Understanding How The COTI V2 and GCOTI Airdrops Work

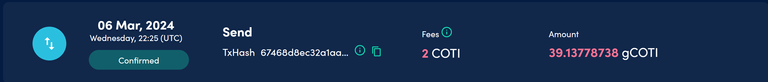

I have been trying to understand how the GCOTI airdrop is working by comparing what is different from week 1 and week 2. In week 1 I purchased COTI and staked this on the Treasury but the second week I didn't buy any and he only difference is the Trust score dropped slightly. The Trust score is based on activity within the Treasury.

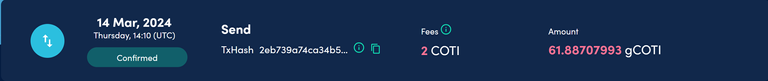

Next week it states I am to expected to receive another 54 GCOTI so 7 GCOTI short from what I received this week. My Trust score dropped this week due to no purchasing and staking with the price of COTI having risen I thought it better to wait on the side lines for another dip. Tonight I purchased another 500 COTI which will raise the Trust score back up again.

So Far I have received 100 GCOTI which is worth $8.60 on Uniswap, but more importantly generates more COTI when staked in the treasury. This 100 GCOTI represents 23 COTI per year in earned rewards due to it's boosting potential as an APR. Next weeks additional APR percentage growth should see me around 34 extra COTI earned annually which if everything stays the same will grow rapidly with an estimated 50 COTI per annum being added monthly through this GCOTI boosting over and above the value of the GCOTI token which will rise in the future.

In a couple of weeks time I should have over 22K GCOTI which is roughly worth $2k on it's own and not a token I would ever consider selling due to it's earning potential boosting the APR for COTI.

If we were not already in a Bull cycle phase I would be looking at buying more GCOTI but the focus has to remain on COTI for now because that is where the real dollar value is going to come from over the next 18 months. Just with some quick calculations $100 would buy roughly 1100 GCOTI or roughly 470 COTI. The 1100 GCOTI would take roughly 2 years to earn the 470 COTI against my current stake so this is why it makes no financial sense right now. The priority has to be with COTI because when the time comes to sell there will be more profits and that is more important due to where we are in the cycle.

From my understanding as long as the stake remains staked in the Treasury you will receive the extra GCOTI rewards over and above the COTI earned via the APR. This number will continue to slowly rise because your stake is growing through the compounding that is taking place. I will buy some more COTI this week adding to the stake ensuring my trust score rises again enabling more GCOTI being rewarded the following week.

What I am trying to do is to learn how this is all working because once the COTI V2 token goes live and we swap it out their will be an extra airdrop of tokens continuously whilst it is staked. I do believe this reward method they are using on GCOTI is going to be replicated on the COTI V2 token. This will be over and above what you are airdropped for the size stake you have.

As airdrops go this could be the biggest crypto airdrop I am involved in value wise because of the value of my current stake. The need for holding more COTI is apparent because this should pay off handsomely in the future over and above the extra tokens earned via the airdrop.

Posted Using InLeo Alpha

I was looking at swapping some ETH into GCOTI to get a jump start on things for when I can stake, but I wasn't able to get it to complete.

Listened to the podcast today and it was mentioned if your Coti is in metamask you score all the benefits from the treasury when COTI V2 goes live and can stake in the treasury. They are going o announce the dates shortly for this. I haven't managed to score any GCOTI off Uniswap besides swapping some COTI for GCOTI with a node operator many months ago.

Oh, thanks for letting me know that. That is great news!

That's a nice news to hear, haven't know about it before