Breaking: Paypal Announces the Launch of Their Own Stablecoin - PYUSD

Stablecoins have become a staple in the crypto industry. They are used in a wide variety of ways within the crypto space. Whether you're pooling funds on DeFi or trading against USDT on a CEX or collateralizing BTC for a decentralized stablecoin loan like DAI, there are so many use cases already proliferating with Stablecoins.

Stablecoins are a natural progression for a lot of TradFi businesses. Imagine someone like VISA integrating a stablecoin for payments.

The payment rails would be a lot cheaper, require a lot less middle-men and allow a company like Visa to ultimately soak up more TX Fees and create a more efficient business model.

pssst have you seen @leofinance's proposal to double the userbase of Hive? It's officially live and waiting for you to vote and support it getting funded! The proposal outlines our strategy to grow the Hive blockchain by 9,615+ monthly active users using our LeoInfra Lite Account protocol and bring the masses to Hive. We need just 5.7M more HIVE POWER to vote it and reach our goal of 30M backing our proposal. Check it out here -> https://peakd.com/me/proposals/269

Obviously, this cutting of the middle-men is competitive. Some people are going to get competed out. People who have made themselves into a business provider of things like payment rail fees, organization, collections, etc.

Stablecoins offer efficiency, transparency (well, sometimes), faster fees and 24/7/365 settlements.

PayPal's PYUSD: A New Stablecoin Competitor

We're seeing some competition amongst stablecoins to capture market share. Everyone is vying to be the top dog.

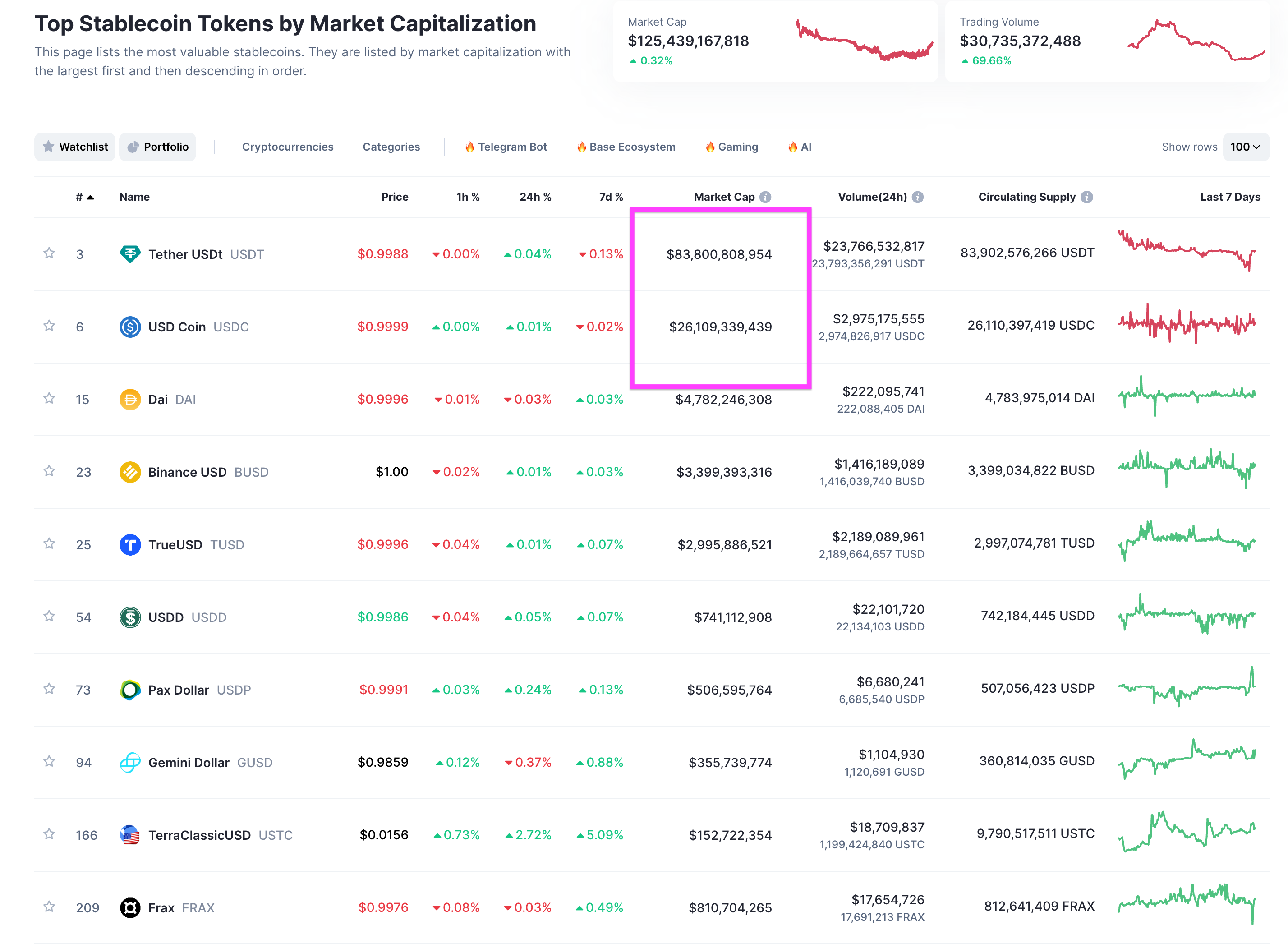

The vast majority of stablecoin market cap has flowed to the top 2:

- USDT

- USDC

USDT recently has become subject to a lot of transparency checks. The team behind it - Tether Limited - has also started buying BTC with up to 15% of their quarterly profits. I wrote a post about this last week, if you're interested in learning more about their transparency and BTC accumulation practices.

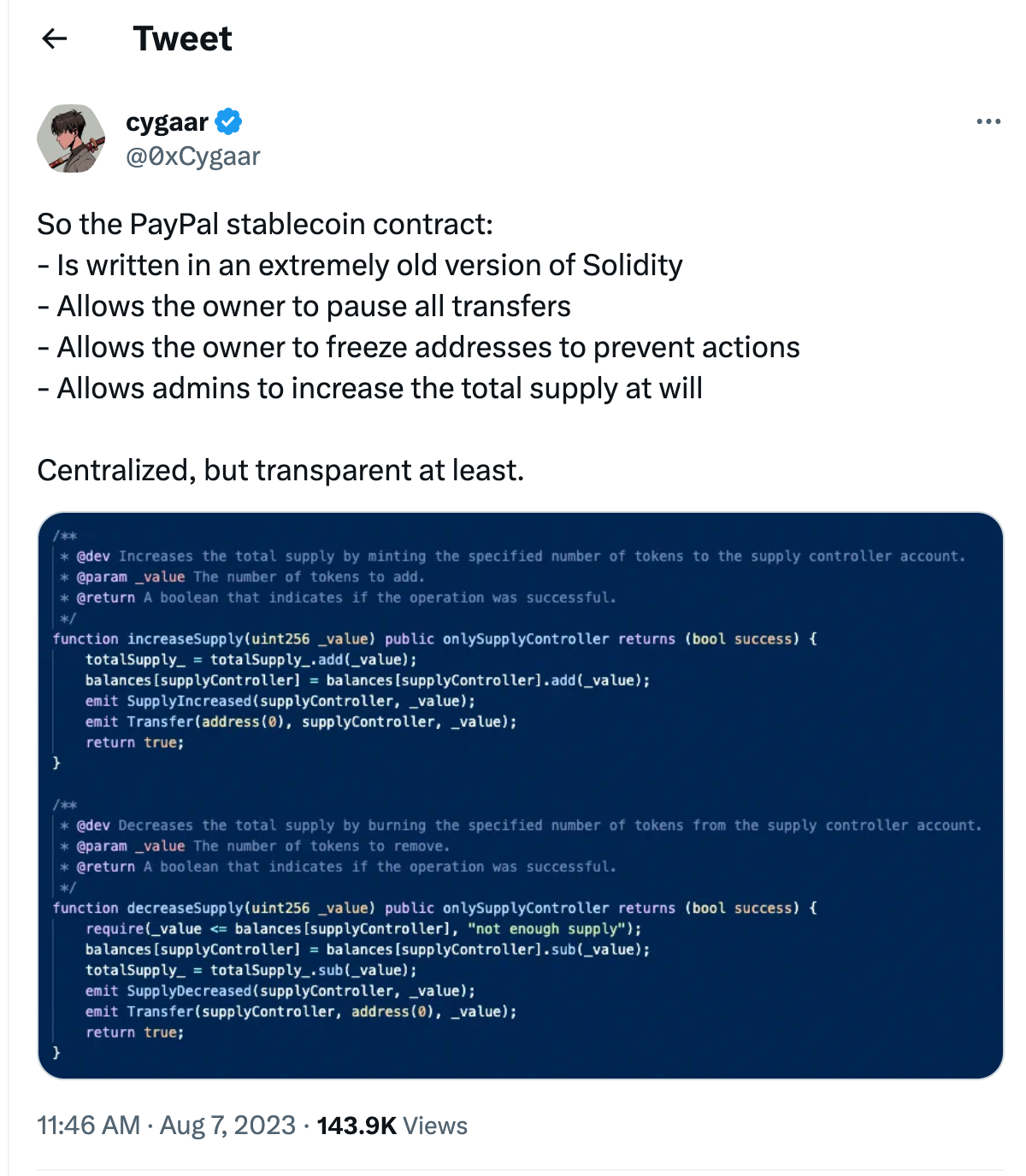

PYUSD is really nothing new. When you dive into the contract, you'll see that it basically gives the owner (Paypal) complete control over the system:

"The CEO envisions PYUSD becoming an integral part of the payments infrastructure, offering users a transformative financial experience characterized by speed, cost-effectiveness, and accessibility."

Paypal is framing PYUSD as being a highly transparent stablecoin. They are emphasizing how important it will be to ensure that it maintains its redeem ability for dollars at all times.

Paypal's Evolving Relationship with Crypto

In 2020, Paypal began talking about Crypto and slowly started rolling out features to the platform. By June 2022, Paypal was usable to buy BTC, ETH, BCH and LTC. You could also withdraw them from the platform (which differentiated them from other TradFi platforms like Robinhood that allowed you to buy/sell but not withdraw actual crypto).

PYUSD Would Have Blown Up with FTX?

This is a funny tidbit that Toni posted in the LEO Discord: apparently PYUSD originally had a contract with FTX to launch PYUSD on Solana first.

Considering that Solana has mostly gone into the toilet and FTX was a massive fraud, it seems Paypal's due diligence on their prospective partners was... subpar.

Centralized vs. Decentralized Stablecoins

Dan Shulman (CEO of Paypal) has a vision for PYUSD. He's attempting to create a "more trustworthy" centralized stablecoin. Something to rival USDT in my honest opinion.

Stablecoins of all forms will have a growing influence in the world at large. I believe this is just the beginning.

You can see in one of the images I showed above that stablecoins have been growing....a lot. The total Stablecoin market cap is $125B now. USDT owns nearly 75% of that market share and USDC owns another ~15%... That leaves only a little room for all the stables that follow.

Decentralized stablecoins have taken quite a hit since the LUNA/UST disaster. Crypto has seen better days.

We saw LUNA/UST... not too long after, many other stablecoins started blowing up.

The question of whether decentralized will flippen centralized (in terms of stablecoins) remains to be seen.

I believe there is a market for both of them. Decentralized stablecoins are newer tech, more complex and have different pitfalls and benefits as compared to centralized stablecoins.

With big corporations like Paypal stepping into the stablecoin market, I think we could see a bit of a shake-up. I would love to see USDT's strangehold on the stablecoin market diminish. I think it's a massive risk to have so much market cap for this industry tied up in 1 single centralized stablecoin.

I use DAI as much as I can and it's convenient to use with my lending vault on MakerDAO which allows me to borrow DAI against my BTC.

I also am a heavy user of HBD. I have a lot of HBD in savings and work with it form a technical/dev perspective as well.

That being said, I also do have USDT and other centralized stablecoins that I often use as payment rails / paying team members, etc.

Every coin has its own unique value prop for use cases. I'm not sure if PYUSD has a place in that toolkit, but we'll see if they start to offer something unique.

pssst have you seen @leofinance's proposal to double the userbase of Hive? It's officially live and waiting for you to vote and support it getting funded! The proposal outlines our strategy to grow the Hive blockchain by 9,615+ monthly active users using our LeoInfra Lite Account protocol and bring the masses to Hive.

- Vote the Proposal on PeakD ▶️ https://peakd.com/me/proposals/269

- Vote the Proposal on Ecency ▶️ https://ecency.com/me/proposals/269

- Vote the Proposal on Hivesigner ▶️ https://hivesigner.com/sign/update-proposal-votes?proposal_ids=%5B269%5D&approve=true

Posted Using LeoFinance Alpha

They’re addicted to gas fees

I don't understand how a company that hates everything crypto is going to come out with their own stablecoin and not tie it to anything? I'm totally lost on this what a joke and what a joke of a company. Legit everyone I know hates using them and does everything possible not to use them.

I just wrote a post on this because I heard people saying it was going to stimulate mass adoption of cryptocurrency. While it definately has its niche for large money sum transmissions or bank settlement, I am unsure if another stablecoin on Ethereum can compete effectively with USDC, Tether and Dai. If it came out with faster transaction times or lower fees on another blockchain I could see it being a potential vehicle for mass adoption, but on Ethereum it’s just another rich guys tool. HBD is a better tool for mass adoption because of speed and free transactions. But it will take time.

This is like Ripple a total centralized chain and currency dont fall for it everyone its crazy bad ..

But HBD tops it all, dunno if the adoption of stablecoin is gonna be a good idea, let's see how it goes anyways.