GDP Data & A Dose of Hopium

The crypto market, especially Bitcoin, has turned green once again since the Gross Domestic Product (GDP) for Q1 data signed a weakness in the state of economic health. This is interpreted as a slow down in the economy due to the current monetary policy and the interest rates in the U.S.

The investors' ideas are divided into two groups already. Some of the veteran investors support the idea that the data is just preliminary, the rate can be corrected after a while. The other group of investors and economists support the idea that the " sudden stop " case is almost inevitable and the FED will start to cut the interest rates in the summer months.

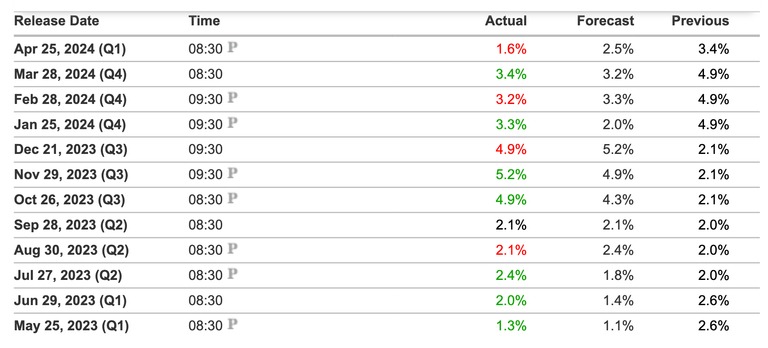

To be honest, it is too difficult to conclude as the common expectation was around 2,5% and the actual rate is as low as 1.6% according to the preliminary data. Thus, supporting one side by disregarding the other is almost impossible. What makes the case even worse is that the data for Q4 that was announced in March is 3,4% already. Such a huge discrepancy is hard to explain without being either too bullish or extremely bearish for the markets.

When we consider the difference between the forecast and the actual data in the recent history, we realize that the current data has diverged significantly from the average and the forecast.

In the case that the GDP data is cared by the FED, the policy might be more lenient and the statements would be dovish. However, they are likely to support the claim that they cannot initiate the interest rate cuts only with a single data without further confirmation.

Aside from the dovish point, the dark side can also hit the market further. The gap between the actual and the forecast might be interpreted as a sudden stop and the risk of recession may shake the markets, too.

Core PCE for Confirmation

The GDP might be open to discussion depending on the perspective but the data of Core PCE has no surprise. If we see that the down trend is violated or the data exceeds the expectations, then having another leg of drop might be inevitable.

The risk level is getting higher and volatility may go up due to the fear in the markets. Unless we can acknowledge a drop, which can be around 2.6% - 2.8%, in the Core PCE index, the situation may be even more chaotic.

To prepare for the crucial data, the hedge long / short positions may help you preserve your investment. If we get positive data below the forecast, I will be more optimistic about a small bull market and altcoin season in crypto.

What do you think about the data of GDP and tomorrow's Core PCE Index?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thanks for that ✌️