The Best Way to Start Buying Bitcoin

With the latest run in the Bitcoin price, we're seeing a lot of new entrants and a lot of re-entrants into the crypto space. As the price moves up, people inevitably get bit by the crypto bug and wonder:

"Should I be investing in this thing?"

My answer is an obvious yes. I've been investing in crypto for years and believe that currencies like Bitcoin are a forgone conclusion and other currencies like Hive are a bit more speculative in nature, but have wildly high potential.

I'm sure many of you share a similar trait as I do in your family/friend circles: the bitcoin guy or gal. The crypto nut. Your friends and family look to you as the person who "does the bitcoin thing" or the "crypto trader" and thus, when they get crypto currency curious, they reach out to you and ask questions like:

"Is it a good time to buy Bitcoin"

I wrote a LeoPedia article not too long ago which answered this question specifically. In it, I claimed that it is never a "bad time" to get into the crypto market. The real question is how do you get into the crypto space... do you learn how to earn crypto on a platform like Hive or LeoFinance? Do you dollar cost average (DCA) your way into a crypto portfolio? Do you become some sort of "crypto investor"? Do you buy a digital wallet to store your Bitcoins?

$10 a Day Keeps the Central Bankers Away

As I'm writing this, I have two working titles. This one ended up being the title of this post, but the alternative was:

"The Best Long-Term Wealth Building Strategy in All of Crypto??"

I shared my LeoPedia article with friends and family and told them that if they were genuinely interested in getting into crypto, the best way is to buy a very very small amount of Bitcoin each day over a long period of time... regardless of the price. Bitcoin trading is a dangerous game and the best strategy is often one that involves passively purchasing Bitcoin through an exchange over long periods of time. Financial services can often be misleading and purchasing a single Bitcoin at once may not be the best way to get money from your bank (fiat currency) and into the virtual currency space.

Bear in mind that the people I'm talking about are ones who have a steady paycheck and who also don't care to really learn much about the space right now. They just want to speculate on the success of cryptocurrency in the long-run. Learning about satoshi nakamoto and all of these profit seeking aspects of the virtual currency space bring an unnecessary level of complexity. Instead, start small with a simple bitcoin wallet and programmatic buying experience. As time goes on, you can delve deeper into central bank, digital currency, the bitcoin core tenants bitcoin exchange complexities and more. Get in and start small. Then dive deeper.

My goal in telling them to get into crypto in this way is to simply get some exposure to the largest crypto asset (Bitcoin) and start learning about the industry slowly while leveraging an automated buying system with a bitcoin exchange app like Coinbase or Square's Cash App. When you have skin in the game, things become a lot more interesting and learning about inflation, deflation, mining, earning crypto, etc. all becomes relevant because of your exposure to the space.

"So what is the best way for me to get exposure to Bitcoin?" - crypto market curious individual

I've been saying this for years to my friends and family - the best way to get exposure to crypto is to buy $10 worth of Bitcoin every single day, regardless of the price... if you meet these criteria (which almost all of them do):

- Steady paycheck (full-time job)

- High risk tolerance for a small amount of disposable income

- Crypto curious but not crypto convinced

- Set it and forget it mentality

$10 a day is $300 a month or about $3,600 a year. For many of the friends and family that I'm talking to, this is the perfect balance of relevance. It's not enough money to the point where it would negatively impact their day-to-day lifestyle, but it's also not such a little amount of money to the point where it is completely meaningless.

If you're reading this and $10 a day is too much (making the balance of lifestyle trade-off uneven), then drop it down. Maybe $1 a day is all you can afford... $1 a day is better than $0 a day.

Or maybe you're a wealthier individual with a higher paying job. $10 a day might be completely irrelevant to you. Pick a higher number. Say $30 a day.

For most people though (especially in America), I believe that $10 a day is a perfect balance between being relevant and irrelevant.

What Do The Returns Look Like?

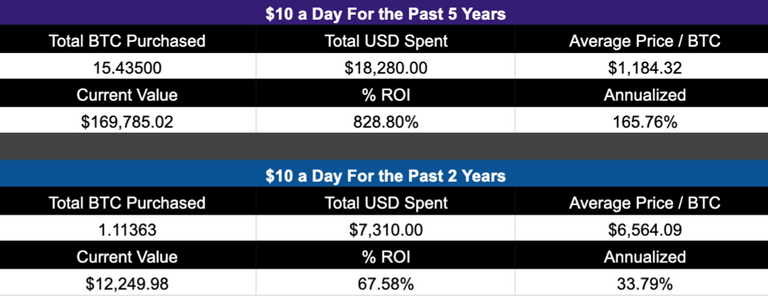

I've been telling people to do this for over 4 years (since I got into this space). So I thought it would be fun to download the Bitcoin price history and see what the returns would look like over a 5 year time frame. I also included the past 2 years to give a little more solidity to the argument that Bitcoin has already risen past that time of being a super early stage investment (when it was $200 per BTC).

So if you bought $10 a day worth of Bitcoin starting 5 years ago (7/29/2015), then you would have purchased a total of $18,280 USD worth of Bitcoin.

Today, you would have 15.435 BTC which is currently worth $169,785 USD (@ $11k/BTC). That is a 828.8% Return on Investment (ROI) or an annualized return of 165.76% per year.

Tell me what other investment vehicle you could choose where you'd make 165% per year on your money.

Now to answer the rebuttal: "but that was when Bitcoin was so early... nobody knew what it would do back then because nobody even used it"...

Okay, let's take the past 2 years then. You would have been entering the space after it had matured a great deal and got mass media attention in the 2017 bull run.

The "Blue" bar shows the past 2 years of buying at $10 a day. 7/29/2018 - 7/29/2020:

- Spent $7,310 USD on BTC

- 1.11363 BTC purchased

- Current value: $12,249 USD

- ROI over 2 years = 67.58%

- Annualized Return = 13.52%

33.79% per year is obviously less attractive than the 165% figure. You've gotten into the space later and it's also a shorter time frame. Regardless of that, 33.79% per year is still a very attractive return against other investment vehicles.

The 5 year rule

When I tell someone to do this strategy, I would also say that they should forget about the money for 5 years. Just set this system up where you buy $10 worth of BTC every day and forget about it. It's just a $10 fee that comes out of your bank account every single day (yes, you can automate this strategy 100% so it just automatically draws $10 from your bank and buys BTC with apps like Coinbase or Cash App).

Let the strategy do its work and dollar cost average into a large Bitcoin position over a 5 year time frame. Your total investment will be ~$18,000 USD after 5 years and if you have any shred of belief in the long-term appreciation of BTC, then you'll understand the potential in this.

Looking at the past 5 years, you would have done extremely well. Would you achieve 10% of the results in the next 5 (16.5% annual return)? How about 20% of the results (33% annual return) or even 50% of the results (82.5% annual return)?

To me, this is a no-brainer strategy. You set a small amount - be it $1 a day or $10 a day or $100 a day - based on your regular paycheck and you automate the buying of BTC with that amount each day.

You let it buy BTC for the next 5 years and if Bitcoin is successful in the long-run, your average buy price will be lower than the price in 5 years.

You can then sell all of the Bitcoin or some of the Bitcoin and take profits.. do whatever you want. In that 5 year time frame, you'll also become increasingly curious about Bitcoin, crypto and the entire industry because you now have skin in the game.

You have a reason to care.

LeoFinance is an online community for crypto & finance. We run several projects that are powered by Hive and the LEO token economy:

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

| Trade Hive Tokens | Learn & Contribute | Hive Witness |

|---|---|---|

| LeoDex | LeoPedia | Vote |

|  |  |

Posted Using LeoFinance

Yes, right behind the question on whether it is a “good time” we get “how should I …”

This has always been my “tried and true” method, since historically there is so much volatility with which to contend. Can’t speak for you, of course, but that has always been my challenge with family and friends. Whether to actually discourage them (it is not for everyone, at least not historically …) from “jumping in” versus encouraging them to, as you are always going to be in for a “what the …” conversation later … Almost guaranteed.

No doubt about it! And your “slow, but sure” recommendation here (in your title) is something anyone can start into, so they do have “skin in the game.”

Hopefully, the long, “bitter” crypto winter is almost at an end and we’ll all see what it is like, with family and friends, once “the sun is back out” and shining brightly. And everyone suddenly “wakes up” …

Posted Using LeoFinance

Cool. Now tell all those people to buy 10$ worth of leo everyday

Haha I’ll run the math on that. Let’s see what the ROI has been ;)

Posted Using LeoFinance

This is the premise behind projects such as SPInvest...Get Rich Slowly.

Steady returns over a long period of time can really add up.

Thanks for this post.

Posted Using LeoFinance

I don't think I know much about SPInvest..

Like to enlighten me?

Posted Using LeoFinance

It is an investment club that started about a year ago. The goal is to get rich slowly by generating a 20% annual return (first year hit 80%).

The club owns both on and off chain investments. It is now holding Bitcoin, gold, silver, Splinterlands Alpha packs, HP, BRO, and other tokens.

I think the value of the holdings now amount to 1.9 HIVE per SPI token.

Posted Using LeoFinance

That's a huge one. We could create such club on leofinance. Would really help some of us.

Posted Using LeoFinance

Slow and steady does in fact win the race. Sometimes we need a reminder of that

Posted Using LeoFinance

It's all about the drip, if you don't take your cash and drip it into assets, it drips out of your pocket into someone else's assets, simple as that

Very well said. I like that a lot - create your own wealth and don’t let your cash drip into someone else’s retirement fund

Posted Using LeoFinance

Someone once said that sellers make profits but hodlers get rich. This is quite and how does it relate to the subject matter?

Buying small fractions of BTC or any other crypto and holding for several years can yield a huge profits. Sometimes, I just wished I had a huge pay check or any other job, such that I wouldn't sell my Hive. But I can't help it; I have to sell and survive.

But I'm planning on buying and holding other smaller tokens with potentials. Long term investments pay better.

Posted Using LeoFinance

Hodlers will make higher returns over time (if the underlying tech is successful).. traders will make returns in the short run (if they are successful).

A paycheck helps, but with Hive we can earn crypto. A true unicorn in my opinion

Posted Using LeoFinance

Very true about Hive because it brings value to social media

Posted Using LeoFinance

Great advice. The numbers in that table don't lie.

Posted Using LeoFinance

I’ve already got 1 new friend to start buying BTC each day following this $10 plan. Let’s see how many more I can convince from this article ;)

Posted Using LeoFinance

It easy to cherry pick (BTC especially) crypto, look back and see the profit with your strategy.

I wonder what the 5 year plan (4 yrs, but hey) of the same strategy, would look like on steem/hive,(forgetting the hard fork).

I dunno, tbh..

...not quite so good though, methinks.

I like to keep it real and prefer not to get addicted to hopium, is all...

Everyone can be a genius in retrospect.

Quite an insightful write.

This is the investment module I adopted for the Hive Engine I like and it's been an amazing accumulation over the past weeks. THough, I never pegged at a particular value daily. Maybe I'll have to consider this approach. Thanks for sharing this Khal.

Posted Using LeoFinance

That really shows the power of Dollar Cost Average, and as you said just adjust it to what is feasible for you, up or down, thanks for sharing.