100% Equity is Not Ideal even for Long Term Investment

Whetever anyone says that long term investment is good, but having 100% equity for your long term investment is not an ideal scenario. We have to have some debt and gold in our portfolio to balance the market fall and other things. So even your goals are like 15 years down the line having 10% or 20% debt or gold should be ideal.

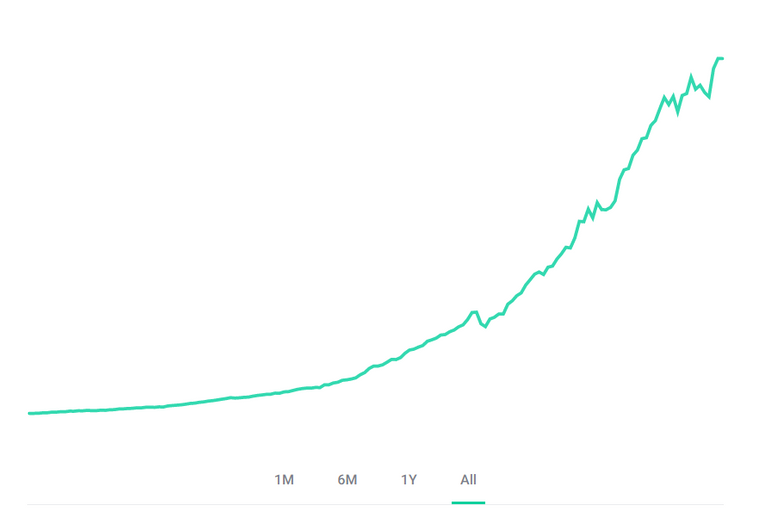

PC: Groww.in

We have seen the past performances and deduce that having equity for longer duration gives you good performance and that is correct for future too. But who knows the future. What if you dont get that performance which you have got earlier.

My investment was down 30% when the market fall in corona times. But stil my CAGR was not that bad because i had 20% debt in my portfolio. And that time i too have moved my debt to equity and rebalance the investment so that it will be good for the future. Now i don't know the ideal equity and debt ratio but what i really know that you should have the some investment in debt.

Now debt can be anything, your Fixed Deposit, your Profident Fund, your 401, your NPS or actual debt mutual fund. So when you create your future value of your goals keep everything into account and see how it creates your goal. Also debt helps you to give the cushion in times of volatility and other things.

So now when you create your portfolio try to keep eventhing into it be it equity, debt or gold which can help you to balance out the volatility and helps in the rebalance scenario, where you can move funds between the sector.

In my portfolio I have 70% equity, 20% debt and 10% Gold, which is my ideal scenario where when one sector goes out by 5%, I rebalance.