THORSwap Earn Now Supports Stablecoins

THORChain launched a service called Savers Vaults in the last quarter of 2022 which enable users a permissionless option to earn yield on their native assets (L1) without price exposure to any other asset - meaning, no risk of impermanent loss.¹

Users can supply to any single-asset liquidity pools by depositing Layer 1 assets like Bitcoin (BTC), Ether (ETH), Binance Coin (BNB), Bitcoin Cash (BCH), Dogecoin (DOGE), Litecoin (LTC), Cosmos (ATOM) and Avalance (AVAX) and earn yields on them.

Yields are in the same kind of asset that users have deposited. For example, providing BTC will earn yield in BTC which is automatically added to user's balance. The Annual Percentage Rates (APRs) are not fixed (variable) because they are dependent on the swap fees, pool depths, block rewards, among others.

The service is accessible through various interfaces like XDefi Web, THORWallet (Mobile), ShapeShift, Edge Wallet (Mobile), and THORSwap Earn just to name a few. And most recently, THORSwap Earn added three stablecoins on its Savers Vaults.

Stablecoins Supported on THORSwap Earn

The following stablecoin have been added to the vaults:

- USDC (ERC20 and Avax)

- BUSD (BEP2)

- USDT (ERC20)

At the time of this writing, the APRs are quite high with USDC leading (over 70%) where 35% of the Vault cap has already been filled, and USDT at 35% APR (deposits at 15% of the vault cap). BUSD at just above 10%.

It is expected that the APRs will drop really soon as more liquidity gets added or provided so it is best to manage one's expectation.

Assets deposited on these single-asset liquidity pools can be withdrawn at any time since users control their own wallets. But it is worth noting that there are associated slippage fees (both when depositing and withdrawing).

Per my own experience, depending on the network (chain) and the amount being deposited or withdrawn, the slippage fee varies. It can be lower when the asset amount is smaller so when depositing larger amounts, it is better to check them out first and perhaps split them into one or two transactions. Of course, taking into account the network fees as well.

How to Deposit to the Savers Vault

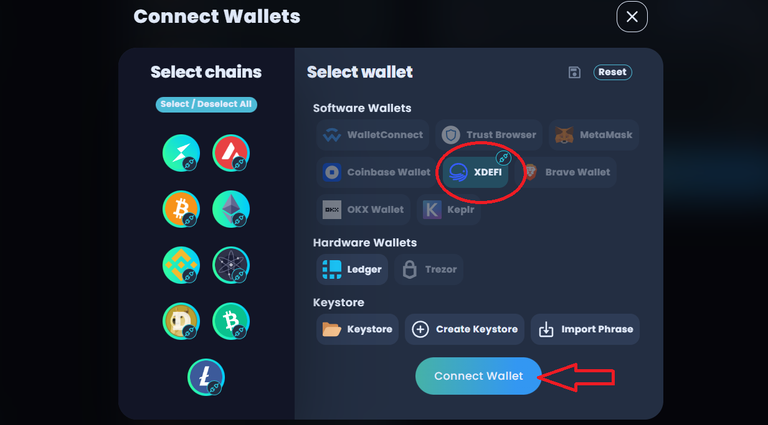

Go to THORSwap Earn, connect your preferred wallet.

I'm using the XDEFI wallet (browser extension) for this example. It supports most of the chains.

Choose the asset you want to deposit.

Once again, I recommend checking the slippage fee and playing around with the amount you are comfortable with. In some networks, the fee can be negligible no matter the amount. Check the huge differences in the fees in the example below between depositing USDC on Avax network (more costly) and on Ethereum (slippage is a lot cheaper).

The number of days with which you can recoup the slippage fee through the yield (break even) is indicated at the bottom of the deposit window and more detailed numbers including the network fee will be displayed on the next window before you confirm the transaction.

Risks

Assets deposited on the Savers Vaults are not exposed to impermanent loss as they are not paired with others. And while THORChain has its own layers of security, risks are not totally eliminated. Hence, it is advisable for users to take into account some associated risks like the following:

Temporary Chain Halt

As a security feature, THORChain can stop withdrawals from any blockchain temporarily when there are issues detected like "significant block lag on majority of validator nodes due to individual chain issues, automatic solvency checker, consensus failure, etc."²

I personally experienced this some time ago when THORChain paused the withdrawals in the BCH network for a few weeks. The assets were there, but I just could not initiate any transaction, including depositing BCH into the vault.

Slippage Fees on Depositing and Withdrawing

As mentioned above, the slippage fees can vary so users must consider these when entering or exiting the vaults.

Network Loss of Funds

There's a possibility of losing funds when there's an exploit. While the likelihood of this happening on THORChain is low, it is still best to take it into consideration.

Personal Thoughts

THORSwap Earn is a more comfortable option for me to keep a few idle assets and earn APR.

Why so?

I get to keep my assets on their native blockchain (no wrapping needed). Also, I'm not exposing them to impermanent loss or any centralized control. In addition, I can withdraw them at any time (except when there's a chain halt).

[For information only. Not investment or financial advice. DYOR. Sources: THORSwap Earn / Medium]

Lead image created on Canva. Logo from THORSwap. Screenshots linked directly to their sources. 31082023/10:00ph

Posted Using LeoFinance Alpha

Wow this is amazing one because it good sometimes to take risk, some take risk and favor they and some take it and ruin them. Thanks for sharing this with us.

Yes, people have different risk appetites, and some make good profits by taking risks. THORSwap Earn is not the type where anyone can get quick bucks though.😉 Thank you lots, !LADY ❤️

View or trade

LOHtokens.@ifarmgirl, you successfully shared 0.1000 LOH with @olamummy and you earned 0.1000 LOH as tips. (2/18 calls)

Use !LADY command to share LOH! More details available in this post.

I am not interested in it because I feel the risk is more in my eyes compared to it's benefit. I would prefer to keep my assets in my wallet without APR.

By the way, hope you acknowledge that from February 2024 Binance will stop supporting BUSD.

That's okay, Inti. Better be safe than sorry :)

And yes, noted about BUSD. I don't have any significant amount of it so no worries on that.

!PIZZA

$PIZZA slices delivered:

ifarmgirl tipped itwithsm

ifarmgirl tipped mintymile

ifarmgirl tipped b-hive

ifarmgirl tipped intishar

@ifarmgirl(2/5) tipped @djbravo

https://leofinance.io/threads/ifarmgirl/re-ifarmgirl-2tg7cpbck

The rewards earned on this comment will go directly to the people ( ifarmgirl ) sharing the post on LeoThreads,LikeTu,dBuzz.

Parang ngayon ko lang narinig yang platform na yan.

Matagal na yan. Don't say d mo naririnig ang THORChain? or RUNE?

!PIZZA

Kabisado ko ang Thor/Rune, yung Thorswap hindi pa. Hehe

It will give a boost to their project as impairment loss is everywhere when we talk about yield.

Yes, that's one of the advantages of single-asset pools. However, there are still other risks like slippage fees and a few more mentioned in the post.

!PIZZA

https://twitter.com/lee19389/status/1697218844702781454

#hive #posh

I think this makes sense

Do you think there is a minimum amount of money that we can deposit or no limit?

I need to check out my assets on the thor wallet... I need to exit because this app is just too complicated for me to use... ouch...

Sorry to hear. I've not used the wallet myself so I have no idea how complicated it is.

!PIZZA

Congratulations @ifarmgirl! You received a personal badge!

Participate in the next Power Up month to get another one!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Thank you HB team. Glad to have not missed a day.

Congratulations @ifarmgirl! We appreciate your support for Hive and your efforts to grow your stake regularly.

I haven't used it yet, and the way you're suggesting it now, I'm having trouble getting people to stop using it.

Haha, why would you have trouble? Just tell them to do their due diligence before putting money.

!PIZZA

Because their APR are reduced then the person does not get that much profit.

Aah, that's true though. All the best to you on your investments.

Thanks alot.

Congratulations @ifarmgirl! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: