Physical Gold or Mutual Fund Gold

Hello friends, how are you all?? Wishing you all happy and prosperous life ahead..

Physical Gold on Mutual Gold Bond has its own Advantages and disadvantages, so today I will discuss about it in blog so that it will help investor to have an idea, where to invest to get financial Goal and Reduce the Risk of Loss.

One thing is sure that if you invest in gold, you will never incur any loss,As my elders told me, they had bought gold very cheaply in their time. Today the price of gold is skyrocketing. The current rate of Gold is the highest(All Time high) till now so if you still want to buy then And if you want to buy, you will never get a better opportunity than this. Because the rate will increase in the future as gold experts have predicted that Gold price in India will be up to Rs 1 lakh per 10 grams by the End of the Year. But the question is whether to buy physical gold or mutual gold. So first let us understand what is physical gold? Then we will understand what Gold Mutual Bond.

Physical Gold

Investing in physical gold involves purchasing gold in the form of jewellery, coins, or bars. Having gold assets in India is a heritage and symbol of wealth. In India, people usually believe in buying physical gold, just because of it tangibility but there are unnecessary charges added to it such as making charges, GST & wastage. Because of these charges, the price of every seller gets Difference.

I think the disadvantage of physical gold is that it has to be properly secured.There is a lot of theft or Robber in Indian House, so keep your gold in House is risky and to be more secure we have to take Bank locker, for which have to Pay extra. The second disadvantage I feel is that the shopkeeper fools the customer. Takes money for high Karat gold and gives low purity. That's why our government has made the BIS hallmark and HUID(Hallmark Unique Identification) it's a6 digit Unique Number on Gold ornaments,to know the exact Karat and purity.

Gold Mutual Bond.

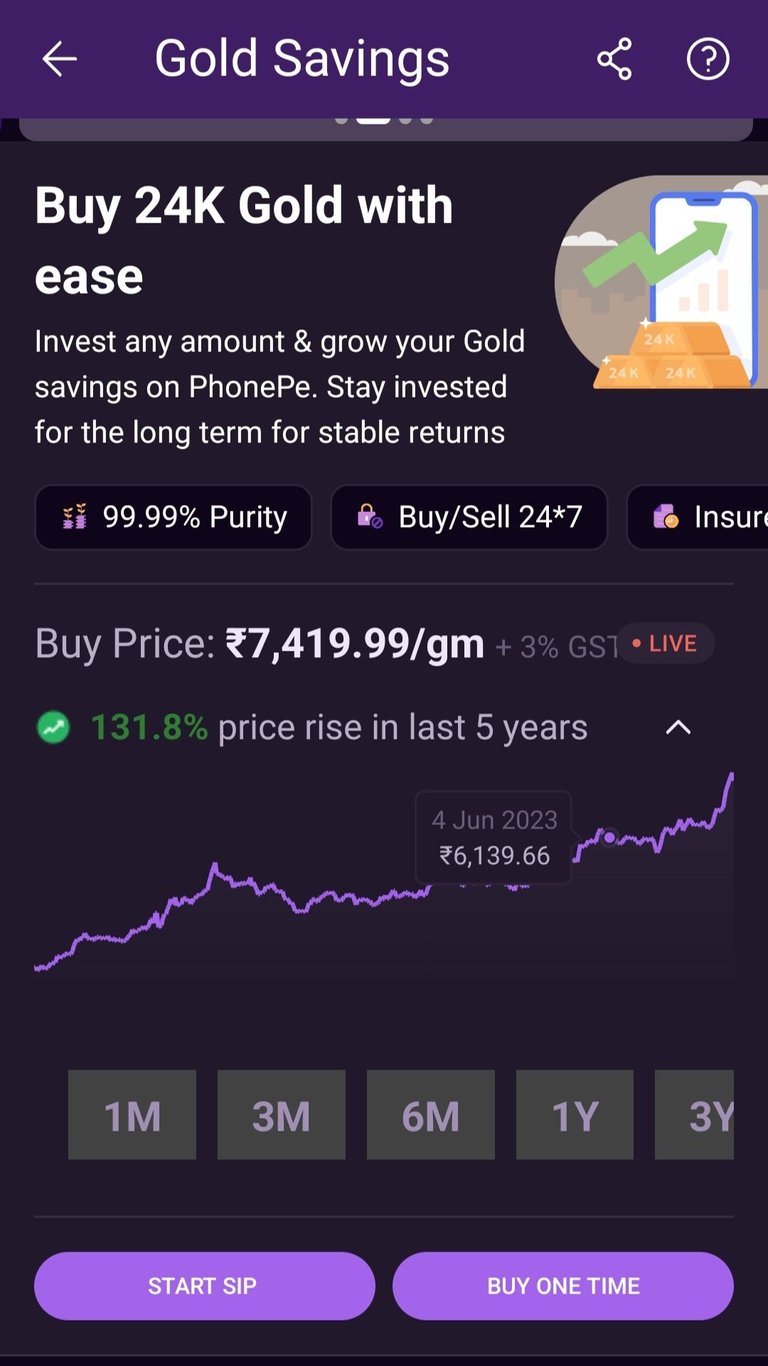

Screenshot from Phonepe App

Gold mutual funds, also known as gold exchange-traded funds (ETFs) or gold funds, offer a convenient way to invest in gold without owning physical metal.

There are many investors who want to diversify their profile and hence invest some amount in gold also. This also has its own advantages like you can buy it online anytime, anywhere and sell it whenever you want, without visiting any jewellery store, hence it provides liquidity and price transparency. In this type you to buy 24 Karat gold, with no extra charges like making charges. More importantly it is totally risk free to gold, Even in Gold Sovereign Bond (GSB) investors get 2.5% of rate of interest annually for Five years, which is applicable to Physical Gold.

Which one is better ??

Which is better, physical gold or gold bonds, depends on some factors?

Long term/ Short Term

If you are buying for short term i.e. buying some gold Ornaments today and Sell it in future, then you can buy physical gold as a jewellery. For being an investor if you want to diversify your portfolio, then For long Term go for Gold Mutual Fund. Even I must say that Gold mutual funds offer more convenience than physical gold.

Cost consideration

If you are buying gold to fulfill your desire, then go for the physical Gold, There are some extra charges like making charge, wastage etc where is there no Such Cost in Mutual Gold Bond.

Tax Implications

Understand the tax implications of gains, as there is different Captain gain Tax in Physical gold and Mutual Gold Bond, Which is more suitable for you, go for it.

Both physical gold and mutual gold have their own advantages, But everything is depends on investor's priority? If you want to invest in gold then my personal suggestion would be to go for mutual gold Bond as it gives higher returns, diversify for Portfolio and easy access to liquidity when needed.

Friends participate in ongoing April initiative by @leo.tasks, you don't have to think about the topic to make the post, make a content according to inleo April calendar given below....

For More details regarding initiative kindly visit the link given below 👇🏻

Initiative: April Monthly prompt

Thankyou 😃

@gargi 🙏🏻🇮🇳

Posted Using InLeo Alpha

Always physical GOLD and this proposition does not accept any exceptions, if...buts...etc.

Exactly..

👍👍👍

This post has been manually curated by @alokkumar121 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @alokkumar121 by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thankyou @alokkumar121 ji

This post has been manually curated by @alokkumar121 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @alokkumar121 by upvoting this comment and support the community by voting the posts made by @indiaunited.

thankyou @alokkumar121 ji..🙏🏻

I've already amassed a stake in, physical Maple Leaf gold coin, Bitcoin and a Physical Precious metals ETF.

it is always great Strategy to diversify your portfolio.. You are doing great 👍🏻

Friend, you have shared very important information about gold. You have written well about purchasing, investing, advantages and disadvantages. Thank you.

'm glad you liked it... Thanks for reading..