MakerDAO - collateralized lending protocol built on the Ethereum blockchain!

Web3 is revolutionizing finance by opening up so many opportunities to access funds, invest and make your money work for you. The umbrella term used to describe all finance-related instruments powered by blockchain technology is Decentralized finance (DEFI). Here is a concise definition of DEFI from the Leoglossary:

Utilizing distributed ledger technology (DLT), DeFi eliminates the need for intermediaries such as banks, exchanges, or brokerage firms. All financial activity can occur utilizing applications built to facilitate what is needed. This is possible due to the use of smart contracts. source

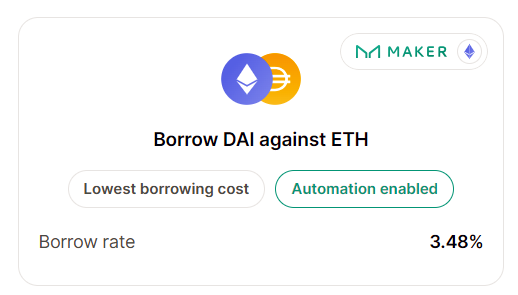

One of the services provided by many DEFI platforms is lending of digital assets. In this presentation, I will take a deep look at MakerDAO, perhaps one of the oldest Ethereum DEFI protocols that offer collateralized loans and other blockchain-powered services.

MakerDAO - a quick overview

MakerDAO is one of the earliest DEFI protocol built on the Ethereum blockchain. Among other things, the project is renowned for creating DAI, the first stablecoin not backed by or pegged to any fiat currency. DAI is backed up by Ethereum which is provided in excess as a collateral for borrowing DAI.

The MakerDAO project provides lots of many services for its users, chief among them is providing DAI loans. MakerDAO also offer community members the opportunity to participate in governance. But to do this, each user needs to hold the MKR token. Users that hold this governance token can vote on blockchain upgrades, interest rates for DAI loans, and any other decisions that the community wants to take.

MakerDAO have partnered with many DEFI projects and this accounts for the growing popularity of its stablecoin DAI. Its community development initiatives ensure that valuable contributors receive funding support from the ecosystem based on the votes by MKR holders. The grants project by MakerDAO is the tool for organizing funds from the community to support projects that add value or improve the entire platform in one way or the other.

How collateralized loans work on MakerDAO

MakerDAO is one of the earliest to lend digital assets in form of DAI to users that are able to provide Ethereum as collateral. The Ethereum collateral is locked throughout the time the user is in possession of the DAI loan. Once users return the loans and pay off the interest it accumulated, the collateral is unlocked and made available to the owner.

There are some necessary tools and instruments every user need to understand about MakerDAO loans. Lets discuss some of them below:

- Collateral and nature of Loan: The collateral for MakerDAO loans is mainly Ethereum. However, the platform added other assets which could be used instead of Ethereum. All assets used as collateral are Ethereum backed tokens. The community through its decentralized governance vote on assets that could be used for collateral. The collateral is usually higher than the DAI loan, which is why MakerDAO loans are sometimes referred to as over-collateralized loans.

While the collateral is provided in form of Ethereum or any Ethereum-backed tokens voted by MKR holders, the loan is provided in form of DAI.

- Maker Vaults: In order to initiate a loan, the user need to deposit their collateral in Maker Vaults. The Maker vault is a smart contract which contains all the rules and requirements for obtaining the DAI loan. Being a decentralized network, users are free to create vaults, deposit collateral into the vaults and generate the DAI loan. Once they pay off the loan, the vault remains empty until it is filled again by the user.

Creating a Vault: MakerDAO is a decentralized platform. As such borrowers create and interact with the smart contract. There are many user interfaces or DAPPS that could be used to create a vault. They include the following:

1: Instadapp

2. MyEtherWallet

3. Summer.fi

It is all too easy to set up a vault with any of these DAPPS. Let me quickly demonstrate with Summer.fi

Step 1: Log on to https://summer.fi/

Step 2: I need to connect my DEFI wallet. I will connect Metamask wallet. So click on Connect wallet. Then select Metamask or any other wallets of choice. check image below:

Step 4: Having connected the wallet, I will select the vault shown below and complete a few steps to set up the proxy. Its easy as that.

Once you finish up the remaining few things, the DAI loan would be made available in the wallet you connected to the protocol.

Maker Vaults play a big and crucial role in obtaining, managing and repaying MakerDAO loans. The great thing is that it can easily be created from many frontends.

Collateral-to-debt ratio During the governance sections, holders of MKR vote for the ratio at which the collateral provided should be higher than the loan. This is not fixed, but the community decides what it should be from time to time. Remember that the collateral must always be higher than the loan in order to cover the risks of non-payment and vault fee. To request a DAI loan successfully, the user must match the collateral ratio. It means that they must provide the requested collateral amount which matches the ratio voted for by the community.

Liquidation of Maker vaults: MakerDAO has mechanisms put in place to ensure that collaterals in the system would be enough to settle all outstanding loans and keep the value of DAI stable. When it is determined that the collateral-to-debt ratio of a debt is lower than that voted through community governance, that vault might be subject to liquidation. This means selling the collateral through bidding in the open market and using the funds raised to settle the loan. This protects the system from sudden collapse and ensure that DAI maintains a stable value over time.

Buying Liquidated vaults: The platform created a bid-based market where liquidated vaults are sold. Once a vault is labelled for liquidation, it is placed in the Collateral auction market and bids will start coming in from interested buyers. Once the time of the bidding is up, the user that bids highest will buy the collateral and make payment in DAI. This payment is then used to cover for the loan collected and any fees the loan attracted. In this way, collaterals in the system are made to have enough value to cover the loans. And DAI remains stable.

Why are MakerDAO collateralized loans innovative

MakerDAO collateralized loan have all the benefits that traditional loan systems cannot have. They include the following:

No KYC: MakerDAO loans is unlike traditional loans where extensive paper work and processing is done before accessing loans. They do not require any personal data that could endanger the borrower's privacy. Anyone is eligible to obtain the loans provided they meet the requirements such as providing the Ethereum collateral.

No middleman: MakerDAO loans are decentralized in nature and as such is accessible from any location. There would be no need for a middleman like banks or other financial institutions. The borrower processes the loan by creating Maker vaults. This smart contract contains all the agreements which the user fulfills and gets the loan without requring any third-party financial services.

Small interests: Compared to traditional loans whose interests skyrocket, MakerDAO loans have small iinterests. This makes it easy for borrowers to repay both the loan and the interest.

Funds on demand: It is very difficult to access loans in many places. Bank loans for example require expensive collateral which the average customer cannot afford. But MakerDAO and other DEFI lending platforms provide loans 24/7. Anyone could access such loans at any time provided they have the necessary collaterals to process the loan. Basically, MakerDAO loans make funds available all the time.

Retaining value of collaterals: When borrowers deposit their collaterals, they lock it up and this maintains its value throughout the loan period. If there is a positive price action in the market for that crypto, the collateral benefits too and appreciate in value. Once the loan is repaid, the borrower enjoys their asset with a new value.

Finally.

If you are a startup or a entrepreneur looking for funding to invest in your business, consider MakerDAO or other crypto collateralized loans in DEFI. They have all the unique features that are sadly missing in traditional loan systems.

Posted Using LeoFinance Alpha

Congratulations!

✅ Good job. Your post has been appreciated and has received support from CHESS BROTHERS ♔ 💪

♟ We invite you to use our hashtag #chessbrothers and learn more about us.

♟♟ You can also reach us on our Discord server and promote your posts there.

♟♟♟ Consider joining our curation trail so we work as a team and you get rewards automatically.

♞♟ Check out our @chessbrotherspro account to learn about the curation process carried out daily by our team.

🏅 If you want to earn profits with your HP delegation and support our project, we invite you to join the Master Investor plan. Here you can learn how to do it.

Kindly

The CHESS BROTHERS team

Congratulations @fokusnow! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 6000 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts: