Mantra Finance - defi project with a unique regulatory perspective

I recently came across Mantra Finance, one of the many defi platforms utilizing blockchain technology to provide unique services such as crypto lending, savings and staking. Mantra surely has a great project on hand with focus on regulatory compliance, decentralized investment opportunities and community governance.

I have taken a little deeper look at what Mantra finance is working on and I decided to share my findings here. First of all, here is a quick overview of the project

Mantra finance - taking a quick look

Mantra Finance is an Ethereum-powered defi platform that offers finance products and services to individual users and institutions in compliance with standard regulatory frameworks. It attempts to build a common ground - an integrated ecosystem - where Defi meets traditional finance in a way that local or international finance regulations would permit.

The main focus of Mantra finance is to provide a secure, decentralized crypto investment platform where standard user authentication and regulatory procedures are strictly observed. This creates an efficient meeting point for all fragmented and often disagreeing elements of modern Defi projects made up of traditional finance, institutional investors, individual users, and finance regulators. Mantra finance can thus be viewed as the vital missing link in the defi space today.

Take a look at the problem Mantra is trying to solve

The problem - distrust for crypto

Mantra finance is not the first to offer really nice opportunities in Defi. There are existing Defi platforms that have done a great job in providing lending, staking, liquidity pools, plus other cool products never seen in traditional finance. But Mantra finance has identified the major challenge crypto is facing globally - lack of trust from everyone.

Lack of trust from governments: Because crypto is not regulated, there are no rules to validate users or the transactions processed. To make it worse, almost every transaction is anonymous. As a result, crypto platforms unknowingly process funds acquired illegally such as through money laundering. Governments therefore lack trust for anything crypto and continues to fight for its regulation. Evidence of this growing distrust is seen in legal disputes between the SEC and crypto companies like Binance and Coinbase. Generally, governments around the world continue to blackmail defi as either a major investment risk or scam.

Lack of trust from institutional investors: Institutional investors worry that getting involved in defi might make them partners to crime, criminals or illegal entities because crypto transactions are mostly anonymous and not regulated. This distrust makes large organizations to stay away from crypto and defi.

As a result of this distrust for defi and crypto, large organizations and even big time individual investors stick to the stock markets and other traditional finance investment instruments. They accept to miss out on all the opportunities defi offer instead of risking their business image or financial loss.

The solution - Mantra finance builds trust for Defi

Other defi projects allow anyone to participate in their system, which is a recipe for illegal users to get involved. But, Mantra finance introduces standard KYC procedures to its defi platform, ensuring that only verified users have access to its defi products. This builds the trust badly lacking in other defi projects.

Mantra finance therefore requires users to provide some form of national identification document, real-time selfie and proof of residential address before they can access defi products. Proponents of full decentralization might ague this approach, but this a little sacrifice that must be made in order for defi and crypto to have a chance of achieving mass adoption. Regulated defi is probably a big selling point for Mantra finance which will definitely make institutional investors consider getting involved with this project.

Mantra finance simplified staking contracts

One of the main services provided by Mantra finance is staking. Once a user completes the mandatory KYC, they have access to the staking vaults. The process of staking and claiming rewards is one of the simplest I have seen anywhere. Of course, you know its also automated as it runs on a smart contract.

To stake on Mantra finance, the user deposits a stable coin (USDC) into any of the vaults. The deposit is converted to the native coin of that vault and locked up. Once the staking period is over, the coin is re-converted to USDC and unlocked for the user. In addition to the capital, the user also receives their staking reward.

Mantra Finance offers mainly two staking vaults - single asset vaults and the multi-asset vault. Take a look below and see what each of these vaults contain.

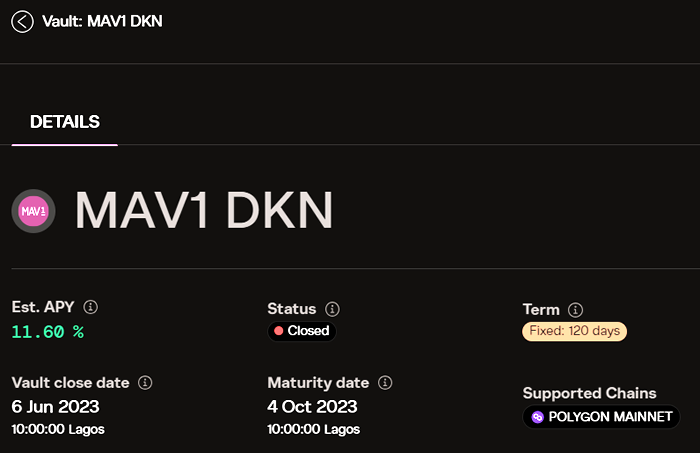

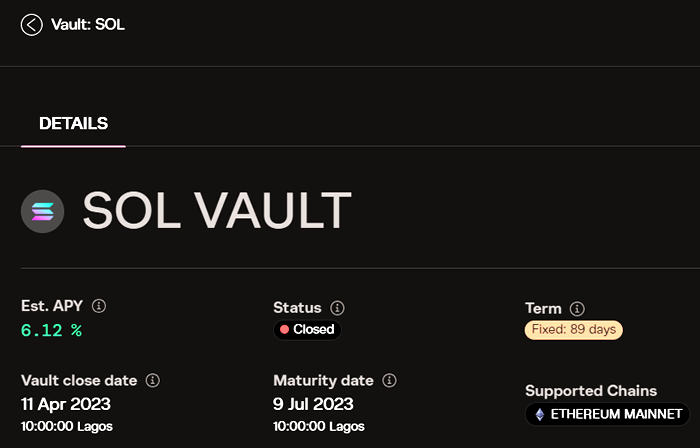

- Single asset vault: This vault features tokens like Ethereum, Solana, DOT and MATIC. Each of them have different APY, staking time, vault closing and maturity dates. I just did a screenshot of SOLANA vault below.

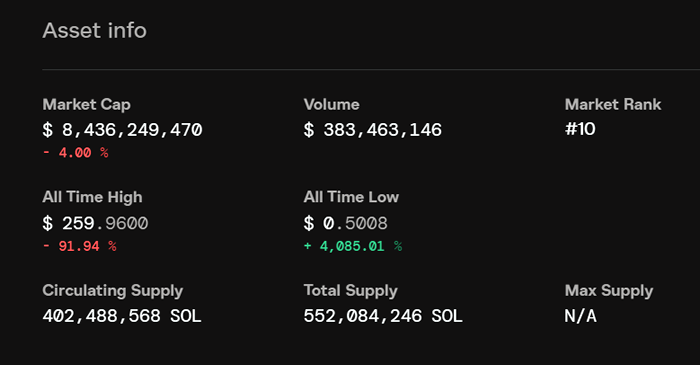

Interestingly, you also have a nice detailed market information about the coin. For the Solana I featured above, Take a look at the token information below.

- Multi-asset vault: This vault contains different combinations of DOT, KSM and NEAR cryptocurrencies. Once the USDC is deposited, the system automatically converts and splits the total amount into these 3 coins. Upon maturity, the 3 coins are re-converted to USDC. The user then reclaims their capital and any yields obtained from the staking. Below is a screenshot of the multi-asset vault.

source

source

Important note: The system automatically deducts 10% from the staking yields which is the validator commission for the contract.

Mantra finance - products/services to be launched

Mantra has a lined up a number of other great products to be launched. Chief among them is their decentralized exchange platform which will have features to beat existing products. For example, the Mantra Dex will feature a Central Limit Order Book. This will record all transactions in a transparent manner and let users see the process. The order book will also list prices of crypto so that users will stay informed and discover without stress.

The Dex will also feature a simple UI to streamline user experience. Some defi projects feature complex interfaces that make it difficult for new users. A simple and easily navigable interface will make onboarding of new users easy.

The project road map of Mantra Finance has a lot being developed by the team. It includes fiat integrations so that users could make deposits in fiat. We will wait and see the fiat currencies that will be accepted on the platform. The Mantra blockchain has not yet been developed. It is one of the future products that will be implemented too. Liquidity pools and other yet-to-be announced features will all make it to into the platform.

Why Choose Mantra Finance?

Non-custodial staking: Mantra finance will not hold any assets of users in the platform. Users will retain complete control of their funds by interacting with the platform through web3 wallets like MetaMask. This ensures that this project returns its web3 features which includes letting users manage their own wallets.

Regulatory Compliance: Mantra finance products will comply with international regulations in order to retain the confidence of individual users and institutional investors. This is the main selling point of the project which is also a market difference from the other defi projects around.

Enhanced Interoperability: Mantra finance would offer products and services across multiple chains. It will also create bridges that will allow other blockchains to seamlessly connect with it. With so many siloed blockchains around, Mantra will provide that crucial missing link and make all blockchains 'talk' to each other seamlessly.

Earning opportunity: Mantra finance creates an ecosystem full of opportunities to invest and earn in Defi. Currently, participants could stake crypto and earn rewards at the end of the staking period. Future products will create more opportunities to earn from DEX staking, liquidity pools, etc

Stay in touch

There is a lot to learn about this amazing project. Maybe you should stay in touch with the Mantra finance through the following official channels:

- Mantra Finance website

- Mantra finance Vaults

- Mantra Finance Litepaper

- Telegram

- Medium

Posted Using LeoFinance Alpha

The solution to the modern financial institution is exactly what Mantra objectives are.

The Ability of introducing KYC for the user's identities and protecting it during transacting in a purely decentralized manner is a great capabilities and benefits

This is so true. Mantra finance is so unique in their approach. For me, this is the first project that tries to build a common ground for all. While some may not like the idea of regulatory compliance, I think its a perspective we can debate on all day. If all parties could bend a little to clear the ground for mass adoption of crypto, then why not? I think that is the essence of this project.

Posted Using LeoFinance Alpha

I like the staking aspect of Mantra finance. It will help individuals make extra money via rewards even when their staking capital is still intact. Good investment.

Sure beyond the staking, their main selling point is the regulatory compliance aspect and interoperability features. They are basically trying to build trust so as to attract institutional investors and somehow please governments too. A regulated project will make investors trust it and willing to participate.

Posted Using LeoFinance Alpha

!1UP Mantra Finance's approach is very sophisticated and can attract many users to their platform, enjoyed your post a lot!

You have received a 1UP from @underlock!

@leo-curator, @ctp-curator, @vyb-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

$PIZZA slices delivered:

@curation-cartel(10/20) tipped @fokusnow

https://leofinance.io/threads/herculeand/re-herculeand-lpm2bzgk

The rewards earned on this comment will go directly to the people ( herculeand ) sharing the post on LeoThreads,LikeTu,dBuzz.

It is going to be a great win for Mantra to solve the problem of trust in blockchain technology. Once all this projects are all launched its going to be huge and I am on the look out @fokusnow.