broke from its all time highs made in 2017. For almost four years ETC has finally gotten above its previous highs. Yet it did not stay there long at all.

The originally top in 2017 may have likely been a decent resistance line as back then investors who bought at that price may have felt that they wanted to sell their holds to breakeven.

How Crypto Short Squeezes Work?

Little did shorts know that in all likelihood long term holders may have just felt that the current ETC price run up is just beginning hence would not sell. With low supply and demand high the only thing left is price going higher. As of middle of this week ETC on US crypto exchange Kraken had ETC demand go so high people were buying ETC at a premium of over 50%.

The willingness to buy higher at a time where the token may not technically be worth that much in other parts of the world did not slow prices down. In fact immediately afterwards when other exchanges across the globe saw Kraken's premium on ETC being bought up, other exchanges did the same. A squeeze effect was born. This is when so many investors are buying an asset that the price just soars out of contol.

"In South Korea, where ETC’s trading volume is surging on the Upbit exchange, investors behind the rally are only looking at profits in the short term"

Currently South Korea does not have institutional investing in crypto so it is likely retail investors are getting hook at current crypto boom. The boom is now making them go buy ETC even as it continues to explode in price.

Adding fuel to the fire will be investors who did not think ETC would rise so far and so quickly an in turn went short the token. Being wrong and having to buy back the shares to cover it only adds more buying into ETC. Buying leading to more buying.

What will come of this buying? Since it all started with Bitdon and that lead to ETH and then to DOGE..It may be a passing of the torch to ETC? No matter what the retail demand of crypto is continue to hold and rise as more tokens begin to move up parabolic and get more people to invest in. ETC is one of those cases.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

Squeeze! !LUV and !wine

Thanks !LUV and !PIZZA

@logicforce! I sent you a slice of $PIZZA on behalf of @mawit07.

Learn more about $PIZZA Token at hive.pizza

Hi @logicforce, you were just shared some LUV thanks to @mawit07. Holding 10 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares

Hi @mawit07, you were just shared some LUV thanks to @logicforce. Holding 10 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares

Why are they investing in something that they know is overvalued and can cause a crash with profit booking.

I don't understand the mentality behind this. Why are they risking their money ?

!LUV 1

Hi @mawit07, you were just shared some LUV thanks to @harpreetjanda. Holding 10 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares