Why The Sudden Drop in The Crypto Market?

Yesterday 17th August, 2023, the price of Bitcoin experienced an abrupt decrease of around 8% within a 10-minute period, leaving cryptocurrency investors worried and confused about the sudden drop, because let's be honest; everyone is tired of the bear season. Several potential explanations for this unexpected price decline have emerged.

One theory involves SpaceX, Elon Musk's company, reportedly selling its Bitcoin holdings, which amounted to $373 million, although this is isn't officially confirmed yet. But such a move by a prominent figure like Musk could have exerted downward pressure on Bitcoin's value.

https://twitter.com/WatcherGuru/status/1692304995176104393?t=oSzQ4EMeXeDafU9smbq3pQ&s=19

Another possibility is that the shift in market sentiment resulted from the anticipation of interest rate hikes by the U.S. Federal Reserve, along with existing weaknesses in global markets.

Additionally, the rise in government bond yields has been suggested as a contributing factor. Increasing bond yields often indicate reduced liquidity across the broader market, potentially impacting cryptocurrencies. Despite the Evergrande crisis causing concerns, some analysts believe its influence on Bitcoin's price is indirect, mainly affecting sentiment toward the Chinese economy.

Another perspective proposes that the risk of a devaluation of the Chinese Yuan might have significantly contributed to the price drop. This risk could have been triggered by historical examples of Yuan devaluation impacting Bitcoin prices in the past.

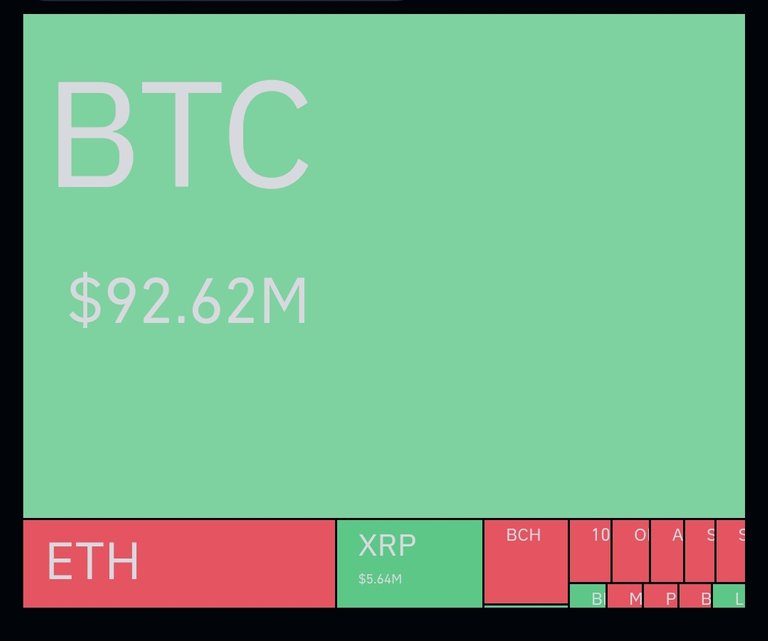

While various factors have been proposed, a significant sell-off by a single large participant could have initiated the rapid price decline, thereby influencing derivatives and cascading further sell-offs. Over $427 million worth of Bitcoin long positions were liquidated in a span of four hours, and over $822 million in liquidations occurred in the previous 24 hours.

Despite these theories, much of the reasoning remains speculative. One intriguing suggestion is that the news of the SEC considering the approval of an Ethereum Futures ETF coincided with the Bitcoin price drop, possibly prompting a significant fund to sell its Bitcoin holdings to initiate a chain reaction of buying Ethereum.

How has Hive so far?

Surprisingly Hive seems to have held up against the selloff quite well, reaching just a low of 0.2686 as against the lowest level it ever dropped to which was 0.2490. This is good news, it means the community is immune to some extent against the general market sentiments.

Following the crash, Bitcoin's price experienced a slight recovery, increasing by 1.2% within two hours, reaching a value of $26,502 at the time of writing this. This price rebound might have been bolstered by news of the potential approval of an Ethereum Futures ETF by the SEC in the coming months. Let's hope this will be the end of the selloffs... at least for now.

https://cointelegraph.com/news/why-did-bitcoin-price-suddenly-drop-analysts-explain

Cool Hive divider by @thepeakstudio

Thanks for reading, if you found my post interesting, then remember to hit the follow button so you don’t miss out on future posts. I look forward to your contributions in the comment section.

My name is Edwin Ifeanyi Louis (eil7304) and I love to write about finance and investing, movies, technology, gaming, fiction and just about any topic that piques my interest on a Blockchain platform called Hive.

Contacts

Cool Hive animation by @thepeakstudio