Hong Kong Bitcoin ETFs Expected

The Bitcoin Spot ETFs have been the main factor behind the bull leg in both Bitcoin and crypto market. The ETFs are the gates that open the crypto ecosystem to the traditional finance. Rather than setting up a Web 3 wallet, securing the private key, transferring funds, and buying Bitcoin, the spot Bitcoin ETFs provide the service with a very low fee.

Of course, the ETFs can be the easiest way of boosting the adoption of the crypto ecosystem. Since the blockchain - based products are complex by nature, any external support on decreasing the complexity can be highly useful. As we have witnessed the massive price actions in a short time with spot Bitcoin ETFs, the investors have started to seek more from them.

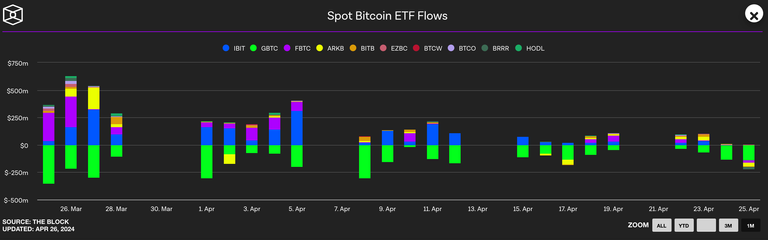

The correlation between the positive inflow of spot Bitcoin ETFs and the upward movements in the price of Bitcoin, the ETFs have become the most influential factor in terms of the direction of the crypto ecosystem.

Hong Kong ETFs to Arrive on Tuesday

The ETFs are approved in Hong Kong, too. However, there is both bad and good news about them.

First of all, any type of spot Bitcoin ETFs will be positive for the market as they are generating buying pressure on the coin. You can easily track the CVD data of the centralized exchanges to understand the degree of supply squeeze in Bitcoin.

The bad news is that Hong Kong spot Bitcoin ETFs may not be able to meet the expectations. Though some people assume that the Hong Kong's Bitcoin ETFs will be open to the residents of the mainland, they are not allowed to trade these Bitcoin ETFs due to a ban that was applied several years ago by the government of China. Yet, it does not necessarily mean that the prohibition will never be lifted. Actually, I expect to see a new approach towards spot Bitcoin ETFs in Asian countries. Once the mainlanders are also allowed, the price may go up drastically!

Different ETFs; Different Scenarios

The ETFs are the narratives of the current market besides the global factors that we always discuss. What we have realized from the functionality of the ETFs and the attitude of the SEC is that the spot altcoin ETFs, such as Ethereum ETFs, are not viewed as a solid / reliable products to serve the public. On the other hand, future ETFs, like GBTC, may turn into trouble due to the high fees paid by the investors for a derivative.

People care about buying spot Bitcoin. The story of " digital gold " has been working well for Bitcoin. In the case that the policy makers change their attitude and welcome some major altcoins, then the sentiment shift in the crypto market will be extremely bullish. For now, IBITs, BlackRock's, Fidelity's, and other giants' spot services are the mere source to be preferred. I expect to see both spot Bitcoin and altcoin ETFs all around the world! Even if they do not affect the price as it happened in January, the adoption matters more than a temporary price action for the growth of the crypto ecosystem.

What do you expect from the spot Bitcoin ETFs in Hong Kong?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha