Halving & Search for Narratives

The buy the rumor and sell the news motto has yielded positive results in the history of the crypto market. Though its effects are more visible to the rumors that take longer periods, the success rate of this strategy cannot be disregarded.

One primary reason why this motto works out is that when all retail / naive investors open positions in a specific direction, the whales get more greedy to hunt them down with a massive price drop. Try to memorize the day that the Bitcoin Spot ETFs got approved. The price was around $48K, we had a huge dump up to $38K in a couple of days because everyone believed that the narrative was over.

Yet, the story had just begun with the end of the rumor stage. The reality initiated a mini bull leg in Bitcoin that carried us to the prices that we are at today.

The quality and the sustainability of the narratives matter a lot when it comes to their immediate and post impacts on the crypto market. So far we have utilized the stage of rumors that took the price from $25K to $48K levels.

Then, the narrative / reality of Bitcoin Spot ETFs took over the price of Bitcoin from $48K to $73K and we tested a new record high in Bitcoin. Simply the hardcore utilization of this story has come to an ending.

Halving as a Narrative

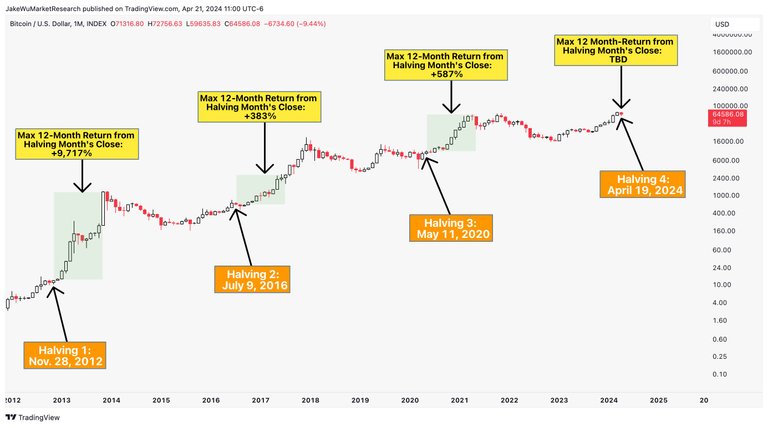

Halving itself has no immediate impact on the market and the prices in the early stages. However, around the third month of post - halving days, the supply shock starts to hit the market as the ongoing demand continues.

The halving has a longitudinal impact on the direction of the market as a factor that decides on the deflation of the asset.

As you can see above, the effects of halving come true within a year rather than having long - lasting impacts like Bitcoin ETFs have.

Apart from the timeline, we need to remember that each bull market was triggered by a specific reason.

- The first bull market was too early for many of us, it was based on initial recognition.

- The second narrative in Halving 2 was based on ICO - Mania that we sent thousands of dollars for copy paste websites.

- The third one was the times when the pandemic and hyper - quantitative easing hit the whole world. The money supply increased drastically all around the world.

When it comes to the last halving, we are in search of a story that will keep the market dynamics for a longer time rather than the hype that memecoins create for a very limited time.

The nominees of the narrative are

1 - Real World Assets

2- Artificial Intelligence & GPU markets,

3- SocialFi (The strong hand of Hive)

4- GameFi (Splinterlands to rise again)

5- Liquid Staking (Eigen Layer, Renzo, Bouncebit and further)

6- Layer 2 - Layer 3 projects (on Bitcoin, Ethereum and other top chains)

7- Cross Chain Operations - Modular Chains

These are the possible ones that may keep the market hot for a long time to trigger a bull market. Considering their effect size, the Layer 2 - Layer 3 can be the foundation of the move as we have not seen any FOMO on neither ARB & OP or other new ones.

The cycle might continue with the newest ones that are Modular chains, RWA, AI & GPU, and Liquid Staking as snack narratives that ignite the risk appetite and adrenaline in the market. SocailFi and GameFi are constant hypes that the investors cannot fully satisfy themselves.

This is my observation regarding the search for a new hype that will shake the crypto ecosystem aside from the global factors such as inflation, quantitative tightening, and regulations.

What do you think about the next narratives the market is likely to follow?

Share your list below 👇

Hive On ✌️

Posted Using InLeo Alpha