India Income Tax Filing Using Desktop Utility (ITR 1 - 4) the ultimate way to follow and File Your Tax...

Hi All,

I'll start this post by thanking @sanjeevm my dear friend for his detailed post around Filing the income tax return yourself and the post can be found Here. His post was the motivation for me to file my income tax return for the fiscal year 2022-2023 by myself. Earlier, I use to take advantage of portal like cleartax which is India’s only end-to-end tax filing platform for all kinds of income and one need to pay some fees to use their services for tax filing. Hence this time I thought, I'll give it a try myself and save some professional charges on filing the income tax return.

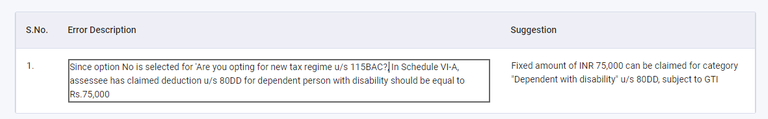

I started with using the portal which is provided by the Indian government to file your income tax returns. To be honest the experience was not that great. I had to deal with many issues which @sanjeevm already described in his follow up post - Grievance for grievance with the Income Tax Department - Here where I also got stuck into entering the HRA and other components. Anyhow managed to get rid of that issue but again there were other issues faced where I did not mention about the deductions in section 80DD but still was getting errors/warnings around it something like this::

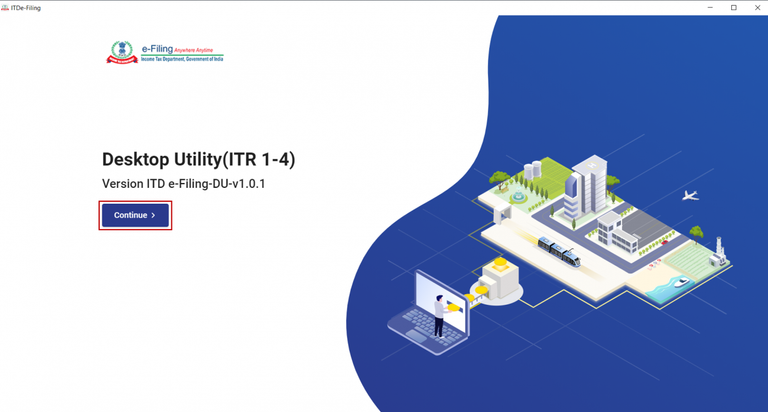

I tried different ways to get rid of this warning but all in vein and finally had to opt for using the Income Tax Filing Using Desktop Utility (ITR 1 - 4). The utility is provided by the income tax department and can be downloaded from their website Here Once the utility is installed it provides various way to preload the data incase you have downloaded the prefilled Json file from the income tax department website then you can simply import Json file using the desktop utility. Its a very simple and easy to use software that helps you file your returns may it be ITR1 - ITR4. Its not that I didn't face challenges here but comparatively it was easy to resolve errors here as opposed to using the online incometax portal. A simple example is that on the online portal it gives the warnings and says click on the errors that will redirect you to the page with warnings. But when you click hyperlinks nothing happens but whereas using the desktop utility it does redirect you to the page with warning where you need to fix those errors.

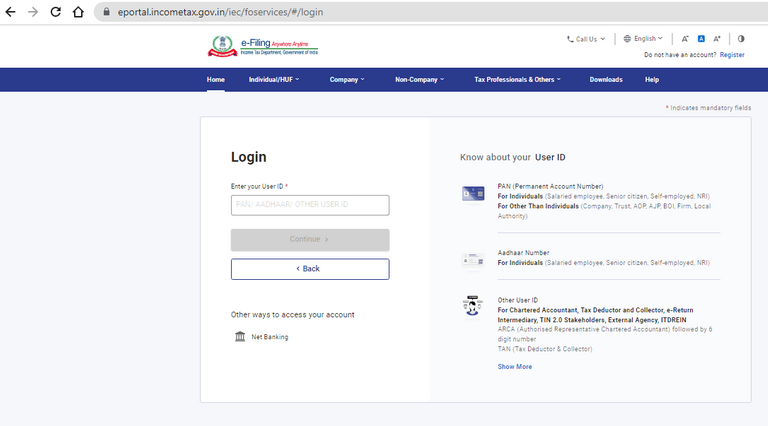

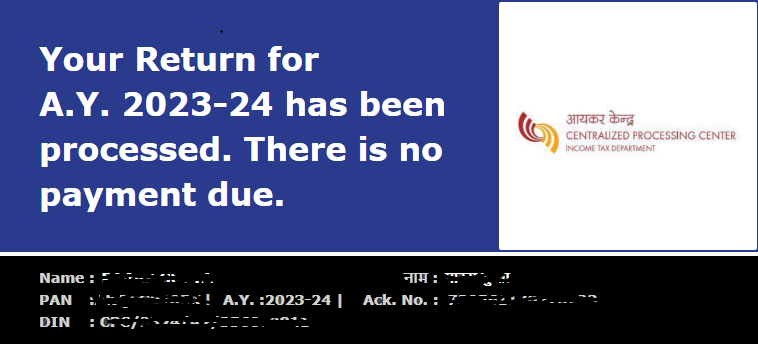

After all the hit and trails and exploring the utility, I was able to build my incometax Json file without any errors. The next step was to go online and upload this Json file and submit the return. As soon as I uploaded the file and hit submit - I got a messages that the incometax return has been successfully filed and within couple minutes I got a notification on my mail is as well stating that Your ITR Intimation - Your Return for A.Y. 2023-24 has been processed. There is no payment due. Finally done with all the formalities of Incometax filing its a very daunting process when you do it but at the same time you learn a lot as well while you fill out all the details provided in your Form16 and 26AS - one important point to note here is that please ensure that you are filling the right details as mentioned in Form16 that you receive from your employer and 26AS which can be obtained from incometax portal any discrepancy found will lead to a notification from the Income tax department.. So be watch and vigilant while filing your returns. cheers

India Income Tax Filing Using Desaktop Utility (ITR 1 - 4) the ultimate way to follow and File Your Tax...

#tax #income #incometax #india #taxfiling #incometaxfiling #utility #incometaxgov

Have Your Say on Incometax filing fiscal Year 2022-2023

Are you done with your incometax filing for this Year? Online Vs Offline? Did you explore the desktop utility for you tax filing. Le me know your views in the comment section below..cheers

Image Courtesy:: incometax,

Best Regards

Posted Using LeoFinance Alpha

Finally, that means, that online utility was putting something automatically ?

probably could be, I may have added something but when I removed it then its not removing from the backend. cheers

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 11.48% vote for delegating HP / holding IUC tokens.

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts: