Kimchi Premium?

source

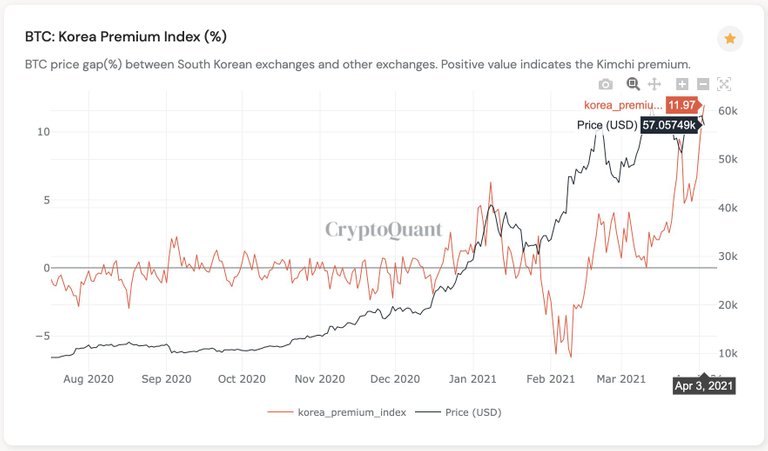

Bitcoin is trading at $66 000 in Korea today which is approximately $9000 higher than everywhere else. This would be an ATH so there must be 2 Bitcoin prices for this now surely. XLM and XRP are also way up so it will be interesting if the rest of the world follows suit today.

Kimchi is a real thing in South Korea and it is not some funky food either. If we look at Bitcoin pricing around the world on the various exchanges we will see some things start to stand out. Many of us don't understand why anyone would pay over the top for something that is in some cases 25% cheaper somewhere else. This time it is not only Bitcoin having the Kimchi effect but Ethereum as well.

Kimchi first appeared in the 2016 Bull market and between 2016 and 2018 the Kimchi effect averaged out at 4.8% price difference on Bitcoin. What we are seeing today is not quite as bad as January 2018 when the difference in price was as much as 55%. When investors don't want to sell their coins this creates a liquidity problem and this creates a premium price due to less coins being available.

To understand this scenario we have to look at the laws regarding financial controls in South Korea and only then will things become far clearer. Living in South Korea citizens are subject to very tight financial controls especially with taking money out of the country. In South Africa we also have limits but they are not as stringent as what the South Koreans have to deal with.

Taxation of cryptocurrencies will take effect in January 2022 as up until now they have been tax free. Just this year there has been another boom in crypto interest as exchanges like Bithumb have seen a nearly 800% increase in new accounts since this time last year.

One would suggest that they would open an account on an exchange outside of South Korea and trade that way but the Won is not accepted so they would need foreign currencies which would be denied by their government. The same applies for the likes of us thinking we could trade the difference in price but we won't be allowed to trade either as the exchanges are closed for foreigners in other parts of the world. OKEx and Binance had exchanges in Korea but both have been closed down stopping that loop hole.

The problem is what do you do with your extra Won then and basically the South Koreans knowing the value of Bitcoin will push it even higher trading internally amongst their exchanges. At some point this could turn out to be a signal or a front running price indicator of where Bitcoin and Ethereum are heading.

south Koreans are up to date with technology and have been one of the leading countries regarding online payments and wallets. In 2001 a gaming company was receiving 60 000 micro payments per day ($30 000) and within 3 years was processing 500 000 payments per day. They are not scared of technology and it is not surprising to see mass adoption happening here with crypto.

Posted Using LeoFinance Beta

I see the price around 57k in the chart though.

Yes. The red line which is the premium went up to 66K today after this was taken.

Posted Using LeoFinance Beta

Woah, but why it looks pretty different from global price in south korea? 🤔

Wow that is pretty interesting. Couldn't you still work the numbers by using a VPN an moving into a stable coin or something like that. It is far more complex than I feel like dealing with, but it seems like it would be do-able on some level. I really do hope this is an indicator of where we are going!

Posted Using LeoFinance Beta