Unlocking Cryptocurrency Value: A Beginner's Guide to Navigating Tokenomics

Do you ever feel that the world around you is evolving too fast for you to keep up? There are too many things happening at such a quick pace, that it makes it extremely difficult for someone to live, work, and be able to make informed decisions regarding their life. And even if you think it does not affect you directly, economics is undergoing too many changes for you not to care about that.

In this post, we will briefly touch on the topic of 'tokenomics', and give a general definition. What is tokenomics and why is it important? How can we briefly understand the value of a coin/token and how can we know more about ways to use our knowledge for investment opportunities?

created with Bing Create

What is 'tokenomics'?

The word tokenomics combines tokens & economics, therefore it refers to the economic system governing the operation of cryptocurrencies. One of definitions I enjoyed was this one "Like many concepts in the crypto world, Tokenomics is an ambiguous concept with different interpretations, depending on whom you ask".

In this blog post, we will try to keep the definitions as simple as possible, and we should always keep in mind that tokenomics is still evolving and has different meanings and interpretations depending on the context and perspective.

Why is tokenomics important?

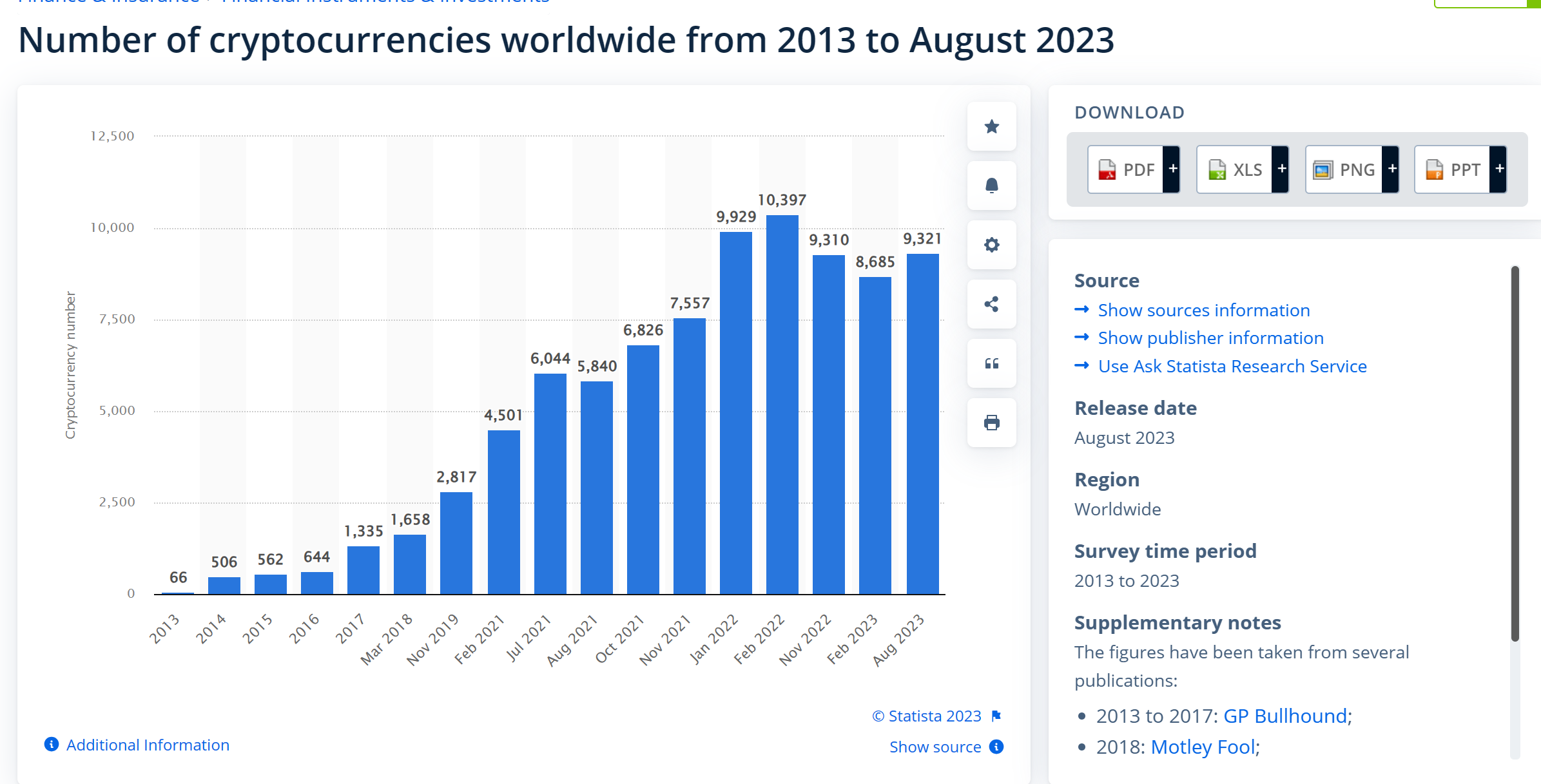

There are approximately 9000 cryptocurrencies at the moment, and this number has been growing rapidly.

When you study tokenomics, you examine things such as how the tokens are created, distributed, used, and valued within a specific ecosystem. The study of tokenomics and the combination of all the information can offer valuable insights and affect the incentives and behaviors of the users, investors, and developers of certain projects. Every project has its own rules, and each one influences the demand/price and value of the tokens.

Learning about some key metrics of token economics

Some key metrics of tokenomics are:

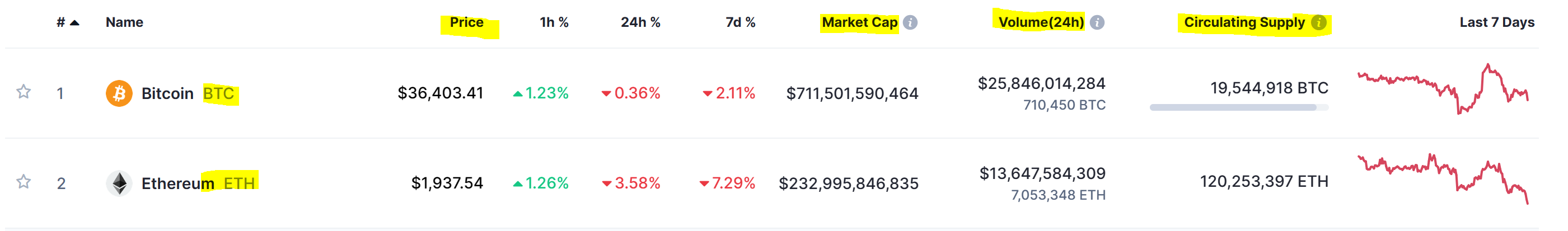

- Market capitalization: This number refers to the total value of a token in the market, calculated by multiplying the current price by the circulating supply. It indicates the size and importance of a token in the crypto space.

We can easily see these numbers on a website such as CoinMarketCap

Volume: Volume is the amount of tokens that are traded in a given period and reflects the liquidity and activity of a token in the market.

Price: Price is a very straightforward metric, as it is the current value of a token in the market, determined by the supply and demand forces. A token price can be affected due to various factors, such as news, events, sentiment, and innovation.

Supply: This metric is very important because it defines the amount of tokens that exist or will ever exist in a project. This affects the scarcity and inflation of the tokens, and consequently their price/value. For instance, Bitcoin has a fixed supply, which has a maximum of 21 million coins. Ethereum, on the other hand, has an unlimited supply, which has no cap on how many ether can be created. It is worth mentioning here that there is a 'burn' mechanism used by some tokens to limit the token supply.

Distribution: How are tokens allocated and distributed among the different participants? Distribution is very important because it affects the fairness and decentralization of the project, as well as the incentives and behaviors of the users.

Utility: What is a token's utility? How is the token used and what is its purpose? The utility can affect the demand and usefulness of the tokens, and therefore their value. Tokens may serve as a form of money, used to buy services or products. Some other tokens can be used as governance tokens (users with more tokens can influence decisions on a project).

Investment Opportunity or General Knowledge?

Tokenomics as a concept is complex and dynamic. There is no simple-guide to use in order to be able to evaluate a project.

You will need to do your own research, and to make sure you have a good understanding of the tokenomics basics. Make sure to have all the information, such as the website, whitepaper and metrics of a project so that you can evaluate it correctly.

Compare, evaluate, and make sure to make your own decisions - always based on complete research in the project(s) you are interested in.

Final Thoughts

Understanding tokenomics is very important, whether you are entering the crypto space or not. The key elements of tokenomics influence a token's value and it is essential to recognize that there isn't a singular factor that acts as a magical solution. Tokenomics can be integrated with other fundamental and technical analysis tools to form a comprehensive assessment of a project's future potential.

Useful sources:

- https://www.node.capital/blog-posts/part-1-tokenomics-the-engine-the-fuel-and-the-generator

- https://blockworks.co/news/what-is-tokenomics

- https://www.coinbase.com/learn/wallet/tokenomics-101

- https://coinmarketcap.com/alexandria/glossary/tokenomics

- https://academy.binance.com/en/articles/what-is-tokenomics-and-why-does-it-matter

Posted Using InLeo Alpha

Nice information

its a nice pic, createed by AI?

Hi! Yes, I used Bing Create (I mention it below the photo)

ok

I understand much more better how tokenomic really works

Thank you very much for telling us about tokeonomics

Hello katerinaramm!

It's nice to let you know that your article will take 15th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by fantagira

You receive 🎖 0.9 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 120 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART