Unpacking Uniswap Protocol (P1)

One of the best innovations in the crypto industry is the decentralized exchanges which allow direct peer-to-peer cryptocurrency transactions and eliminated the need for intermediaries when swapping and/or trading.

A popular and successful DEX that has been around for years now is Uniswap, the protocol that allows users to easily swap or trade ERC-20 tokens on the Ethereum blockchain through automated market makers (AMM), thus functioning without any intermediary.

Launched in 2018, Uniswap had grown big and is now the 5th largest decentralized exchange protocol with over $1.5 trillion in trading volume.¹

But before delving deeper into the protocol, let's take a look at its ecosystem first.

The Uniswap Ecosystem

Uniswap is a growing network that offers a range of decentralized finance (DeFi) applications, tools and services. It is open and accessible to all participants, including liquidity providers, traders, and developers. This is developed by Uniswap Labs, founded by Hayden Adams.

Developers can build apps and tools on its protocol and can also apply for funding from the Uniswap Grants Program.

UniSwap Protocol

A decentralized protocol consisting of "persistent, non-upgradable smart contracts that together create an automated market maker, a protocol that facilitates peer-to-peer market making and swapping of ERC-20 tokens on the Ethereum blockchain."²

This is a completely decentralized, permissionless automated market maker that allows users to swap ERC-20 assets and provide liquidity at any time without the need for an intermediary.

The Uniswap Protocol's code cannot be changed or modified and will run as long as the blockchain is functional, even if Uniswap Labs disappears tomorrow. Anyone can deploy the protocol's contracts on any blockchain. It now runs on Ethereum and other popular blockchains like Polygon, Arbitrum, Optimism, Binance Smart Chain, and Celo.³

Uniswap has its own governance token, UNI which was launched in September 2020 with a maximum supply of 1 billion minted at genesis with a 4-year allocation:

- 60.00% to Uniswap community members 600,000,000 UNI

- 21.266% to team members and future employees with 4-year vesting of 212,660,000 UNI

- 18.044% to investors with 4-year vesting 180,440,000 UNI

- 0.69% to advisors with 4-year vesting 6,900,000 UNI

A perpetual inflation rate of 2% per year will start after 4 years, ensuring continued participation and contribution to Uniswap at the expense of passive UNI holders.⁴

UNI with over $3 billion market capitalization, is tradable in various centralized exchanges (CEX) and on other decentralized exchanges like Pancakeswap and on Uniswap's own DEX.

Uniswap Protocol Iterations

Uniswap V1

This was the very first version that only supported ERC-20 trading pairs on Ethereum.

Uniswap V2

Released in May 2020, this enabled the ability to create more (ERC20-ERC20) token pools, allowing trading of any ERC-20 tokens, not just pairs that include Ether (ETH).

Implemented harder-to-manipulate price feeds making the platform safer from exploits and price manipulation.

V2 also allowed liquidity providers to earn a fee for their contributions to the liquidity pools.

Flash Swaps was introduced. This allowed traders to borrow tokens without collateral for a very short time period, usually less than a second.⁵ Other changes include upgrades to the Core/Helper Architecture and some technical improvements.

Uniswap 3

This was launched in May 2021 on the Ethereum mainnet. This further upgrade introduced the following features:

Concentrated Liquidity: This "allows liquidity providers to stipulate the price range they want to provide liquidity into, improving capital efficiency and making Uniswap more diverse, and enabling pools to be configured for pairs with different volatility."⁶

Multiple pools per pair which enables liquidity providers to choose to provide liquidity to different price ranges within the same pair.⁷

Range orders: Allow traders to place orders within a specific price range, enabling them to execute trades at a specific price point.

Oracle upgrades which reduced price slippage and easier for traders to get better prices.

Ticks to represent price ranges which allows liquidity providers to hold liquidity and earn fees within a specific price range.⁸

Apparently, passive liquidity providers were not able to take advantage of the benefits of this version and some inexperienced providers lost out due to impermanent loss.⁹ But that didn't deter other protocols and AMM to adapt, copy and implement to their own platforms.

Uniswap 4

To further improve the protocol, Uniswap Labs released another iteration on June 2023, more than 2 years after the release of V3.

This latest version introduced the following upgrades or features:

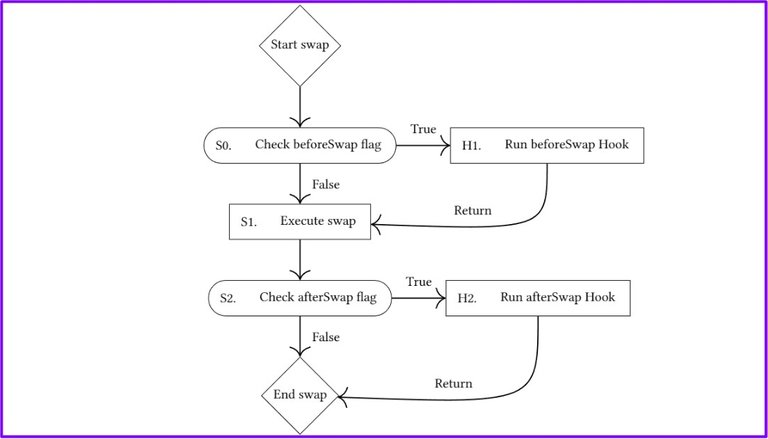

Hooks and Custom Pools

Customizable liquidity pools through the inclusion of Hooks, which are plugins to customize how pools, swaps, fees, and LP positions interact.¹⁰ This allows endless options for liquidity pools. Here's a diagram of the Swap Hook Flow:

V4 will allow pools that natively support dynamic fees, add on-chain limit orders, or act as a time-weighted average market maker (TWAMM) to spread out large orders over time.¹¹ This is similar to the investment strategy, Dollar-Cost Averaging.

Singleton Contract & Flash Accounting

All pools will share a singleton contract, an upgrade to the V3 where each pool has its own smart contract. Accordingly, this will generate gas fees savings of up to 99% for traders because swaps will no longer need to route tokens between pools held in different contracts."¹²

"Moreover, the singleton contract enables flash accounting, which means that the changes in each pool are recorded as net changes rather than at the end of each swap, further increasing savings for users."¹³

Native ETH Support

V4 also brings back support for native ETH and WETH in trading pairs.Governance

V4 will be governed by the community (Uniswap DAO and holders of UNI).

V4 will be released under Business Source License 1.1, which limits the use of the v4 source code in a commercial or production setting for up to four years, at which point it will convert to a GPL license into perpetuity.¹⁴

Source: Uniswap Blog

Summary (TL;DR)

The Uniswap ecosystem continues to innovate from its inception. Its protocol has been upgraded 3 times since 2018, the draft code of the 4th iteration was recently released to get community/users feedback and will undergo testing and auditing in public over these months.

The "sky is the limit" they say and it will be interesting to see how Uniswap will become in a few years' time.

A little trivia that you may not know:

- The name "Uniswap" was Vitalik's idea. The project was initially thought to be named "Unipeg" (a mixture between Unicorn and Pegasus).

Info Sources: Uniswap Blog / CoinmarketCap / CloudsCom / Bitkan / Uni Docs / V4 Whitepaper

Lead image created on Canva. Logo/s from Wiki Commons. Other images linked to their sources. 24072023/10:30ph

Posted Using LeoFinance Alpha

!LUV

@ifarmgirl, @myintmo.shweyi(1/3) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. InfoThank you !LUV

@myintmo.shweyi, @ifarmgirl(2/5) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. InfoCongratulations @ifarmgirl! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Thank you lots, I appreciate it.😉

I remember the first time I heard about Uniswap and I was having some doubts but it is so good to see it do well now. Nice one!

It's growing and quite exciting to see how it innovates through the coming years.

!LADY

View or trade

LOHtokens.@ifarmgirl, you successfully shared 0.1000 LOH with @rafzat and you earned 0.1000 LOH as tips. (3/18 calls)

Use !LADY command to share LOH! More details available in this post.

Uniswap, I think is the king of DEX.

King indeed. Which one is the queen then 😅

!LOLZ

lolztoken.com

Every judge knows bananas splits.

Credit: reddit

@b-hive, I sent you an $LOLZ on behalf of ifarmgirl

(2/4)

Uniswap is one of the best decenterlized platform i have ever used, I was using it when they launch uni and airdropped to their users, it was the best feeling ;)

That's awesome :) The UNI airdrops sure are great way to reward the early adopters of the protocol. Congrats, yay!

!PIZZA

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

$PIZZA slices delivered:

@intishar(3/5) tipped @ifarmgirl

ifarmgirl tipped itwithsm

https://twitter.com/lee19389/status/1683432316226400257

#hive #posh

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

I used Uniswap long ago. Generally, I don't have an interest in that dex for swapping ERC-20 tokens. It's because of the high fee. Maybe I used it for an airdrop. No negative experience with it.

!PIZZA !LUV

@ifarmgirl, @intishar(1/1) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. InfoAt least you have experienced it, Inti and glad you've had no bad experience with it.

!CTP

Hehe. But I would love to take back the fee if possible 🤣🤣🤣.

Haha! Only if we could 🤣

This is the first exchange I used when I came into the industry and the way we see it now is that it's going to be number one and people believe in it more and we pray it will continue to do so.

Great breakdown! I use uniswap all the time and still learned a bunch!