LBI token Hardcapping - 7th May 2021

Authored by @silverstackeruk

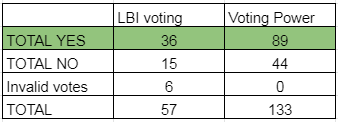

Hello, LBIer's. Earlier this week we got the results of a recent governance vote to decide of LBI should hard cap its tokens supply or not. The results came on with the result, YES to hard capping the LBI token so now we start the process.

You can see the Vote results post here. 51 out of an eligible 176 voted. 89 Yes/44 No

Hard capping makes sense as only a few hundred new tokens are being issued directly every week, a few hundred might sound like a lot but a few hundred into a quarter-million is a fraction of a percentage and there is much more activity on the hive engine and LeoDEX exchanges were the LBI tokens can be bought at a cheaper price sometimes due to people wanting quick sells. The LBI token is being hard-capped, that does not mean new investors are locked out, its just means they buy LBI from the exchanges. It's what most people have been doing the past 2 months already as they can be bought cheaper sometimes. I am sure if someone put in a 5000 LBI buy order for whatever 1.2 LEO is worth in HIVE, that order would get filled within 72 hours.

So, a YES vote has been passed. There are few ways we can go about this and I feel it's my responsibility to think of an easy to understand and fair way to complete the task at hand for the LBI token holders. From my experience with hard capping SPinvest and all the thousands of hours, I've spent thinking, playing out scenarios in my head and sharing at numbers on excel sheets, I think I can do just that.

LBI issued and circulating - 220,974

If LBI were to hard cap today, this would change to

- 276,217 Hardcap

- 220,947 circulating

20% of LBI tokens are reserved for the LBI content team to be issued as LBI hits certain price targets. These range from the lowest of 1.20 LEO to the highest of 5 LEO per LBI token. This ensures rewards are only issued when the fund performs well. For the full 276,217 to be in circulation, LBI tokens need to be worth 5 LEO each.

LBI Hardcapping procedure (4 weeks)

We cant just cold turkey and stopping issuing tokens as there are still a few users buying tokens every day and others that might want a few weeks to save up and buy a last batch directly from @lbi-token. We will set the date to hardcap in 4 weeks from today on the 7th of May giving people time if required.

- Hardcap will take place on the 7th May

- LBI token price will remain at a direct issuing price of 1.20 LEO until hardcap

- On the 7th, the hardcap is created and all remaining tokens are burned

- From the 8th onwards, the LBI price will be updated daily to the LBI discord server

Here's an easy way to work out the hardcap. Take the circulating amount, divide it by 4 and then multiply that by 5.

On the exchange, it says LBI has 250,000 issued tokens which is correct but only 220,947 are issued to investors, the 19,053 are stock to be sold. To find out the current circulating supply, visit https://he.dtools.dev/richlist/LBI and remove the amount held by @lbi-token from 250,000.

After the Hardcapping

We will have a set number of LBI's that can never increase, the token price will be updated and posted daily instead of weekly as is now and transactions will take place on exchanges.

For LBI, hard capping its token is levelling up and could be viewed as ending the ICO. We're definitely funded and it's time to put these funds to work. We can start to explore earning out of content and curation and maybe launching a small subsidiary project/service and start to build LBI out to increase weekly earnings on the chain. The focus will still be on increasing our LEO power balance and keeping investments with into LeoFinanace ecosystem. LBI is still growing and if even we are in a bullrun year, our plan to increase LEO stake and ride through whatever the market throws at us for the next 4-5 years. I am still increasing our bLEO/BNB position to the tune of $1000 for a week so god knows what that will be worth in 6-9 months from now never mind in 5 years. Blank is still to come and LEO GOV tokens are still a big interest of mine.

The great thing about LeoFinance is we'll end up with all these different investments under the same roof. LeoFinance for producing content and curating. CUB finance for off-platform investing, Blank for a subproject, GOV tokens for running witnesses on the LEO sidechain. There's hardly any reason to go out of the ecosystem when you think about it.

I think that about everything, i hope this plan is ok with everyone and you are happy will the procedure. So, 4 weeks from today we will get a final hardcap number.

Thank you for taking the time to read this post today.

Posted Using LeoFinance Beta

Sounds like the wheels are in motion, now to just wait and see where the wheels take us.

Exactly, let's push it until she runs out of gas, haha

Thanks for checking out the post

Posted Using LeoFinance Beta

It will definitely be interesting to see how much of the LBI is sold and burned. Just a little bit more left for me before I reach my goal of 100 LBI and I hope to reach it before it is hardcapped.

Are we going to continue increasing the bLEO/BNB pool every week regardless of what happens? I just wanted to know if it would change once the new projects get released.

Posted Using LeoFinance Beta

BNB looks definitely a winner in the mid term so I'm super happy that LBI have some in the portfolio.

Posted Using LeoFinance Beta

I don't doubt it can be a winner and I think its a great investment strategy. I trust that silverstackeruk will probably get out when things starting looking wrong. I just wanted a little bit of clarity on whether or not BNB/bLEO pool is going to continue forever or just until the profitability starts to dwindle.

Posted Using LeoFinance Beta

Hey, the weekly investment into the bLEO/BNB LP will not last forever. So right now, im converting 500-600 LEO every week into bLEO, this is $500 for talk's sake. We are currently harvesting $600-700 worth of CUB every week so around $600 is going into the LP and the reminder is staked to the CUB den.

If for example the ROI's were down 80% in 3 months time, LBI's weekly earning would be equal to around 120 bLEO and if LBI is still earning more than 1000 LEO per week, it's only a small part. I'll never convert LEO into BNB are anything else. We are limited to the amount of CUB we harvest against the value of LEO I guess. If we earn $100 worth of CUB in a week, we can make a $200 bLEO/BNB LP that week.

But no I dont see us investing into this every week forever, the ROI is great for now and we'll have to invest in other things to become diversified. The end goal would look something like a $20-25k LP earning 50% per year. This would produce an income of $200 per week to reinvest into something else, maybe a weekly buy of BTC, maybe we convert back to LEO and power it up. We'll cross that bridge when the LP is big and strong.

Good question

Posted Using LeoFinance Beta

Thanks for the clarification and the extra details on how the CUB earnings are spent. It definitely is a solid plan as we can use that LP to diversify the asset LBI holds.

Posted Using LeoFinance Beta

Are there plans to hodl the purchased BNB? It would be great to start having assets in all the winning blockchains out there. Surely BNB will eventually take a breath from this multi-bagger rally but it is a solid utility token that will keep yielding if staked in Binance Vault.

This ALL looks very well planned out, with room to wiggle and find the best path forward. The only thing I do not completely embrace is maybe just setting a hard cap at 300k which would include the content contributors token share 🤣 That is just the OCD talking!

I like the future options for staying "mostly" on-chain, meaning LEO, but a nice healthy dose of BTC worked wonders for SPI and it is a wonderful anchor for any project. Did you know that HIVE has a very big BTC holding? I did not until recently. And I forget the amount, too!

The cool part of LBI is that my LBI Bag is already nearing 3x my total of SPI when I cashed it out! I sent a lot of HIVE over to LBI via LEO and grabbed some Gold too.

You are doing a FINE JOB, @silverstackerUK!

🤑

Posted Using LeoFinance Beta

Thanks man,

and no, never knew HIVE held BTC. Smart i guess, lol

Posted Using LeoFinance Beta

OOOhhh

I guess it could be that Hive based in Canada 🤔

The ones that sent us a cease and desist LOL

Posted Using LeoFinance Beta

hive who??

Hive is a blockchain, how would it own btc?

Posted Using LeoFinance Beta

Thanks a lot for the thorough info about process and maths. Happy to let the market ride this baby. This time voting express an overall agreement, which is great. Onwards!

Posted Using LeoFinance Beta

Thank you for the nice comment. I did rush this post a little bit time slips away from me, haha.

Posted Using LeoFinance Beta

I'm very curious what will happen with the price of the lbi token after the hard cap. I expect it to easily go in the $2-$3 dollar range

Posted Using LeoFinance Beta

Nothing will happen really to the price, there might be a small premium on the exchange but I dont think so. If the LEO sidechain that they are talking about is priced in LEO, we would be home dry in a boat.

It'll be interesting to see if there is any difference between when SPI capped.

Posted Using LeoFinance Beta

I though prices would go up on exchanges because scarcity and all that

Posted Using LeoFinance Beta

This community finally decides. I believe it's the right thing to do going forward. Looking forward to see how it impacts the price in the coming weeks

Posted Using LeoFinance Beta

I am for limited supply of LBI as that alones should increase the value by having competitions within investors line. And as LEO is limited, so should LBI and in a realistic way should be less than LEO. But we need the supply limited, otherwise the price will not improve in favor of all the investors from the fund!

Posted Using LeoFinance Beta

This is great news! I am happy that things are moving pretty fast with LBI.

Posted Using LeoFinance Beta

I am for limited supply of LBI as that alones should increase the value by having competitions within investors line. And as LEO is limited, so should LBI and in a realistic way should be less than LEO. But we need the supply limited, otherwise the price will not improve in favor of all the investors from the fund!

Posted Using LeoFinance Beta

Supply and demand. I think the hard cap is a great idea and I did not vote so add another happy LBI user to the count!

Posted Using LeoFinance Beta