Loan Repayment Holiday- A Very Bad Idea

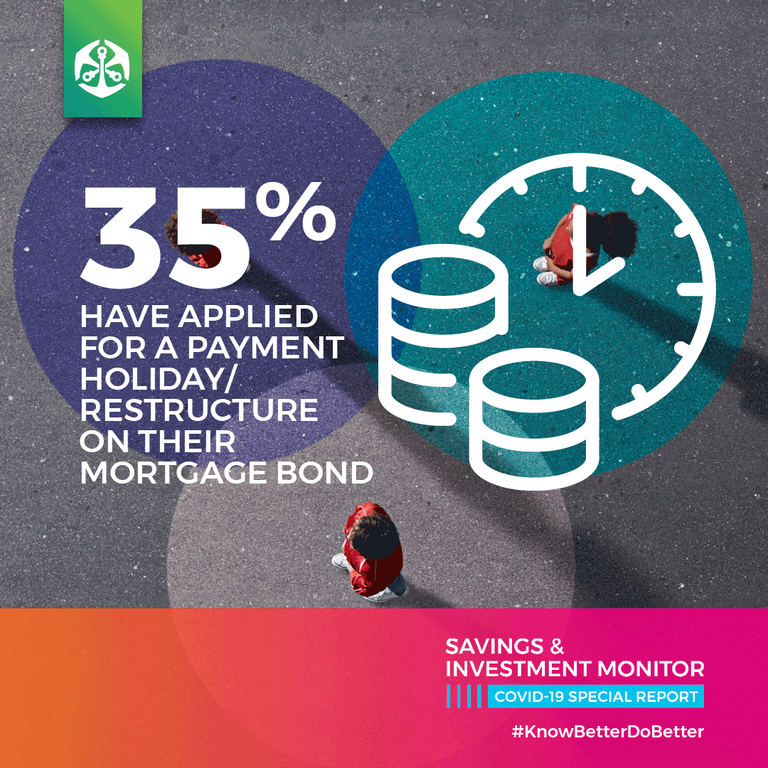

This was from Covid lockdowns when banks offered the holiday no payment for 3 months. When have you known a bank to actually think of you first because this was good business for them.

During the lockdowns in 2020 I can recall getting SMS's and phone calls from the bank offering a 3 month no payment gap. This may have sounded very tempting not paying your mortgage/bond for 3 months, but I rejected this offer for a number of reasons.

Adding 3 months to the time period sounds like nothing, but in reality nothing is on hold and he interest owed on the full amount will only pile up. Over the last week I read a report that this 3 month debt holiday has cost those that accepted this "generous" offer a combined R20.7 Billion ($1.1 Billion) in extra repayments averaging out at R30K each ($1.5K).

There is no such thing as free money or the banks being kind by offering you a temporary break from making your monthly payments. This was a good money spinner for themselves whilst at the same time looking like the good guys for those that have no idea what they just agreed to.

The extra R30k may seem like nothing, but the longer you are paying your bond or mortgage the more the bank makes. On any loan the interest is the killer and what these people did was actually lose a lot more than just 3 months because they just added to the interest debt.

On a 20 year home loan you spend roughly the first 11 years solely paying the interest of the loan and only after that are you paying for the purchase of the property. The longer the bank can keep you paying the interest the more profitable the deal is for them. The same applies to a car loan or your credit card balance as the payments may remain on hold due to their kind offer, but the interest continues to rise.

The ones that would be tempted by this offer would be the ones who are already in debt and the smart move would have been to agree to the payment holiday gap ,but use those funds that you would have paid on another outstanding bill like a credit card or car loan so you are not falling behind. The word "holiday" sold the people the wrong idea as there is no such thing on an interest loan.

The level of ignorance amongst the masses goes down to a lack of education and understanding the basic principles of finance. It comes as no shock to know that 40% of the country has a poor credit rating with only 15% of the country living debt free. The majority are spending upwards of 75% of their take home salary funding existing debt with the advised maximum percentage of debt being 36%.

This is just unfair at some point but I would not even advise anyone on loan these days

Amen. I pay down additional down payments on my mortgage any chance I get. I purposefully asked for a split mortgage at the time, and it was not even a product with bank at that time,but I pushed them to give it to me. It was designed for mortgage arrears, but I saw a loophole.

I fixed 80% at a great rate and left 20% fixed allowing down payments without penalty, which has worked out great.