Is Huobi Insolvent?

The centralized exchanges of the crypto ecosystem have always been stress-tested in the post-FTX time. As a result of the destructive effects of FTX, it gets harder for crypto investors to feel safe even in top centralized service providers. The approach that not your wallet, not your money has been adopted.

Though we regularly go through Binance FUD in crypto, the focus of this post will not be based on it. Rather, we will be going over Huobi exchange that is said to be in trouble over the last 3 months. Remember, Huobi is owned by Justin.

So, why do people create FUD on Huobi?

First of all, there is a growing wave of disbelief in the projects of Justin. The major criticism are the manipulation of markets and the lack of transparency. As you can see above, people leave Huobi because of the risk of insolvency.

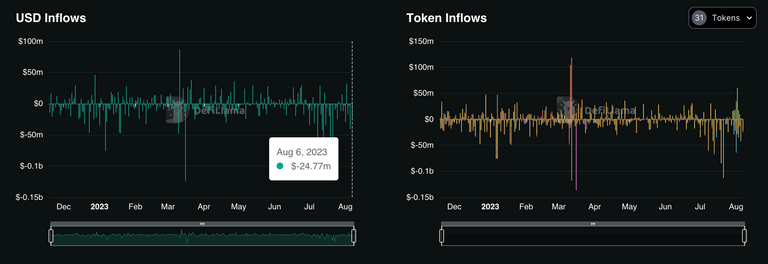

When it comes to the reserves, there is a huge red flag.

According to Adamscochran's Tweet, There must be 631m USDT in the reserves.

However, it is almost 1/10 in the Defillama's report:

This is a big problem and an important red flag for those who have some funds on the centralized exchange.

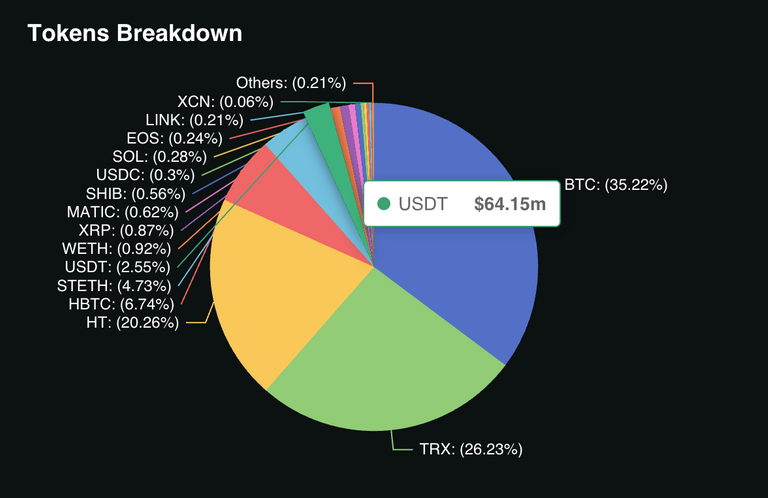

Reserves of Huobi

First of all, over-reliance on any altcoin or exchange's native coin should be seen as problematic.

In the pie chart above, you will directly realize that 26% of the reserve consists of TRX! In addition to that, 20% of the reserves are made up via Huobi's own platform token, HT!

So, we do not need to examine details to have an idea about what is wrong with the centralized exchange. Almost half of it is clearly at risk because of unreliable TRX and HT exposure on the tokens reserves.

On the other hand, the USDT reserves do not reflect the statement of (obligated) reserves.

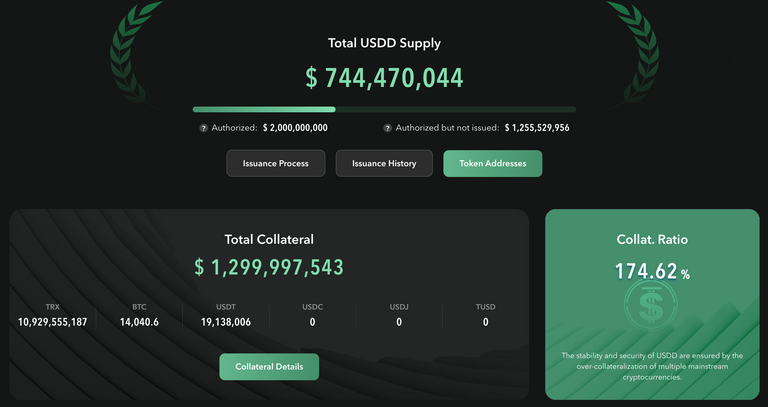

FUD Shift: Huobi to Tron

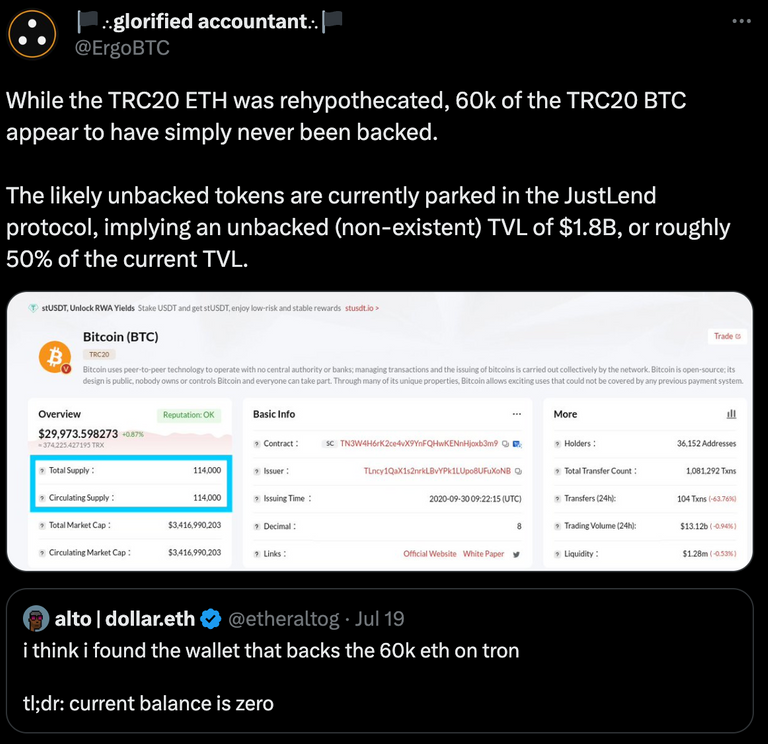

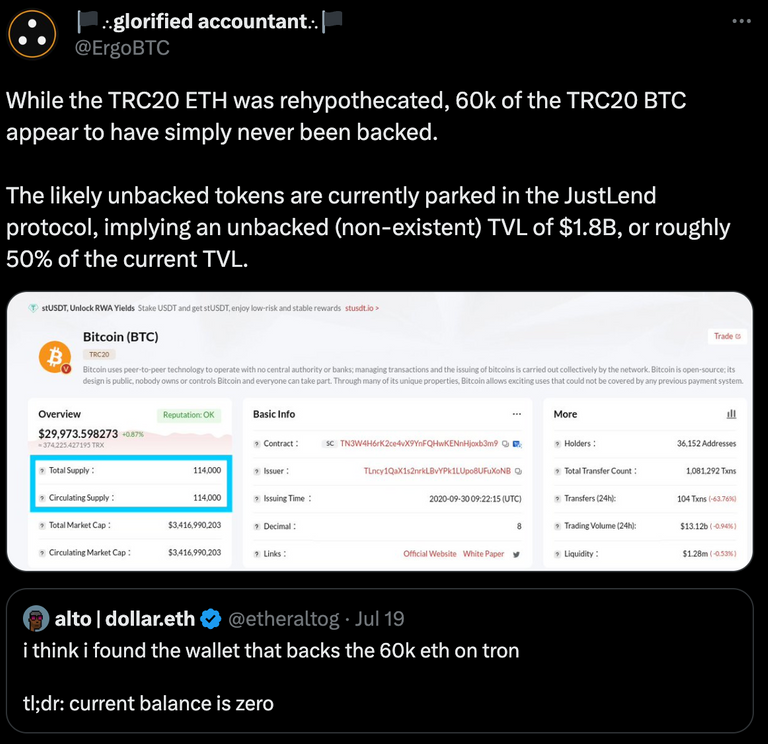

Though the well-being of the CEX is questioned, there are also strong claims over the fake statement of Total Value Locked on JustLend Protocol on Tron.

Do you remember the reserves (!) of USDD that offers 43.68% APR?

Full of Tron.

This is what made LUNA crash in two days. Also, any trigger from the side of Huobi may initiate a sell-off or rush from Tron blockchain as we all know that the TVL, liquidity, volume and every single data is questioned on this side.

The rumor is strong. It is no longer disregarded as it started to threaten Huobi and crypto.

So, the snowball of FUD is growing.

This is just an example of the discomfort people feel.

Huobi is not one of the most influential crypto exchanges in crypto. The fall of it may hurt a bit but it would not inflict a deep wound. What may bring more trouble to the ecosystem is the addition of severe Tron FUD. The combination might hurt the investors of both.

What makes people feel safe is the money owned by Justin. They believe he would never let the projects fail by using his crypto funds and strong connections. To some extent, their way of thinking is reasonable. However, we never know how harsh crypto can be on a fearful day. Considering the collapses that we witnessed, everything is possible in this market.

What do you expect to see regarding this concern?

Do you think there is no need to be thrilled?

Let's discuss it below 👇

Hive On ✌🏼

Posted Using LeoFinance Alpha

FUD set in whenever rumours started but its might be mere speculative ideas or informed analysis. It usually affect the asset and reserve as many might sell off as you rightly said. Thanks for sharing. Welcome back from your vacation

I am concerned about the impacts of a possible collapse on crypto ecosystem. Also, I hope nobody loses their funds due to the shady actions of some people.

Thanks for warm welcome mate ✌🏼

https://leofinance.io/threads/idiosyncratic1/re-idiosyncratic1-echyk8po

The rewards earned on this comment will go directly to the people ( idiosyncratic1 ) sharing the post on LeoThreads,LikeTu,dBuzz.