Strong DXY vs Weak Crypto

The DXY Index, which consists of major fiat currencies and compares the USD against them, has been gaining more power since the 8th of March. The DXY index tested a local low around 102.3 levels and bounced back from that level as it is the 0.5 in Fibonacci retracement levels.

The dollar index is a " supportive tool " that millions of investors use to be able to foresee the direction of the market. After the local low of DXY, Bitcoin formed its ATH on the 13th of March and started to form lower - highs over the last 10 days.

Let's see what kind of price actions we can expect from Bitcoin and altcoins according to the DXY sentiment.

DXY gains more value

Here we see a breakout of the descending resistance level in the DXY index. Basically, there is going to be a slight drop the channel to turn it into a support level and the retracement will end with reaching the flag that I posted on the chart.

In such a price action, the markets may not enjoy the uptrend in the index and the investors may consider taking more profit or closing their leveraged positions. The downtrend in DXY was a bullish sign for financial markets to go up only. However, there is a clear threat to the trend in crypto and stock markets.

The level of 105.3 will be a strong resistance level with 0.618 in Fibo retracement level.

If the index starts to turn red again, we may even talk about a shoulder - head - shoulder formation in the weekly chart. However, weekly timeframe is not the best tool to decide on the short term price actions. Actually, the markets are already bothered by the risk of recession in China and European countries, stable interest rates, and a continuum of quantitative tightening in the U.S. economy.

Simply, the sooner DXY forms lower lows, the better for the markets.

Bitcoin's Possible Reactions to DXY

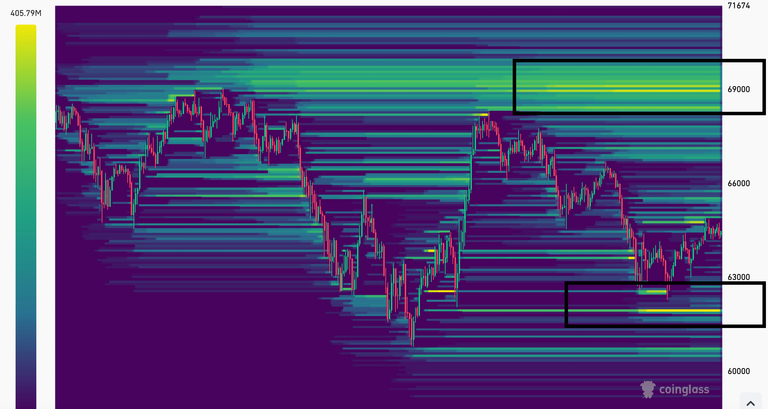

The liquidation heat map by Coinglass shows us an important data regarding the possible price actions in Bitcoin. As I highlighted below, we may expect Bitcoin whales to hunt the leverage positions and get more profit.

There are 2 major price ranges to keep in mind:

In the bearish scenario, the price hitting **$61.9K **will liquidate more than $400M with a spike. If DXY tests 105+ and Bitcoin drops to that level, it might be two birds with a stone.

The bullish scenario is that the market may start to recover if the selling pressure by the future GBTC positions lowers in time. In such a case, up to $69K may bring us a good spot to take some profit in our short term Bitcoin bags.

My personal expectation is to see a bit stronger DXY and weaker crypto that Bitcoin tests 60-61K levels again for a very short time. The level of $63.8K is still crucial to stay positive and continue the bullish trend.

If we drop below $63.8K in the short term, then hunting down the long position may make it up to 60K in the price of Bitcoin. I hope the trend will gain some more strength and form higher highs as soon as possible 😅 Please keep in mind that all these predictions are for the short term actions of DXY index. Since the interest rate cuts are around the corner, we can expect the index to from lower lows as we get closer to the FOMC meetings.

What do you think about the march of DXY index in the short term?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha

I recently had the opportunity to use Auto Auctions in Nampa https://sca.auction/locations/branch-id-nampa-83301 to search for salvage cars, and I must say, it was a fantastic experience. The website's user-friendly interface made it easy to navigate through their extensive selection. What stood out to me was the detailed information provided for each vehicle, enabling me to make well-informed decisions. Furthermore, the reliability of the site was evident – I felt confident in the accuracy of the information presented. Overall, my encounter with sca.auction was highly satisfactory, and I would recommend it to anyone in search of salvage cars.