Should Health Insurance ALWAYS Be a Part of your Financial Planning? Advantage of Cumulative Bonus...

Hey All,

In todays' post, I did like to put some thoughts around as to -

Why your financial planning is incomplete without a good health insurance plan and taking advantage of the cumulative bonuses that is given out by your health insurance provider. I have a health insurance plan for my family apart from the one given by my employer. Its imperative to have an extra health insurance plan and not just rely on the benefits/perks given to you as part of your employment contract.

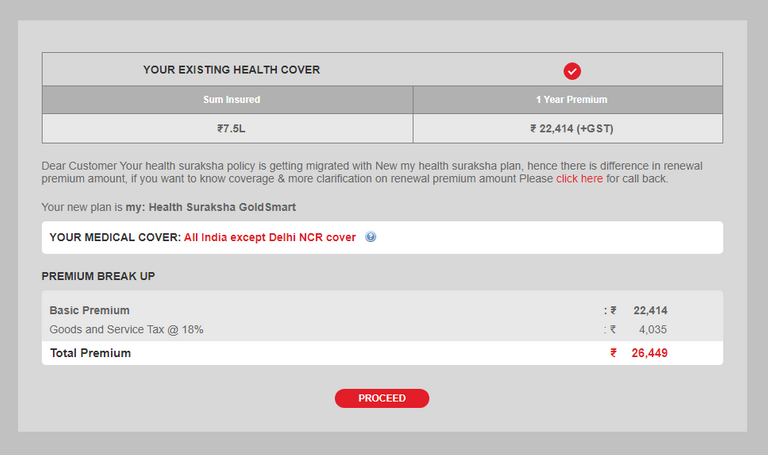

My Health Insurance Plan for $270+ with $10K+ Coverage

You never know when things could change and being without an health insurance plan could lead to a major dent in your pocket during crisis. Ideally hitting your financial planning in some or the other manner. We wouldn't want to be on this side of the boat and hence Health Insurance should always be a part of your Financial Planning. Let us now take my example into consideration where I have an separate health insurance plan and I am shedding close to $270+ in a year and getting a health coverage for around $10K+ for my family. Its like $22 a month expense - which I feel should be fine, considering god forbid if there is a medical emergency at home and if by chance we do not have our employment health insurance plan active then the entire expenses will be born by you leading to a major dent towards your financial planning goals. So as to avoid these kind of situations, I have this health insurance plan going on separately for the past 4+ Years. And over time, I have been able to accumulate the Cumulative Bonus for not claiming any expenses. As I normally make claims via the employers health policy. This as a results increases my claim amount of my personal health insurance taken and can go up to 50% of the insurance amount...and that's again a huge benefit if you see overall when compared to the premium being paid.

Finally summarizing it always consider to have a separate health insurance plan as it is vital to secure your present and future life and live without any financial hassles. No doubt there are many others benefits that you can claim under income tax rebate but what takes precedence is that your financial planning should not be impacted in any circumstance. Ideally a well versed financial planning should include these expenses incurred towards the family health insurance plan always - Its a MUST and the sooner you understand Financial Planning along with Health Planning is a recipe towards a successful & Healthy LIFE STYLE.... cheers.

Have your say on Financial Planning & Health Insurance..

Do you have a separate health insurance plan? What do you think about cumulative bonus and taking advantage of it? Is a successful financial planning be really successful without a separate health insurance plan? Let me know your thought in the comment section below... cheers

Should Health Insurance ALWAYS Be a Part of your Financial Planning?

#health #financial #financialplaning #insurance #bonus #cumulative #financialgoal #healthpolicy #insurancepolicy

Image Credits:: hdfcergo, thewealthwisher

Best Regards

Posted Using LeoFinance Alpha

This post has been manually curated by @alokkumar121 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @alokkumar121 by upvoting this comment and support the community by voting the posts made by @indiaunited.

This post has been manually curated by @alokkumar121 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @alokkumar121 by upvoting this comment and support the community by voting the posts made by @indiaunited.

Congratulations, @gungunkrishu Your Post Got 74.3% Boost.

@gungunkrishu Burnt 15 UPME & We Followed That Lead.

Contact Us : CORE / VAULT Token Discord Channel