Financial Independence and Early Retirement (F.I.R.E.)

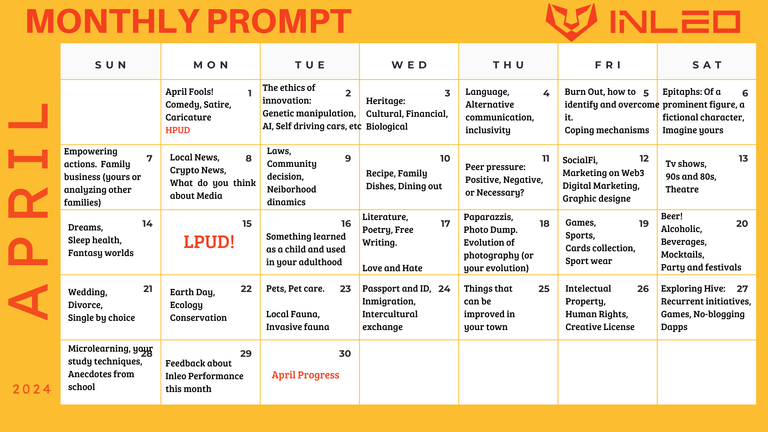

April 7, empowering actions and family business, on #aprilonleo.

"Side hustle" has been such a dear word for me since I was a kid. I may seem to be a bit arrogant, but making money was never a problem for me. Yes, I did not like very much to interact with other people (this one is much better now, with some effort to improve it), or to read other people and their expressions (I am kind of a sucker and believe that everyone is good and trustful until I am proven wrong), yet I could always somehow produce as much money as I need it. I am not pulling millions out of the hat, but if I would need $10.000 by tomorrow, I can always make this happen, easily. See, while I never had money problems and would like to try countless ways to make them multiply as a personal challenge, it was not until I discovered the FIRE movement that I could go forward in some clearly defined direction.

FIRE means Financial Independence and Early Retirement, as you can see from my title. This will get us close to the Personal Finance area, which is our way to manage money and wealth, and to the not-so-appreciated Financial Education, I know plenty of countries and cultures where it is kind of taboo to talk about money and wages and stuff. Get real, you should always be comfortable talking about it. If you don't, only the employer has everything to win if you are too afraid to talk about it. If we knew how much every company pays, all of us would be better paid and live a more meaningful life.

I firmly believe that Financial Education is a must, even more than the resented Sex Education, as learning about money and wealth is a key to a happy life, once you become an adult. Or at least once you pretend to be an adult. I know that there are powerful forces at play, that fight the best they can to keep us in ignorance, as somebody good at that will never lend money to buy something to show off, and will have enough money to buy a phone, or a car, or even a house paying in full. No bank will like this, and your credit score is low if you paid your mortgage in full and never use a credit card or take a loan. Credit score is a lie, a measurement to see how gullible you are and how much money the banks get get out of your stash. At least this is my opinion.

Now, let's skip to the best part, what do we need to do to never work again, trading time for money? Well, technically this is a lie, as you may still do some work, but this will not be linked to how much you are paid, as you will do something that you like, even as a volunteer, once you are not worrying any more about your bills.

There are some easy steps, and if I am to make a short version, this is how you do it:

First of all you need to build your emergency fund, your F U money, which is like 3 months' worth of all your bills and monthly expenses. So, if I need £1200 for all my monthly expenses, I need to save £3600 in a current account, for instant access, if needed. The way to do this can be achieved in two different paths, you can either spend less and save more, or you can work more and be paid better, either way, building your emergency fund is an exhilarating experience. This is more than just money, this is freedom, this is about not needing to worry if you lose your job unexpectedly, or is you get some sudden illness.

Once you have your emergency fund, you need to start to create new sources of income. These can be classified into a few categories, and they always need to be passive. Meaning that they need to gain money for you while you sleep, as a source of income that requires your presence is just another job. You can save money in savings accounts, bonds and ISA (in the UK at least, ISA being a savings account where you have a yearly savings account, for which you do not pay any taxes for your interest, and the past year was around $12K, if I am not mistaken, you may have it in your country too, under another name). Another passive source of income can be a bonds and shares portfolio, which will pay you dividends, the easiest way to do this is by investing in tracker funds, funds that invest in the whole economy, nationally, regionally or globally. If you invest in specific companies, buying individual shares, this will cost you a separate fee for each company, so 60 companies, 60 fees, while when you are investing in a fund you pay only once. Vanguard funds have very low fees, some like BlackRock too, or whichever one is doing the best in your country. The third option is to buy real estate and rent it to others for a monthly income, but this one requires skill and a bit of luck. It is also the most expensive. So, the second step is to invest 10.000 into a source of passive income.

Once you have done this, and invested 10K into passive income, is time to upgrade your emergency fund from 3 months of monthly expenses to 6 months. You never know when the next pandemic hits.

The last step is diversification. You need to calculate how much you need to spend in a whole year, all of it, bills, food, clothes, vacation, everything, and then how much you need to invest to have your whole yearly spending coming back to your bank account as interest, dividends and rent. Let's say that you need £12000 per year for basic expenses. If your profit from all your sources of passive income is 4%, then 12.000 is your 4%, which means that 1% is 3000, which means that you will need 300.000 invested to get that back yearly. the amount of money you need to achieve financial independence is 300.000, but this will only cover your basic expenses. You may need to save a bit more to live comfortably.

The good news is that once you start, you need on average 7-15 years to achieve that on minimum wage. Just imagine, if you read this now, and you are a 20-year-old, you may be financially independent, never needing to work again (trading time for money) unless you want to, by the time you are 35. After that, you are free to do what you want.

This is the short version. It will not be that black and white, and stuff will happen. A leg may be broken. A Covid pandemic will hit the world. A global crisis may kill the economy. A kid may be born. As long as you never stop, and you always adapt to the new changes, sooner or later you will achieve your target.

Start now!

All the best,

George

Why not...

...have fun and win rewards on my favourite blockchain games (Splinterlands- Hearthstone-like card game) (Mobox - GamiFI NFT platform) (Upland - real-life virtual land) (Holozing - Pokemon-like game)and (Rising Star - Music creators game).

...Get ETH while writing on Publish0x blog, using Presearch search engine to maximize your income with PRE tokens. Use Torum instead of Twitter . I am also writing for crypto on Read.cash and Hive.

Posted Using InLeo Alpha

!DHEDGE

Congratulations @heruvim1978! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: