An Overview of EDX Markets (EDXM), The Crypto Marketplace for Institutional Traders

The recent price actions in the crypto markets are said to be due to optimism that was brought by the Bitcoin Spot ETF applications in the US and also of the launching of a new institutional crypto marketplace with a different model (EDX Markets) which is backed by TradFi Wall Street giants and renowned investors. But what exactly is it?

I did a little digging and let me share them on this post.

EDX Markets

The newest institutional digital asset marketplace that begun processing trades on the 20th of June in the US. It is said to be the first-of-its-kind that leverages technology from MEMX to offer a safer, faster and more efficient cryptocurrency trading through trusted intermediaries. The launching was first announced on the 13th of September 2022. (src)

According to EDX website, it is "designed to meet the needs of both crypto native firms and the world’s largest financial institutions. EDX will enable safer, faster and more efficient trading of digital assets, leveraging best practices from traditional financial markets on a purpose-built crypto platform." (Quoted)

EDX Markets has the backing of well-known Wall Street financial firms such as Citadel Securities, Fidelity Digital Assets, Charles Schwab, Paradigm, Sequoia Capital and Virtu Financial. The additional second funding includes investment from Miami International Holdings, DV Crypto, GTS, GSR Markets LTD, and HRT Technology. (src) This shows that despite the crypto regulatory noise, these large financial investors still have the appetite to take opportunities presented by emerging markets.

It is non-custodial which means the exchange does not directly touch, handle or store its customers assets which eliminates the risk of funds being misused. Instead, its exchange will serve as a platform connecting a network of firms to execute trades of coins and dollars, using its platform to agree on prices. Then the firms move crypto assets and fiat between each other to settle the trades. In simple terms, it acts as an intermediary to facilitate transactions between parties. (src)

It plans to launch later this year a new clearinghouse (EDX Clearing) to facilitate trades against a central counterparty. It will involve participation of third-party banks and a crypto custodian entrusted to safeguard customers assets.

The exchange does not cater to individual investors. Instead, it serves only the institutional traders or firms to execute and settle trades on its marketplace. This means that retail investors will have to go through financial intermediaries (retail brokerage) to buy and sell crypto assets. It is similar to how trades are executed on the New York Stock Exchange (NYSE) or the Nasdaq (NASDAQ).

For institutions or firms to join and become a member of the EDX Markets, they need to follow some steps, re: apply first and undergo a process before they will be able to trade.

Assets Supported & Market Info

The platform only supports four digital assets to be traded against USD. These include Bitcoin (BTC), Ether (ETH), Litecoin (LTC) and Bitcoin Cash (BCH). These assets were named as non-securities by SEC.

- Minimum quantity and trade increment: 0.000001

- Minimum price increment: $0.01

- Order Types Supported: Market, Limit, Post-only

- Time-In-Force: Day, FOK, GTT (Good 'til Time)

- Trade Allocation: FIFO

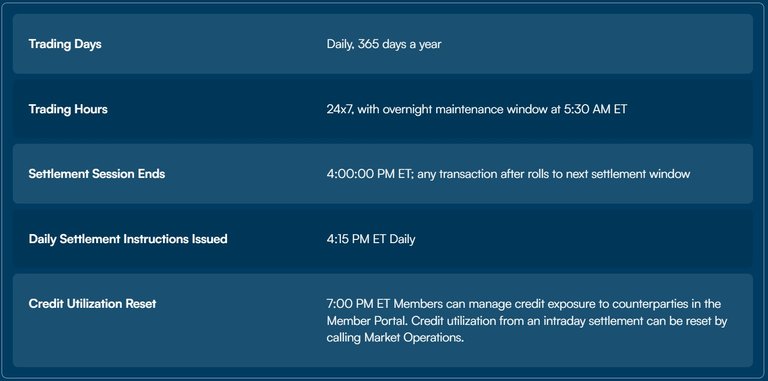

Trading Schedule

Unlike existing crypto exchanges where each have their own UIs, EDX marketplace operates through API-based trading access so it has no traditional frontend or graphical user interface.

And here's how the member's portal look like:

Lastly, here's to quote the statement of its CEO, Jamil Nazarali on the press release, where he highlighted what they can offer, re:

EDX’s ability to attract new investors and partners in the face of sector headwinds demonstrates the strength of our platform and the demand for a safe and compliant cryptocurrency market. We are committed to bringing the best of traditional finance to cryptocurrency markets, with an infrastructure built by market experts to embed key institutional best practices. With the endorsement of our new and growing list of investors and customers, we’re proud to launch trading and look forward to further enhancements to our offering. Looking ahead, EDX Clearing will be a major differentiator for EDX – and resolve an unmet need in the market – by enhancing competition and creating unparalleled operational efficiency through a single settlement process. (via Businesswire)

Conclusion

Being non-custodial and backed by the giants in the traditional investing industry, EDXM seems to be welcomed by institutional investors who are keen on investing on a more structured and less-risky way without subjecting their digital assets to conflict of interest and being misused.

It is noteworthy to know that although EDXM only supports those four assets identified by SEC as non-securities, the marketplace is not registered with the US Securities and Exchange Commission so it may still face some regulatory challenges ahead. It will be interesting to see how this marketplace will impact the crypto market and crypto firms in general.

Disclaimer: For infotainment only.

Lead image created on Canva. EDXM logo extracted from NFTgators. No copyright infringement intended. 26062023/09:20ph

Posted Using LeoFinance Alpha

!LOLZ

lolztoken.com

In his sleevies.

Credit: reddit

@ifarmgirl, I sent you an $LOLZ on behalf of @myintmo.shweyi

(2/2)

!LOLZ for you too 😅

lolztoken.com

but the day before is a sadder day.

Credit: reddit

@myintmo.shweyi, I sent you an $LOLZ on behalf of @ifarmgirl

(1/4)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

Congratulations @ifarmgirl! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP!hueso

Click on this banner, to be directed to the Virtual World Discord and learn more about the curation project.

It's a different thing which i read today about crypto

Thank you Lesly. My curiosity led me to this, lol!

!LADY

Hahaha yes sometimes our curiosity is the reason which we do 😉

View or trade

LOHtokens.@ifarmgirl, you successfully shared 0.1000 LOH with @les90 and you earned 0.1000 LOH as tips. (3/16 calls)

Use !LADY command to share LOH! More details available in this post.

https://leofinance.io/threads/ifarmgirl-leo/re-ifarmgirl-leo-opsjg4h6

The rewards earned on this comment will go directly to the people ( ifarmgirl-leo ) sharing the post on LeoThreads,LikeTu,dBuzz.

Ngayon ko lang narinig yan. Macheck nga.

Go, lol! Although para lang talaga sa tradfi trading firms.

!PIZZA

$PIZZA slices delivered:

ifarmgirl tipped thetimetravelerz

@ifarmgirl(2/5) tipped @malos10

ifarmgirl tipped b-hive

ifarmgirl tipped itwithsm

Nice informative post

Thank you.😉

!PIZZA

Looking and reading at this makes me little madam @ifarmgirl looks like I have along way to go. And I need to put my interest to it to appreciate it more.

Hehe, don't need to feel little sis. We learn things everyday and our interests are not all the same 😉

!LADY

View or trade

LOHtokens.@ifarmgirl, you successfully shared 0.1000 LOH with @usagigallardo015 and you earned 0.1000 LOH as tips. (6/16 calls)

Use !LADY command to share LOH! More details available in this post.

https://twitter.com/lee19389/status/1673277512158441478

#hive #posh

https://twitter.com/LovingGirlHive/status/1673316372091383809

Thanks for informing us about EDX market, it was something new for me.

Pleasure. I'm learning through these research as well.

!PIZZA

It seems you are getting expert in crypto knowledge. Specially from last 1.5 months 😅. It's good for me also because you are sharing your knowledge here..

Haha! I wish that's true, Inti. I'm just learning them through research in the hope of expanding my writing subjects. Thank you :)

!CTP

I think I should learn more about cryptocurrency from you

This is indeed amazing

This is my way of learning too, making research and sharing them :) Thank you.

!LADY

View or trade

LOHtokens.@ifarmgirl, you successfully shared 0.1000 LOH with @rafzat and you earned 0.1000 LOH as tips. (1/16 calls)

Use !LADY command to share LOH! More details available in this post.

It's interesting to see how this new institutional crypto marketplace is trying to bring the best of traditional finance to the crypto space. I'm curious to see how it will impact the market and crypto firms in general.

Indeed. We shall see how SEC would react to this marketplace.

!PIZZA