UniswapX Protocol: A Dutch Auction-Based DEX Trading Protocol

Uniswap has been growing and expanding its ecosystem, upgrading its protocol since its inception in 2018. From its very first version, Uniswap V1, more iterations were introduced through the years.

One of the recent rollouts in open-beta on the Uniswap Labs interface is the UniswapX Protocol which is said to be "the new permissionless, open source (GPL), Dutch auction-based protocol for trading across AMMs and other liquidity sources.¹

What is UniswapX

UniswapX is an "immutable smart contract built to be fully permissionless. No one, including Uniswap Labs, can modify or pause the contract. The earliest fillers are standing by to ensure appropriate auction starting prices and quick order execution, and we expect the filler network will expand quickly with user adoption." This, according to the founder, is launched to grow their on-chain trading and improve self-custody swapping.²

The protocol is initially available on Ethereum Mainnet and will expand to other chains and the Uniswap Wallet over time.

Based on the Whitepaper, UniswapX Protocol will improve swapping in various ways, re:

Next-level aggregation.

Simply put, UniswapX offers swappers better prices by aggregating liquidity sources.

The protocol outsources "routing and batching to a permissionless set of Fillers. These fillers can route orders to a combination of on-chain and off-chain liquidity, ensuring that Swappers always receive the best possible execution on their orders.³

Gas-free swapping.

UniswapX trades use Permit2 executable off-chain signatures, allowing swappers to pay transaction fees implicitly as part of their swap and avoid maintaining a balance of the chain’s native token.⁴

No cost for failed transactions.

Swappers will never pay gas costs for failed swaps and orders that are batch settled and/or filled directly from fillers’ inventory.

Protection against MEV (Maximal Extractable Value).

UniswapX internalizes MEV [9] reducing value lost by returning any surplus generated by an order back to the swappers in the form of price improvement. Additionally, UniswapX orders are far less vulnerable to frontrunning.⁵

UniswapX will go X-chain

They plan to expand to launch a cross-chain version of UniswapX later in the year. Accordingly, it will "combine swapping and bridging into one seamless action. With cross-chain UniswapX, swappers will be able to swap between chains in seconds. Swappers can also choose which assets they receive on the destination chain, instead of a bridge-specific token."⁶

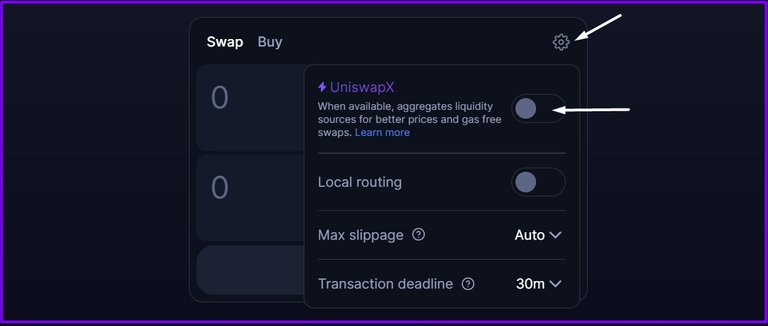

How to use UniswapX Beta

To opt-in to UniswapX, go to the Uniswap Web App, click on the settings icon, and use the toggle to enable the UniswapX.

Do the same thing when you want to opt out, just use the toggle to disable it and go back to the normal swap mode.

To learn more about how UniswapX work, check it out on this example.

Summary

UniswapX is the latest protocol introduced by Uniswap Labs after Uniswap V4 launched sometime in June. According to the team, this protocol will help swappers save money in various ways by "using an open network of third-party fillers to fill swaps."⁷

The protocol is on open beta on Ethereum mainnet and they plan to expand it to more chains towards the end of the year.

Accordingly, the protocol's code has been extensively tested and audited for security. They also offer a bug bounty for those who report bugs that haven't been previously reported.

Info Source: Uniswap Blog / Whitepaper / Uniswap Docs

For infotainment only. Use with care.

Lead image created on Canva. Logo from Uniswap video. No copyright infringement intended. 04082023/09:50ph

Posted Using LeoFinance Alpha

!LUV

@ifarmgirl, @myintmo.shweyi(1/3) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. InfoThank you !LUV 😉

@myintmo.shweyi, @ifarmgirl(2/5) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. Infohttps://leofinance.io/threads/ifarmgirl-leo/re-ifarmgirl-leo-2mob1m9ta

The rewards earned on this comment will go directly to the people ( ifarmgirl-leo ) sharing the post on LeoThreads,LikeTu,dBuzz.

It's true that it's one of the popular ones and I used it but for unknown reasons, I don't feel comfortable using dex. Maybe the transaction fee is the reason.

!PIZZA

I am using it but mostly the polygon network so fees are minimal.

!PIZZA

$PIZZA slices delivered:

@ifarmgirl(1/5) tipped @oilprinzz

intishar tipped ifarmgirl

ifarmgirl tipped intishar

I don't know much about it, but I am glad I have learned something new today. Thanks for sharing.

Thank you, Amie. I am learning too :)

!LADY

View or trade

LOHtokens.@ifarmgirl, you successfully shared 0.1000 LOH with @amiegeoffrey and you earned 0.1000 LOH as tips. (7/18 calls)

Use !LADY command to share LOH! More details available in this post.

I haven't used it for a long time. I used the V1 then.

I seldom use it too except when I swap some assets on the Optimism network.

!PIZZ

One thing I love about it this is that we won't pay any charge for failed transactions

It actually makes sense to me

That's the good thing about it. It's a pain when transactions fail and we still pay gas fees😅

!LADY

View or trade

LOHtokens.@ifarmgirl, you successfully shared 0.1000 LOH with @rafzat and you earned 0.1000 LOH as tips. (6/18 calls)

Use !LADY command to share LOH! More details available in this post.

https://twitter.com/lee19389/status/1687423309032669184

#hive #posh

https://twitter.com/LovingGirlHive/status/1687532825363517440

Wow that's really amazing, to know that there are lots of tokens like this out there too , what someone need is just to focus and try doing research about stuffs like this too.. thanks so much for sharing.

I'm not sure which token you were referring to but UniswapX is a protocol :)

Thank you though and have a good weekend.

!PIZZA

Thank you for the informative write-up on UniswapX. It's clear that Uniswap Labs is constantly looking for ways to improve their protocol and provide better value to their users.

I'm particularly interested in the gas-free swapping and protection against MEV features. Gas fees can be a real pain, so it's great to see that UniswapX is working to reduce them. And the protection against MEV is definitely a welcome addition, as it can help to prevent users from getting their trades front-run.

I'm also excited about the potential for cross-chain swapping. This could make it much easier to trade between different blockchains, which would be a major step forward for the DeFi ecosystem.

You're welcome, trying to learn things outside of Hive too :)

The protocol is a good option to try and check how it would save gas fees :)

!LUV

@malos10, @ifarmgirl(1/5) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. Info