Finally Filed my Taxes for the Year

Taxation is a complicated process and I do not like it to be honest but still, there is no way that I can escape. This process has improved a lot in the past few years and I admit the fact that the government is doing pretty well to make the experience easy but still there is a lot that requires attention. the last date for tax filing in India is the 31st of July every year and sometimes the government extended it further. This extension is never guaranteed so it is always the best practice to be prepared that the extension will not happen and take action accordingly.

I have been filing my taxes since 2011 and ITR 1 is the applicable form but now this year things have changed for me. Crypto taxation was introduced last year and after that, I did some transactions in the Indian exchanges which are reported and I was required to file a different form. It is always suggested to file the taxes whichever is applicable and if there is no clarity on something then ask for assistance. There are so many tax consultants who can help by charging some fee and this process can be done easily but I have a problem here because I want to do it by myself and I went with this option in my tax filing.

Change of Forms

As I have mentioned that I have been filing taxes from the year 2011. I have been using ITR 1 because I'm a salaried employee and there is no source of other income so this form is applicable and I think it is one of the easiest forms across all the available forms. This time things are different because of crypto. Crypto is considered another source of income so I was required to file its two and this is the first time when I used this form. I can tell you that feeling ITR one is just a 5-minute game because there are very few fields to fulfil and the rest of the information is already pre-filled by the portal. there are so many components to be filled in ITR two and even this is lengthy. I wanted to file my taxes in the first week of Aug but could not do because of my busy schedule.

I have seen 2 posts by Sanjeevm in which he talked about the issue he faced and finally, he got the solution. I had thought that if there would be more problems then I will seek assistance from some consultant but finally, I did. Thanks to Sanjeev for sharing the posts it helped me and even I watched some youtube videos to see the steps that I needed to follow.

Crypto Gains & Filing

I get Form 16 from my employer and it shows everything that I earn from salaried income but for crypto, it was difficult to get the proper details. The exchange I used for most of the crypto transactions was not providing the report with a proper breakup so I asked them some questions. Later they shared the update that they are updating it and updated trade history will be available after 15th July. The exchange released the updated report and the next weekend I was travelling so could not file it.

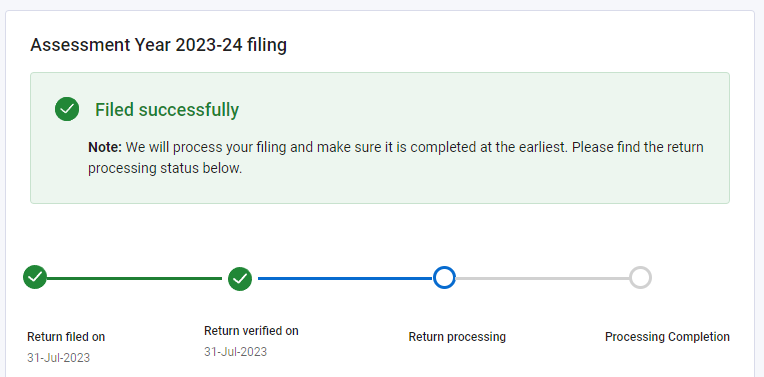

Now there was just one weekend and I had to get it done anyhow. I spent my Saturday and Sunday calculating the figures and finally submitted them. I tried my best to calculate the amount and I hope its correct. Sometimes the tax dept sends notice for some clarification and I will be active to see if they ask for some information. Its filed successfully and the remaining 2 steps are required to be completed by the income tax dept.

Now I know how to file taxes using ITR 2 form and from the next year onwards I should be able to do this easily. Its always good to get things done by ourselves so we know the process and next time we need not struggle anymore. This is what I think and I am glad that finally its done and now there is a relaxing period for almost 1 year.

Thank you

Posted Using LeoFinance Alpha

wow well done. You don't hire anybody to do this that was surprising O.O. Anyways well done nobody likes filing taxes oof. still luckily nothing for crypto tax for malaysia ;3

You are lucky dude because you dont need to pay any tax in Malaysia but things are different here and we are required to pay 30% of the tax on crypto income. Its bad but that's how it is.

but this 30% only counts if u withdraw right? and didnt most of your tokens go down in value? can't u just report a loss?

No.. Its applicable on crypto to crypto conversion too.. Doesn't if I withdraw or not.

This is another problem that loss setoff in crypto is not allowed. When I earn I need to may taxes but in case of loss govt is not bothered.

ouch that's horrible. what if u trade with otohers like with certain. instead of converting u gave him 10 hbd for equivalent in hive this is 30% taxable??

wow this is even worse lol. how do people not complain bout this espeically those that have a lot of money in crypto O.O if u lost like 5 digits in value and still have to pay 30% tax thats crazy

This is taxable technically but govt can't track it so can be avoided. Now I buy mostly hive/HBD through p2p and convert it to another crypto. This is best for me now..

Its crazy indeed. Lots of people are in loss overall but they have to pay taxes unfortunately nd nobody is listening.

It's like they don't want people to get into crypto? Which makes sense because they want to stay in control. If people in crypto complaining about all these problems im sure its going to scare people away from adopting

I see at least you have a way that works for you.

By the way alok do you know companies that are looking for software embedded engineers?

They certainly don't encourage people to be part of crypto it seems. with the hive, I can buy using p2p without getting involved in the exchange and Its good.

which country ?

um asean country?

I have a contact in SG who can help I think. dm me..

You mean they need people? Cuz my part time work now is helping my boss get leads 😅

They certainly don't encourage people to be part of crypto it seems. with the hive, I can buy using p2p without getting involved in the exchange and Its good.

This is good

And more ever, it makes you realize how and where you spent the money. I was literally shocked to see my credit card spends when I saw it on 26AS :) Then I realized I paid school fees and that is why it was so high. But at the end, it made me know.

Right, and this is why I prefer to do it by myself.

Do they also report credit card spending in 26AS? I have never seen it.

Yes, under Miscellaneous payment, I never saw it earlier as well. And also all interests from your bank accounts.

Its not in my form 26as so maybe they have some threshold here.

https://leofinance.io/threads/alokkumar121/re-alokkumar121-yqjnu2jy

The rewards earned on this comment will go directly to the people ( alokkumar121 ) sharing the post on LeoThreads,LikeTu,dBuzz.

Indeed it is a very tough and detailed task one wrong step and we end up inviting a notice from the tax department.

I am sure you would be feeling more relaxed now and better prepared to manage your assets for the next financial year ;)

absolutely. tax filing has become a tedious task and it took my entire weekend to finish and now I am relaxed.

Translated and formatted with Hive Translator by @noakmilo.

Thanks so much. appreciate it.