The Driving Force

Who ordered that $10,000 wick after BTC just hit a new ATH of $69,150? It's hard to answer this question, but one thing is clear to me: the volatility and expansion of the crypto market are at an unprecedented level. Never in the history of Bitcoin have we seen a $10,000 wick, whether it's up or down. We just experienced that yesterday, soon after the ATH was "priced in."

Everyone at this point was expecting a new ATH to occur before the halving, an event that has never happened for BTC, one that, in my opinion, wipes out every cycle pattern we've seen so far for BTC. We're not playing in the same league we were a few years ago. Traditional finance has invited BTC to its table, and this greedy motherfucker will eat a lot of capital off that table.

By no means do I support a super cycle theory for crypto, although it might happen—who knows? But whatever patterns we had on the table for predicting boom and bust cycles are off the charts now. Shit is getting that serious...

For the first time in history, Binance, once the largest crypto exchange by trading volume, had no liquidity to cover BTC loans for leverage traders yesterday. Over $1 billion in longs and shorts got liquidated. That's a billion with a B... Never in history has that happened.

Coinbase is facing the same issue for the third time in less than two months, caused by extreme volatility. The issue is that during such times, their services are simply halted, and the account balances of all users are showing a 0 balance. There's nothing these guys can do about it but wait for the storm to pass.

Speaking of exchanges, we need to address the situation in Nigeria, where Binance is halting all on and off-ramping support for Nigerians, which makes me sad. I do understand these people who somehow managed to make a living off crypto and are having difficulties doing that, especially now during probably the biggest bull market we've ever witnessed.

Anyway...

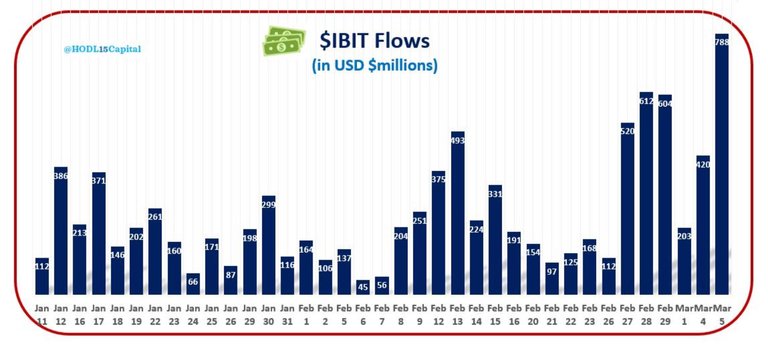

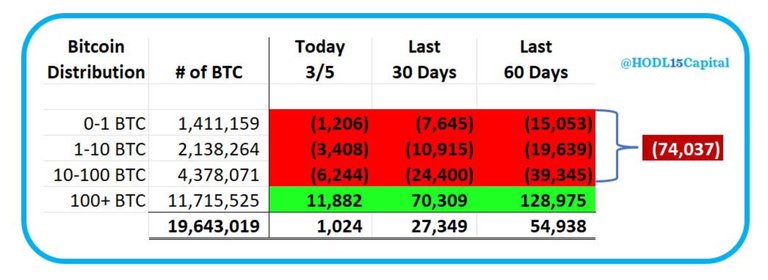

Bitcoin ETFs record $10 billion in daily volume, breaking the previous record. If you pay attention to what's happening with ETFs lately, they're breaking record after record since their launch. And if you didn't know that by now, it's them taking Bitcoin to the moon and not retail money. Plebs are literally selling their Bitcoin to BlackRock. Here's the proof:

BlackRock is devouring the world piece by piece, and now it's highly focused on Bitcoin. Some might wonder, why so late? Well, if they had bought most of it in the early days of Bitcoin, the distribution would have been highly centralized, and the appetite for such an asset wouldn't have been the same.

My take is that their AI (Aladdin) has known about Bitcoin and its potential for a long time, but it wasn't the right moment to get in until it gained traction and recognition. Now is the perfect time for them to leverage this new asset class. So, what are we plebs left with?

Well, I guess meme coins and WEB3... One question that I found very interesting and so easy to answer the other day is how would DOGE reach $5 if that means it will have to have a $700 billion market cap? Where will the $700 billion come from? Well...

It actually doesn't work that way... For DOGE to reach $5, all we need is insane demand and very little supply, translating into people willing to pay $5 per coin coupled with little supply. If the supply is large enough to cover demand the price can't go up that much. DOGE is owned in high percentages by whales(Musk probably being one of them).

The market cap is a result of the price and not vice versa. If the market is willing to pay $5 per coin for DOGE and the total circulating supply is 140 billion, then you have a market cap of $700 billion.

Based on this math, you often see all sorts of shitcoins entering the top 100 just because of their market price and liquidity. If they get to that position, it doesn't mean that someone literally bought that coin for the amount its market cap is. Prices go up and down based on supply and demand, not vice versa. Market cap is a result of price...

It's that simple... Very few try to see it this way. Very few have the balls to buy low and sell high, and very few prefer to think for themselves and make their own strategies instead of listening to all sorts of attention-addicted analysts who are basically living off the attention they get in the attention economy.

Few...

Thanks for your attention,

Adrian

I think what's happening in Nigeria with Binance and maybe other top exchanges has to do with a governmental ban. At least that was the news I reported on recently, but, at the time, it seemed to be something that passed.

Nigeria is killing itself in the foot with this stance on Bitcoin.

Yeah, seems like it.

$10,000 wig won't mean anything in a crypto bully season where BTC is well over $60k.

It definitely means something but it is also the first time it has happened.

Nice BMW driving stick (auto), looks like the one in my BMW X6. Still dreaming to change my 2008 xDrive model with a new one, but it still behaves like a furious kitten.

It’s from a 2015 X5. Not mine though…