About QUANTIATIVE EASING

In today's edition, we will talk about a measure of economic stimulus taken by several central banks (BCs) around the world. This is quantitative easing (QE), whose impacts can be positive and negative.

QE is hotly debated in the investment world and has taken the spotlight further after the covid crisis. After all, many central banks on the planet have turned to quantitative easing to try to stimulate their economies.

To understand what this measure consists of and what motivates a central bank to take it, we must first understand what the role of a central bank is for the economy.

The central bank is responsible for conducting a country's economic policy. It is responsible for ensuring the stability and purchasing power of the currency it controls. In addition, it is also responsible for monetary policy and for regulating a country's financial system.

What interests us mostly for this discussion is that the central bank's objectives, through its monetary policy, are to minimize unemployment and keep inflation stable.

Thus, when a country shows signs of recession or economic slowdown, the central bank adopts expansionary monetary policies, trying to stimulate business.

This expansionary measure usually occurs through a cut in a country's interest rate, as the BC reduces borrowing costs and decreases fixed income returns, causing people to spend and invest more in the real economy.

However, in the current context, many countries already have interest rates close to zero, which makes it impossible or difficult for central banks to act in this way to stimulate the economy.

Quantitative easing emerged in this context, as a policy of monetary stimulus in a universe where it seems impossible to cut interest rates even further.

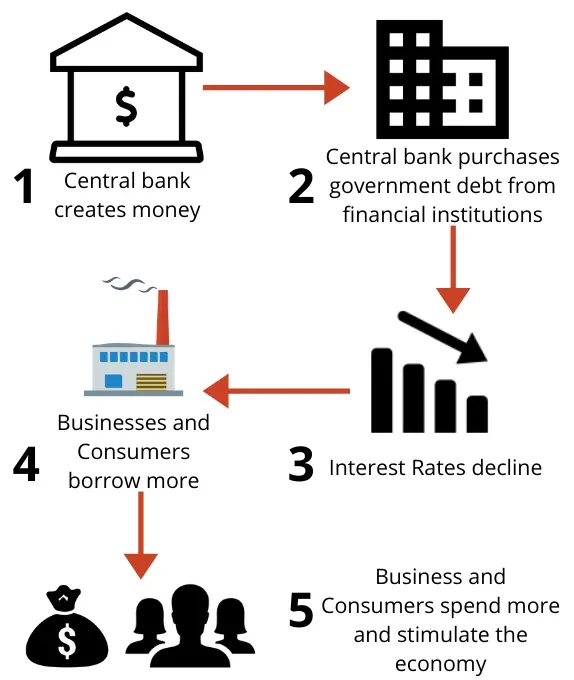

The QE is limited to the printing of money by the central bank for the purchase of government bonds and other securities on the market. With this measure, BCs inject an amount of artificial money into the economy, increasing the availability of money and reducing the effective cost of borrowing.

Thus, QE reduces the effective cost of borrowing by creating a greater availability of money in banks, ideally bringing competition between these institutions, which will seek to lend this new money available to businesses, companies and the population in general - and consequently lowering rates.

This is the reason why a greater availability of money tends to generate a reduction in the interest rate: it is about supply and demand.

A second way in which QE reduces interest rates is by lowering required bond returns. This is because when the central bank buys bonds, it raises their price as a matter of supply and demand.

We can think of a government bond issued by the government at $ 100 that pays $ 10 a year. This would mean that it has an annual return (or yield) of 10%. If the central bank buys that bond and raises its market price to $ 110, it will reduce its yield to 9.09%, as the bond will continue to pay $ 10 a year.

The government, observing the new yield traded in the market, can start to issue new bonds over that same yield - and then generate new government bonds that cost $ 100 and pay $ 9.09 per year, reducing the cost of borrowing to a government. and allowing him to spend more while still remaining competitive.

Another consequence of this is that fixed income securities have a lower return, which encourages investors to seek more risky assets that deliver higher returns, bringing growth to the stock market.

Posted Using LeoFinance Beta

This has been propping up the stock market and crypto for quite awhile. With no decent interest rates available, people put their money in riskier investments. It has been great for investors so far, but, there eventually will be a tipping point.

Posted Using LeoFinance Beta

Exactly! Interest rates are getting lower by the day..

Posted Using LeoFinance Beta