CeFi Vs DeFi - Real Example of Bank Fixed Deposit Interest Rate Vs DeFi APRs...

Hey All,

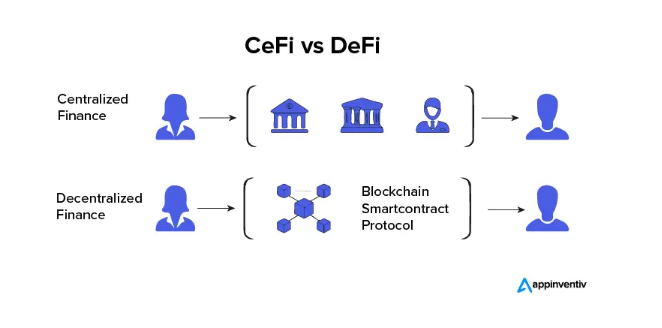

If you are familiar with the Crypto world and its terminologies then I am sure you know exactly what CeFi [Centralized Finance] & DeFi [Decentralized Finance] is all about. Incase not no worries the following image from Appinventiv clearly showcase the difference between both of them.

Source: Appinventiv

Before I move any further on explaining the real example that I have in hand about the Bank Fixed Deposit Interest Rate Vs DeFi APRs. Lets look into some of the difference between CeFi vs DeFi...

Comparison - CeFi vs DeFi

| Aspect | DeFi | CeFi |

|---|---|---|

| Funds Custody | The user has complete authority over funds custody | Outside of the user's custody |

| Ease of Use | Complicated UX [User experience ] | Easy to Use |

| Services Available | Borrowing, Lending, Payments, Trading | Trading, Borrowing, Fiat-to-crypto, Payments, Lending |

| Personal Information | Privacy is maintained | Follows a KYC process |

| Security | Depends on the technology, subject to risk in case of faulty codes | Vulnerable in case of security breaches on the exchange |

This table above illustrates a provides a comparison of DeFi Vs CeFi in terms of funds custody, ease of use, services available, personal information handling, and security considerations. Each approach has its own advantages and disadvantages, and the choice between DeFi and CeFi often depends on an individual's preferences and risk tolerance. For example a person who is willing to take high risk of higher APRs will prefer DeFi as opposed to CeFi.

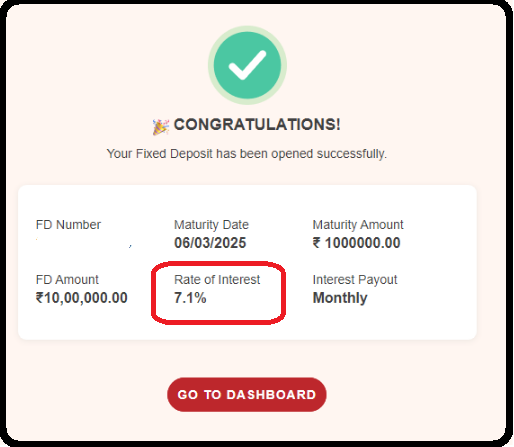

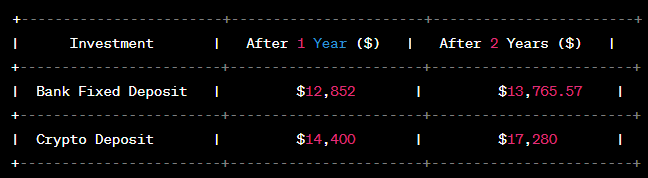

Now lets have a look at the example on the interest rate comparison between both the type of finance. I had recently done an fixed rate deposit in bank for close to $12K+ for an APR of 7.1%; you can refer the post - Where to Allocate Your Funds - Cryptocurrency High APR Vs Banking Low APR - Here. Now if I were to draw a comparison table where at CeFi - Bank is giving 7.10% APR and DeFi #HIVE Blockchain giving a 20% APR what would the total income look like in two years.

Bank Fixed Deposit (7.1%):

Initial Amount: $12,000

Annual Interest Rate: 7.1%

After 1 year: $12,000 + ($12,000 * 7.1%) = $12,852

After 2 years: $12,852 + ($12,852 * 7.1%) = $13,765.572

Hive HBD Saving Deposit (20%):

Initial Amount: $12,000

Annual Interest Rate: 20%

After 1 year: $12,000 + ($12,000 * 20%) = $14,400

After 2 years: $14,400 + ($14,400 * 20%) = $17,280

Definitely no doubt about it that DeFi gives better returns but then there is high risk involved as well. I haven't considered the compounding effect and if that is taken into consideration then the really money gained over a two years period would definitely be much higher then what is showcased. But the point is which team are you IN or would prefer - DeFi over CeFi. Considering all the factors I could not convince my family members to invest Rs. 10 lakhs in #HIVE and reap higher returns from the conventional banking systems i.e. 20% APR but no one agreed and voted to invest in CeFi instead. Anyways hopefully in the next round of investment I'll again try to do a 50 - 50 split between both the finances and when they see the real magic of #HIVE Blockchain savings account 20% APR things and all the perceptions like fraud to good to be true will turn into _ yes that's all correct what I was saying to them about the power of Decentralized finance..take back the control in your hands... cheers

Have Your Say on Cryptocurrency High APR Vs Banking Low APR...

What will be your preference fixed deposits returns from Banking systems Vs Cryptocurrency projects with high APRs? Let me know your views in the comment box below...

#apr #bank #hive #blockchain #defi #finance #cefi #bank

Best Regards

ImageCourtesy: icici, pro canva, peakd

PS:- None of the above is a FINANCIAL Advice. Please DYOR; Do your own research. I've an interest in BlockChain & Cryptos and have been investing in many emerging projects..cheers

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 13.22% vote for delegating HP / holding IUC tokens.