Crypto Investing Likely The Future so Hodl!!!

In recent days there is news about the stock market craze when it comes to meme stocks. Traders or investors who follow wallstreetbets is well aware of some of the stocks that have been recently bid up. Whether it is GME or currently AMC the outcome is the same. The stock price is shooting up in a meteoric rise that no evaluation or fundamental can explain.

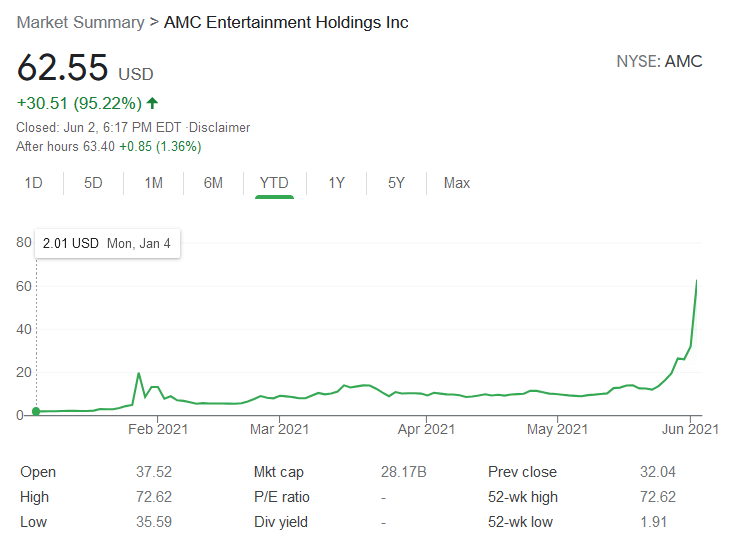

Something came to my mind after seeing how AMC resemble so much as to GME did in January of this year. Looking at AMC stock price at today's close of $62.55 if investor had purchased the stock at the beginning of this year, around $2 on January 1st. If they had held on to the stock they would have +31x their investment in six months. This kind of return in stock market is rare. Just look at the indexes of the market?

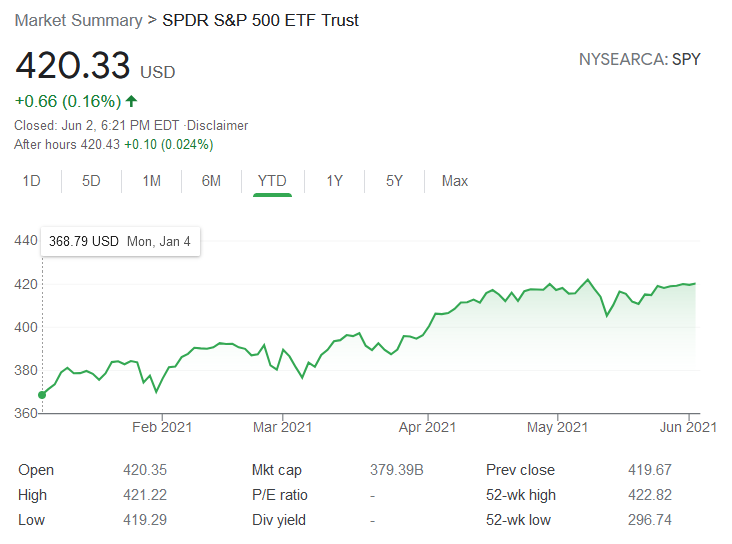

Holding SPY index since January 1st to today the returns would be a meager 14%. The AMC holdings return is over 3,100%! Now what if this was just the beginning? What if the beginning of something that will be the normal in the near future?

A New Generation of Traders Growing

Derivative trading for retail in laymen terms it is trading options. In the stock market most stocks traded daily have derivatives to trade. This creates more order flow for shares of stocks. What stock market has had for decades in options trading has allow for moves that we see currently in stocks like GME and AMC. Investors that are willing to put their money on the line that basically is pushing the stock price up beyond what is consider fundamentally make sense. Not to say this is wrong. On the contrary it is something that has allow investors who buy low and sell high to make large profits in very short period of time. AMC's 3100% gains in six months is unheard of. Especially when the company has been established for decades and revenues/profits are well known from past history.

Fundamentals aside look at the investors who are involved. They are mostly the younger generations from boomers. These individuals may not have a fortune to invest but as a whole when calibrating as in wallstreetbets they sure have a way to bid up the market. These group of individual are savvy when it comes to tech and how to apply it. From use and creation of apps to forming chat rooms to share their knowledge and become influential has made it a formidable foe against Wallstreet itself.

Banks having to get involved into cryptocurrency is likely because the younger generations are interested in them. Furthermore the younger generation is interested in speculative trading to the tune of what are the results we see today in GME and AMC. These meme stocks are not just two stocks but a whole slue. From BBBY, PLTR, BB and many more. The facts are there are willing investors to put in money on investments that are basically giving returns that would not be of normal in a stock market. Instead it is comparable to none other than the cryptocurrency markets.

Cryptocurrency Trading Market Volalitity

With the rise in crypto since late 2020 it is clear that demand for trading crypto is high. So high that we have the crypto overalll market hit over $2 trillion before the middle of 2021. Although it has fallen back to almost half that market cap it is reasonable to say that this type of volatility trading is the norm in crypto markets.

The potential of massive gains in short period of time is the allure with trading crypto. With the big price swings comes big volatility. New investors across the globe can trade crypto and in similar fashion to stock markets there are places now such as Kucoin and Binance where investors of crypto can trade derivatives. With leverage and globalization crypto has become a go to market for investors to have the potential to earn large amount of equity. It is worth noting that when trading derivatives it is important to know the time the investor is trading in. In short when using leverage one can easily lose as well as gain in investing, and it is very difficult to come back from a heavy loss. Risk management is very important when one trades especially when it comes to derivatives.

ConclusionsIf AMC and GME will continue its meteoric rise that leads to other meme stocks to also do the same in the not so distant future I can only imagine how phenomenal the cryptocurrency market will be in the future. Stock markets are isolated mostly to individuals who are in one specific country while cryptocurrency can be traded globally hence 24 hour none stop daily trading.

The potential money that has poured into the stock market to get meme stocks to rise so much in such a short time is most partly started by the younger and more tech savvy generations of investors. If they continue to support the cryptocurrency market by investing in them it will not take long for many of these crypto assets to likely go parabolic similar to that of AMC and GME.

I end this with comparing the total market cap of the current US stock market, which is valued at $95 trillion. The crypto market on a global scale is close to $2 trillion. I would not be hesitant to say that a decade from now that the crypto market will be much more than $2 trillion. The potential increase is high and with flood of investments on a global scale and in large orders it won't take look for things to go parabolic.

Not investment advice but for entertainment purposes only. Thanks for reading.

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

I don't know...it all depends on how long the meme hodlers can hang on and not cash out.

I did not explain well in post but GME which has sustained enough longer than three months above $200 is in fact currently on pursuit to go parabolic again. On the back of a January pump and dump. Similar to how crypto like btc rises and falls but in the end makes all time highs. I do admit this type of investing is not for long term hold but hold long enough to see all time highs. !LUV and !PIZZA and !invest_vote

@deanlogic! I sent you a slice of $PIZZA on behalf of @mawit07.

Learn more about $PIZZA Token at hive.pizza (1/10)

@mawit07 denkt du hast ein Vote durch @investinthefutur verdient!

@mawit07 thinks you have earned a vote of @investinthefutur !

@deanlogic, you were given LUV from @mawit07. Info: https://peakd.com/@luvshares or check wallet: https://hive-engine.com

!LUV

Thanks !LUV and !PIZZA

@logicforce! I sent you a slice of $PIZZA on behalf of @mawit07.

Learn more about $PIZZA Token at hive.pizza (4/10)

@logicforce, you were given LUV from @mawit07. Info: https://peakd.com/@luvshares or check wallet: https://hive-engine.com

@mawit07, you were given LUV from @logicforce. Info: https://peakd.com/@luvshares or check wallet: https://hive-engine.com

Over the past couple of years I have joked with my traditional broker about wanting to put my money into crypto. I have been doing it, but I know he would be hesitant, so that is why it has always been more of a joking comment. I have a feeling more and more brokers are having to start to field similar questions these days. With it becoming more mainstream they are going to be in a position where if they don't do it or at least learn about it they will be left behind.

Posted Using LeoFinance Beta

When more stocks are doubling I have no doubt the brokers we be even more willing to invest in crypto because they are trying to chase yields. !LUV and !PIZZA

@bozz! I sent you a slice of $PIZZA on behalf of @mawit07.

Learn more about $PIZZA Token at hive.pizza (8/10)

For sure!

Posted Using LeoFinance Beta

@bozz, you were given LUV from @mawit07. Info: https://peakd.com/@luvshares or check wallet: https://hive-engine.com