GambleFi Portfolio | Crypto Market Volatility Hedge!

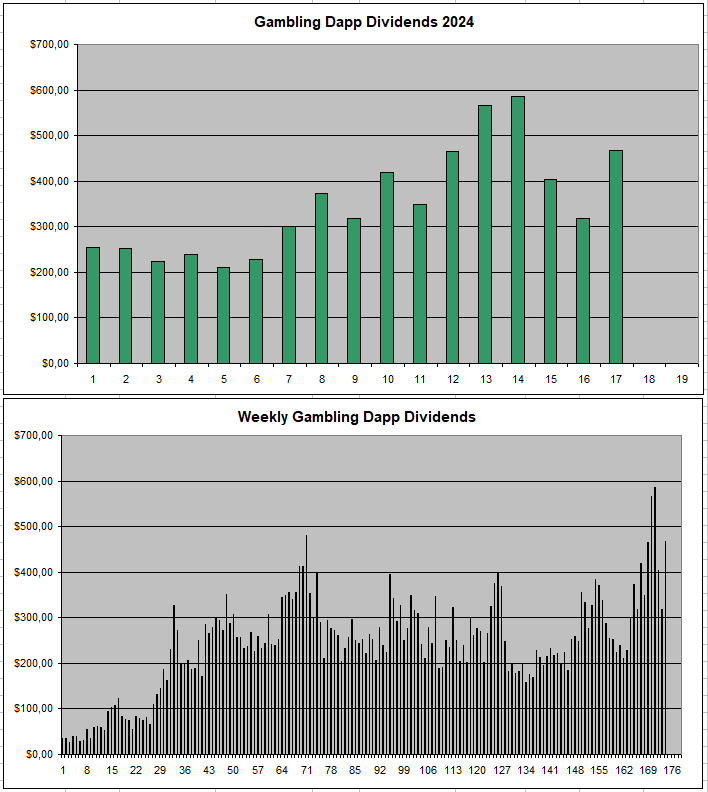

I skipped last week's report as I don't want to spam content in a week with many football matches. If anything, the Gamblefi portfolio continues to deliver stable dividends and fully acts as a volatility stabilizer during the market corrections. These are the latest numbers along with what happened for the projects that I'm invested in...

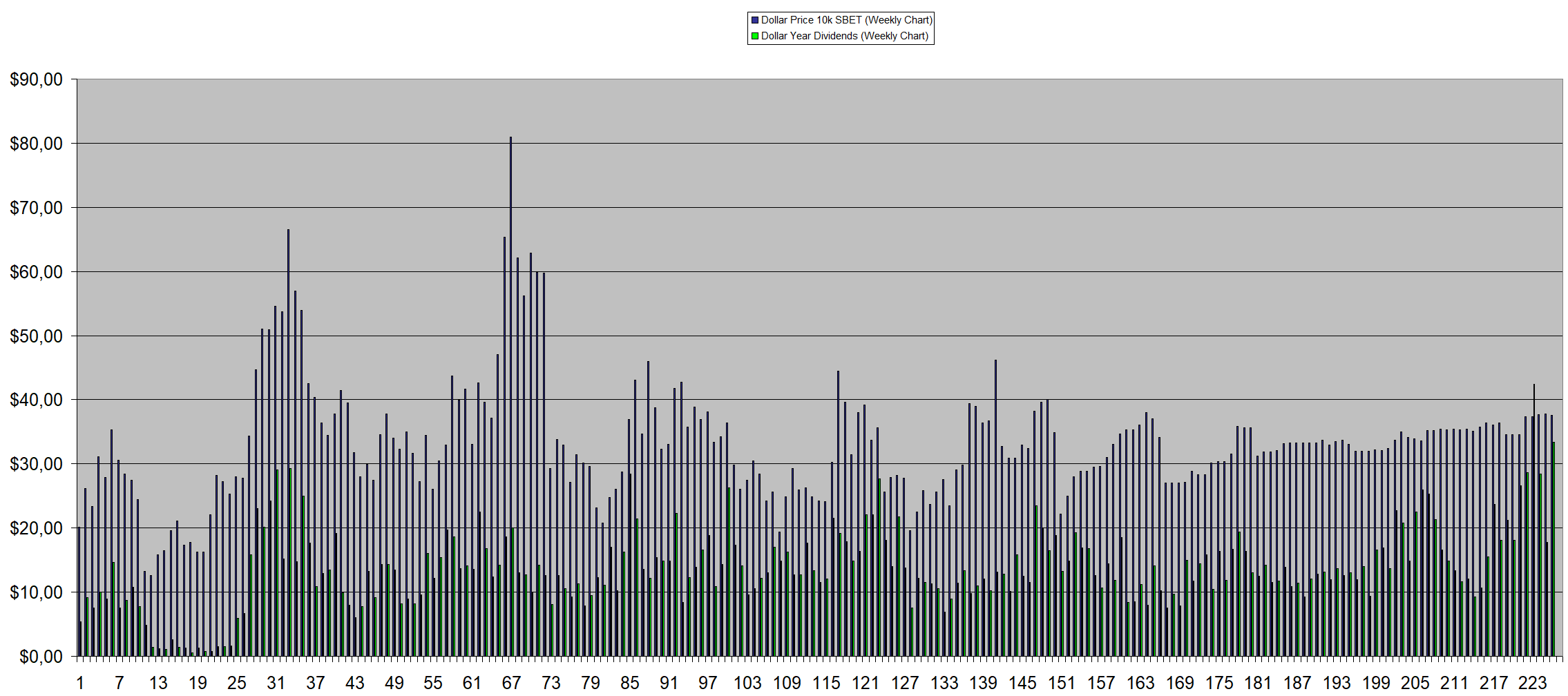

Sportbet.one (SBET)

The previous week showed a dip in dividends for SBET but this week once again was excellent and the averages in the last 6 weeks have been the highest that they have ever been while the price continues to trade flat as there is no real buying or selling since it's so niche to get into as you need an EOS account to really invets. Stability is the name of the game for SBET. Based on last week it has a +89% APY and I just continue to collect good dividends using them to re-invest.

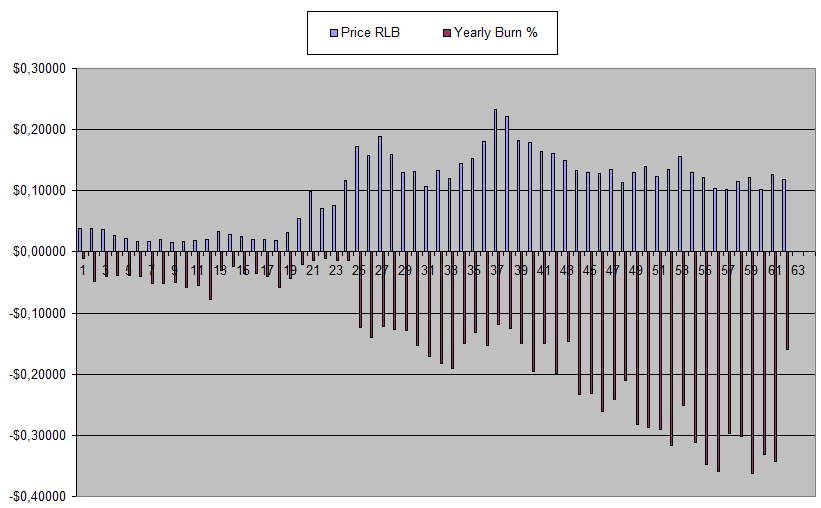

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

I have been reducing my holdings on Rollbit because the KYC requirements didn't allow me to longer stake my sportsbot and I'm less comfortable with the centralized nature. This doesn't take away that everything in the RLB ecosystem as an investment still is putting up excellent numbers.

Last week was one where the burn slowed down a lot so general earnings were a lot less. One of the reasons could be that they have 1 huge whale so a lot depends on that account and there are signs that he stopped betting sports. I have been selling off and cashing out my RLB position not so much because I don't like it anymore but because derisking on the centralization risk and I need some funds to feed my memecoin addiction.

This dividend chart especially the value of NFTs isn't actually representative as I sold 1 of my 3 NFTs

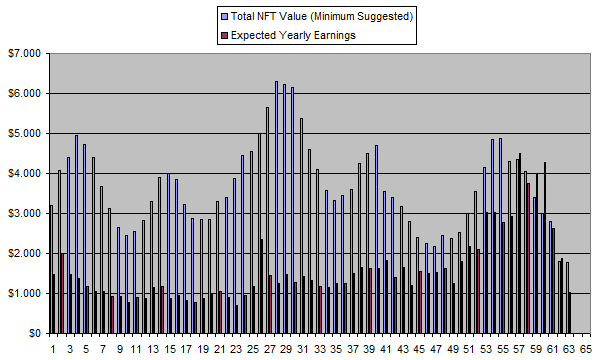

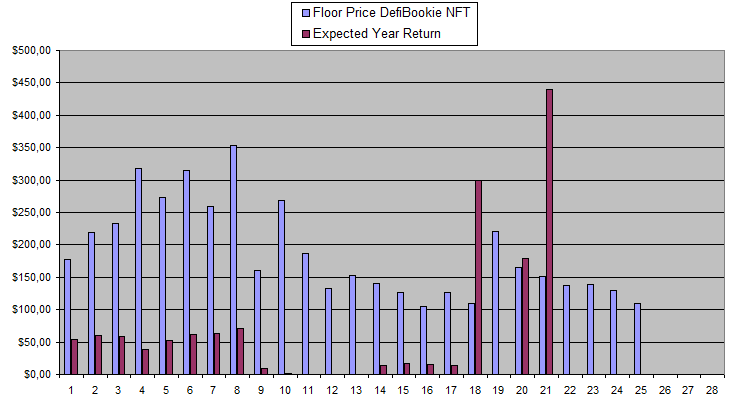

Defibookie (NFTs)

At this point it's a matter of waiting 3-4 more days before the numbers of April are released which halfway through looked like there was going to be some profit. I have 2 remarks on the project.

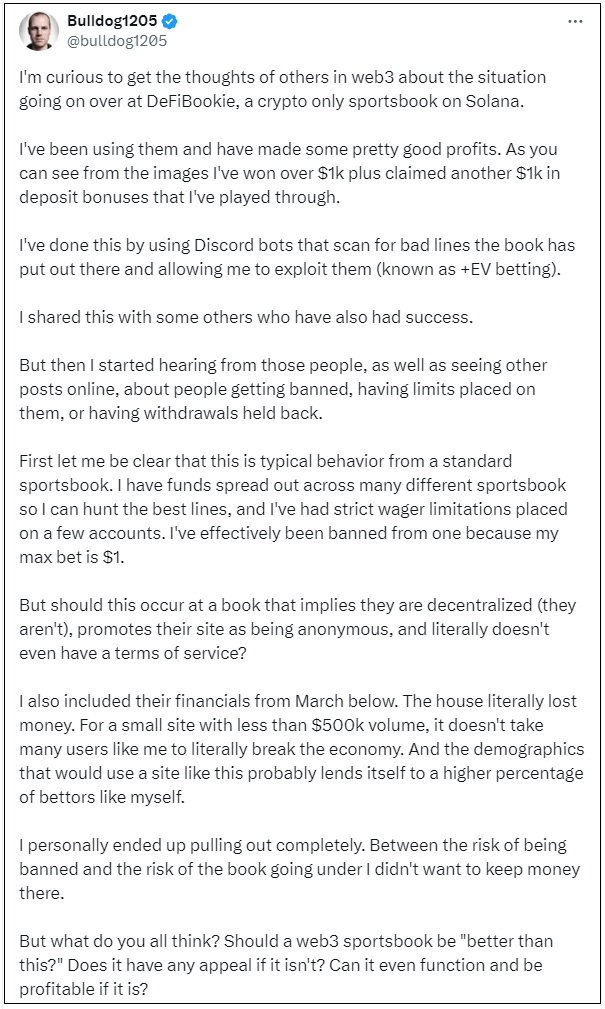

The first is a post from @bulldog1205 adressing the potential leak that I was worried about in the past but believed was fixed by now. So I'm not quite sure where things stand on this problem where lines don't get adjusted soon enough leaving them vulnerable to get exploited by sharp money. I guess the next profit report will show where it is going.

The second is that it looks like they will be doing more free bet promotions partnering with other projects on Solana with an eye to increase the users and the volume. I hope this will come with some more airdrops for DEFIBOOKIE holders.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.000$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.000$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

| Week 17 | 1421$ | 127$ | 1564$ | 4.410$ | 124.88$ | 8.78% | +268$ |

| Week 18 | 1421$ | 102$ | 1287$ | 3.850$ | 128.73$ | 9.06% | -5$ |

| Week 19 | 1421$ | 126$ | 1561$ | 3.320$ | 132.05$ | 9.30% | +272$ |

| Week 20 | 1421$ | 110$ | 1361$ | 74.680$ | 206.74$ | 14.55% | +147$ |

| Week 21 | 1421$ | 221$ | 2730$ | 0.000$ | 206.74$ | 14.55% | +1515$ |

| Week 22 | 1421$ | 164$ | 2044$ | 44.626$ | 251.36$ | 17.69% | +874$ |

| Week 23 | 1421$ | 151$ | 2008$ | 118.52$ | 369.88$ | 26.03% | +956$ |

| Week 24 | 1710$ | 137$ | 1956$ | 0.000$ | 369.88$ | 21.6% | +615$ |

| Week 25 | 1822$ | 139$ | 2114$ | 0.000$ | 369.88$ | 20.3% | +661$ |

| Week 26 | 1822$ | 129$ | 1968$ | 0.000$ | 369.88$ | 20.3% | +515$ |

| Week 26 | 1822$ | 110$ | 1673$ | 0.000$ | 369.88$ | 20.3% | +221$ |

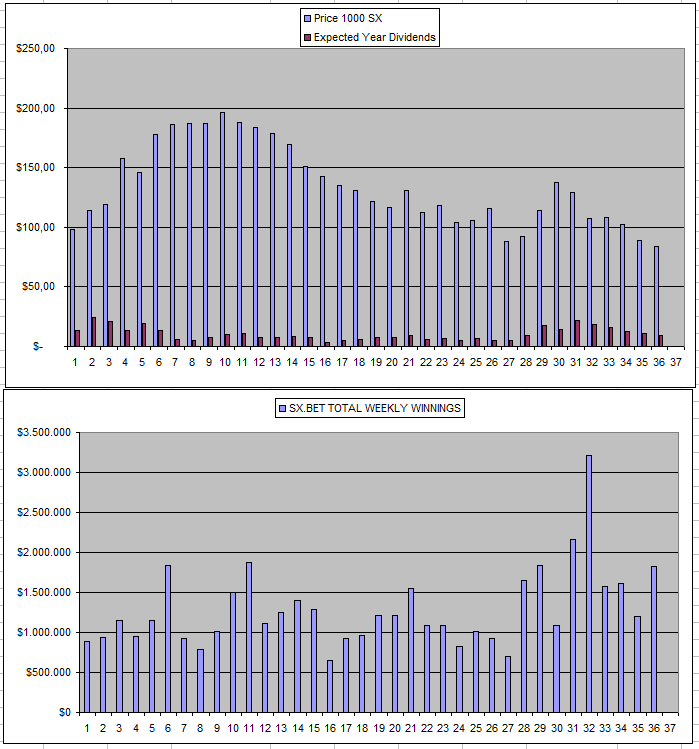

Sx.Bet (SX)

I managed to win a freebet getting 60$ extra in earnings from SX. So far the overall promotion of setting fees at 0% doesn't really seem to have much effect on the overall volume and the adoption and the dividends are still paid out in inflation which inevitably causes some sell pressure which made the price go down. I would get tempted to add to my stack if things go down more as I do still see a good chance for SX to become the crypto betfair over time.

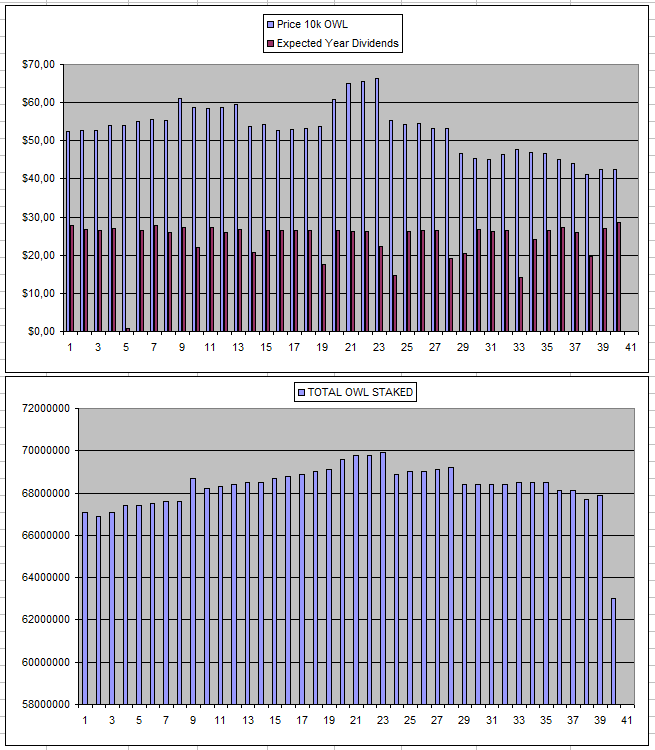

Owl.Games (OWL)

I continue to earn a stable30$ a week with my staked OWL and it looks like there was a big unstake last week decreasing the total by 7.22% which should make it so that I earn more. Aside from this nothing is really happening and I'm just slowly but surely earning back what I put in still having some hopium that at some moment good things happen while hoping it doesn't get rugged somehow.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

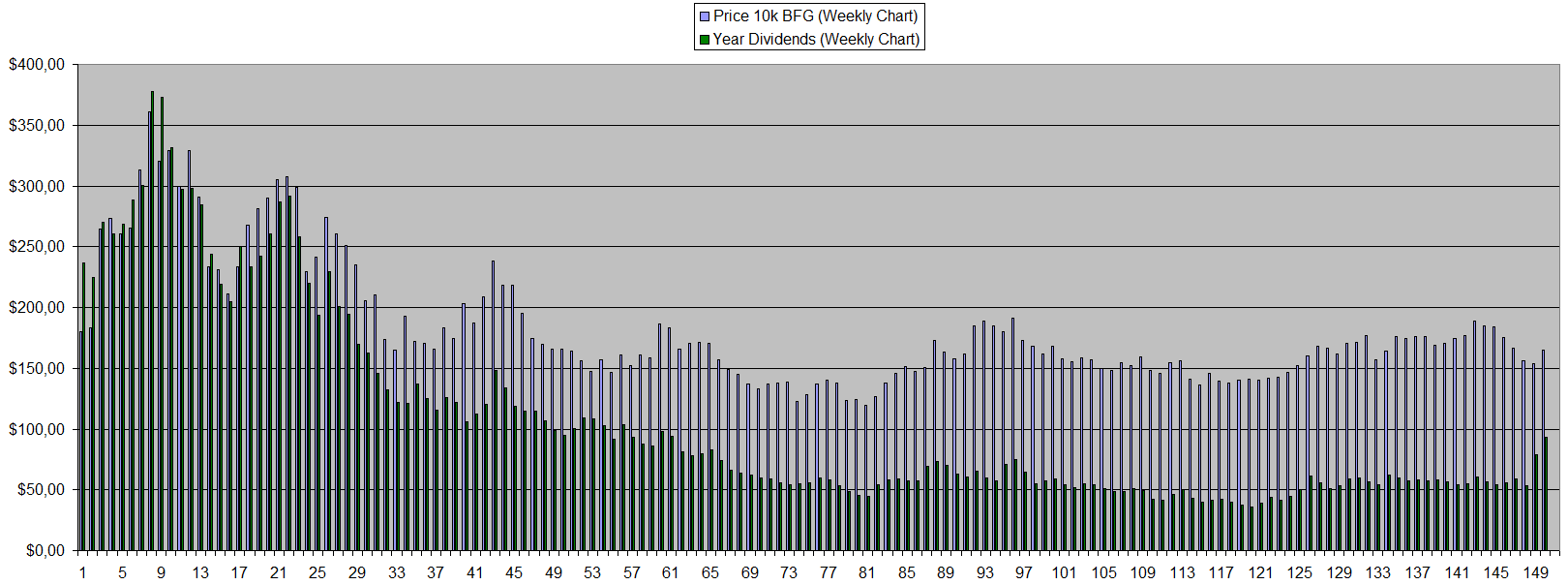

Betfury.io (BFG)

So staking on Betfury became available and I did stake my 500k BFG as I have no real intention to sell anytime soon. This initially seemed to cause a bit of a selloff of those who don't want to comit to at and deal with seeing their dividends decrease. The earnings haven't increased so it's mostly the case that those how don't stake get a smaller cut from here on out. Initially when I staked I had 20$ left to claim which I forgot to do resulting it seeming to be gone. However, that was restored without asking for it and I could claim that this week. At the moment below 8% of the BFG is staked and what used to be 54$ of dividends now are 80$+ in dividends a week. I do expect this number to go down and down as more BFG will eventually get staked.

Their aim is to decrease the BFG in circulation so the price can pump but I'm not really sold on that as in the end it's all about the revenue that the site makes which won't go up because of it. As a holder with a long-term mindset, I don't mind the staking mechanic as it will earn me more dividends. This can clearly be seen in the chart!

WINR Protocol

There was a big dip in the WINR price and I actually got tempted to pick some up as I do see some potential in this projects as a decentralized liquidity hub for the Crypto gambling space.

However, buying more would be with an eye for things to really improve over time as the entire platform and the tokenomics right now is just too complicated while the user experience for me is not good enough to even properly test it.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +89.1% APY |

| Betfury.io (BFG) | +56.3% APY |

| Rollbit.com (NFTs) | +57.5% APY* |

| Owl.Games (OWL) | +67.6% APY |

| Sx.Bet (SX) | +11.5% APY |

| Defibookie.io (NFTs) | +0% APY |

| WINR Protocol (WINR) | +2.7% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

Another 787$ earned in the last 2 weeks in dividends from my GambleFi portfolio which includes. 5M SBET | 500k BFG | 2 Rollbot NFTs | 600k OWL | 25k SX | 16 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|

Congratulations @costanza! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: