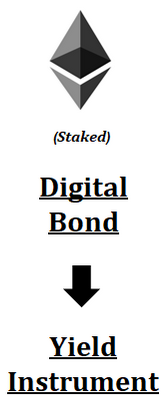

Digital Bonds

Digital Bond

The European Investment Bank (EIB) has come out indicating they will initiate a $100 million Euro 2-year bond through the use of Ethereum. This push ETH prices to all time highs but it also provides an indication that government is supporting the crypto with its use.

Danny Kim, head of revenue at SFOX, a full-service crypto broker, said reports on an EIB digital bond issuance has "triggered a bullish institutional use case for ethereum".

"The amount of ethereum sitting on exchanges continues to drop lower and has been the lowest in the past year," Kim said. "With less supply on exchange available, there's less likely a chance of a major sell-off."

In that regards ETH prices continue higher even though BTC is flat to red.

Why Digital Bonds?

EIB is trying to be environmentally green and by applying the use of ETH blockchain they believe it will structure the buy and sales of bonds more efficient than the standard way. However EIB will still have banks as medium to assist in the transactions the transactions themselves goes through the ETH blockchain.

“Innovation at the EIB goes beyond the projects we are supporting. As a global leader in the green and sustainability bond markets, the EIB is clearly well‑placed to lead the way now in the issuance of digital bonds on blockchain. These digital bonds will play a role in giving the Bank a quicker and more streamlined access to alternative sources of finance to boost finance for projects across the globe," Mourinho Félix, vice president for EIB, said in a statement.

The benefits with digital bonds would reduce fix costs in bond transactions, improve market transparency and quick settlement. EIB is hopeful that banks will be able to benefit with the use of ETH blockchain and other cryptocurrency platforms to enhance their services to clients.

The Block Crypto Article Source

Banks Surviving?

One of the main reasons BTC was created was to remove the bank from controlling the flow of assets. To crypto believers the freedom from government and banks controlling their wealth would be removed with use of crypto. Yet here we are where banks are spinning the situation and applying crypto in the form of a tool for banks to use.

Question to readers here is really the premises if this integration of EIB's digital bond really a benefit for customers or a way for banks to get involved with the crypto boom?

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Posted Using LeoFinance Beta

!LUV and !wine

Thanks !LUV and !wine

Hi @logicforce, you were just shared some LUV thanks to @mawit07. Holding 10 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares

Hi @mawit07, you were just shared some LUV thanks to @logicforce. Holding 10 LUV in your wallet enables you to give up to 3 LUV per day, for free. See the LUV in your wallet at https://hive-engine.com or learn about LUV at https://peakd.com/@luvshares