Economic & Crypto Calendar (June 12 - June 16)

The week of the FED is starting. Though past 2 weeks were not full of important meetings and data, this week is truly exceptional.

We are going to get the decision on interest rates from the U.S FED on Wednesday and the Euro Zone on Thursday. Meanwhile, crypto will be dealing with some other issues such as XRP's lawsuit and the influence of Gary Gensler.

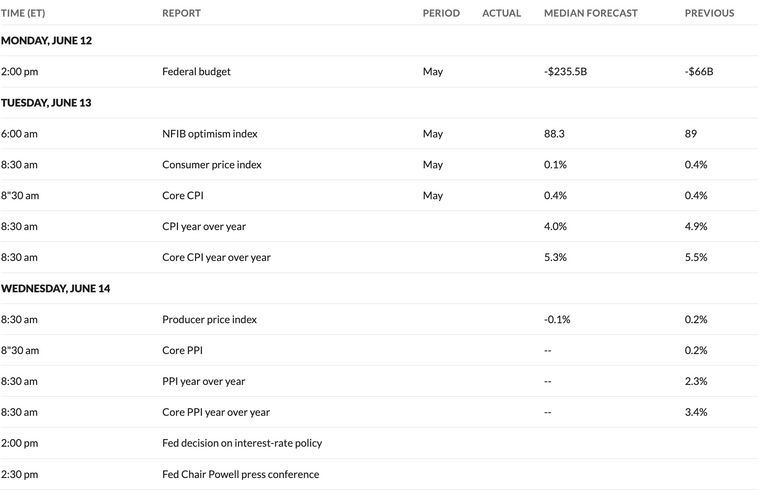

Economic Calender of the U.S.

The week will start with the federal budget in the U.S. However, it might be the least important / cared side as we will be closely watching other important data such as Consumer PI , Producer PI, the interest rate policy by the FED and more!

If the CPI, more importantly, core CPI for FED, shows some strong signs of decreasing demand and inflation speed of goods, then the FED does not need to increase the interest rates by 25 base point this month.

There will not be a huge difference between the rates but the markets do not want to see strictly applied policies to slow down the economies all around the world. As the FED is responsible for the most influential market, every data gains value.

For your investments, please be watchful of the updates on Tuesday and Wednesday. Also, to track the reaction on DXY, we may need to check the side of EURO on Thursday, too.

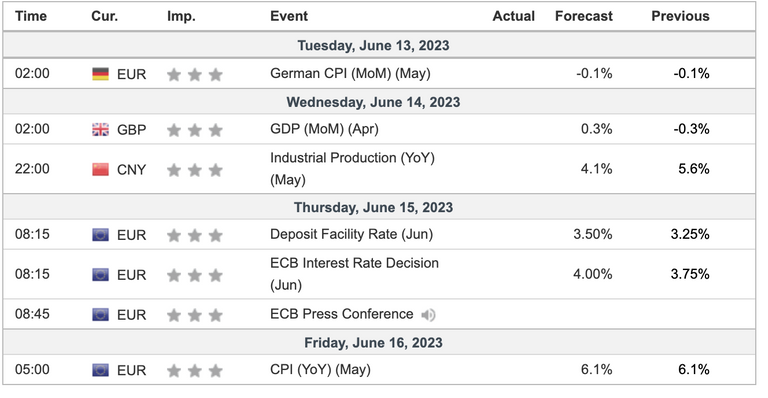

Economic Calender of G20

The most important update on the side of G20 is that both the U.S and Euro Zone will declare the interest rates.

The market does not expect any interest rate increase in Euro zone but there is an expectation of 25 base point rise in Euro zone. In such a case, we may see EURO / Dollar go higher for that.

Oficially, Germany is in recession. The case should not be valid in all sides of Euro zone. On the other hand, the growth of China is a critical point for people to increase.

We may see downward move in DXY if the FED does not increase the interest rate.

Crypto Calendar

The whole crypto ecosystem had a huge damage from the regulators. The FED asserted that some of the leading altcoins are "securities" and they should be treated in this way.

We will also have an announcement from MATIC though the topic is not shared yet. There will be a lot of volatility in crypto, too. Try to stay away from risks meanwhile.

While there will be an immense effect of macro economy, it might be a break time for the crypto's own risks.

Hive On ✌🏼

Posted Using LeoFinance Alpha

https://leofinance.io/threads/idiosyncratic1/re-leothreads-225pdzks7

The rewards earned on this comment will go directly to the people ( idiosyncratic1 ) sharing the post on LeoThreads,LikeTu,dBuzz.

Post voted 100% for the hiro.guita project. Keep up the good work.

New manual curation account for Leofinance and Cent

Do you believe they are going to rise again the interest rate? The rate of inflation in the US is around 6% at the moment.